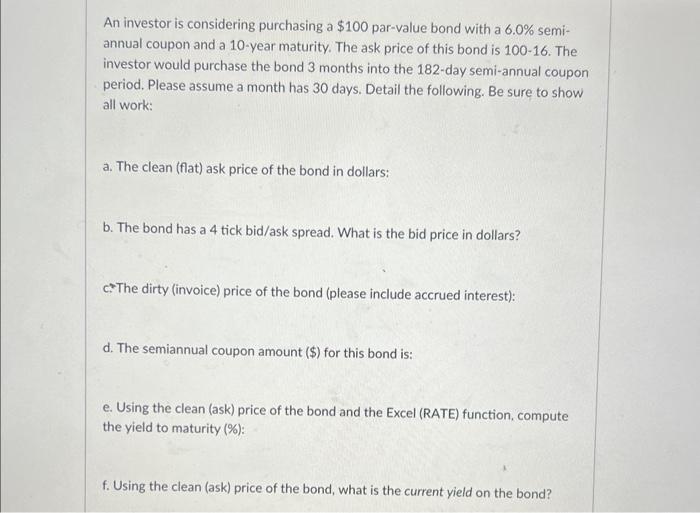

Files 47 48 f. In her preliminary cash budget, Johnson has assumed that all sales are collected and thus that 49 RR has no bad debts. Is this realistic? If not, how would bad debts be dealt with in a cash 50 budgeting sense? (Hint: Bad debts will affect collections but not purchases.) An investor is considering purchasing a $100 par-value bond with a 6.0% semiannual coupon and a 10-year maturity. The ask price of this bond is 10016. The investor would purchase the bond 3 months into the 182-day semi-annual coupon period. Please assume a month has 30 days. Detail the following. Be sure to show all work: a. The clean (flat) ask price of the bond in dollars: b. The bond has a 4 tick bid/ask spread. What is the bid price in dollars? c?The dirty (invoice) price of the bond (please include accrued interest): d. The semiannual coupon amount (\$) for this bond is: e. Using the clean (ask) price of the bond and the Excel (RATE) function, compute the yield to maturity (\%): f. Using the clean (ask) price of the bond, what is the current yield on the bond? Files 47 48 f. In her preliminary cash budget, Johnson has assumed that all sales are collected and thus that 49 RR has no bad debts. Is this realistic? If not, how would bad debts be dealt with in a cash 50 budgeting sense? (Hint: Bad debts will affect collections but not purchases.) An investor is considering purchasing a $100 par-value bond with a 6.0% semiannual coupon and a 10-year maturity. The ask price of this bond is 10016. The investor would purchase the bond 3 months into the 182-day semi-annual coupon period. Please assume a month has 30 days. Detail the following. Be sure to show all work: a. The clean (flat) ask price of the bond in dollars: b. The bond has a 4 tick bid/ask spread. What is the bid price in dollars? c?The dirty (invoice) price of the bond (please include accrued interest): d. The semiannual coupon amount (\$) for this bond is: e. Using the clean (ask) price of the bond and the Excel (RATE) function, compute the yield to maturity (\%): f. Using the clean (ask) price of the bond, what is the current yield on the bond