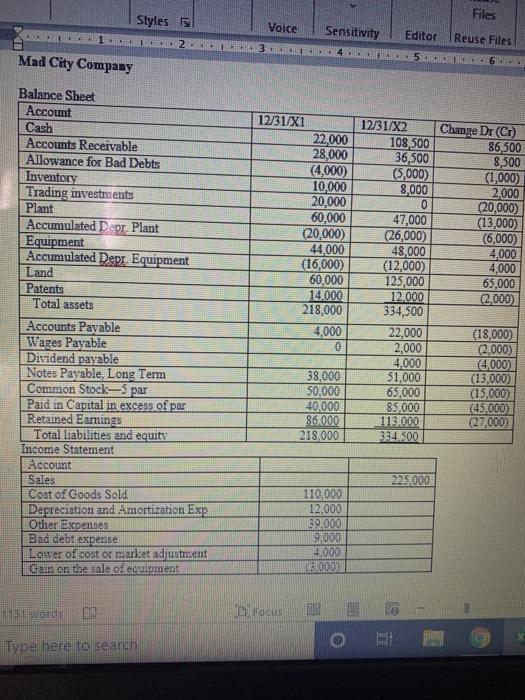

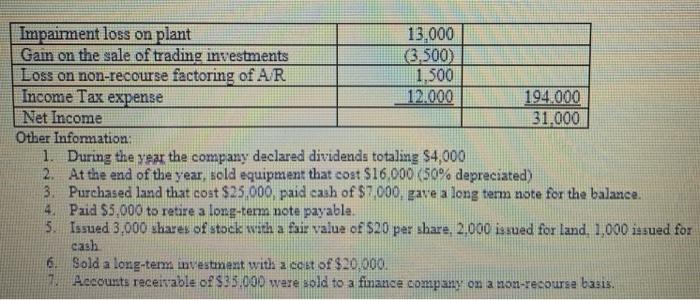

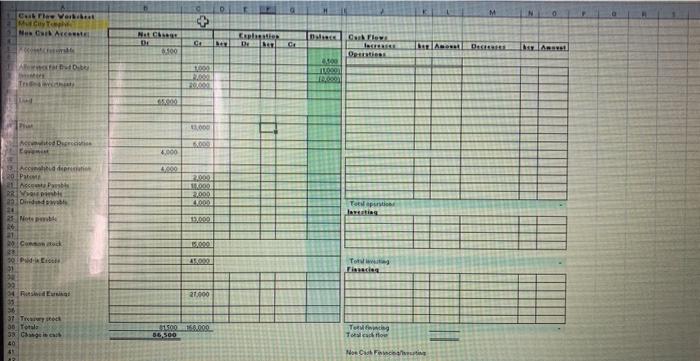

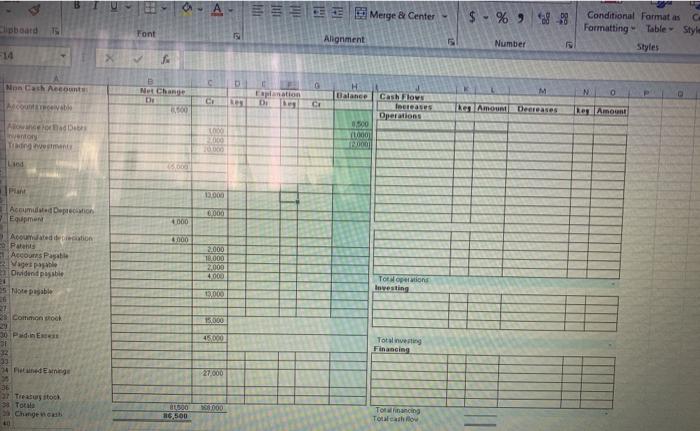

Files Styles 5 Voice Sensitivity 34 Editor Reuse Files 2. F 5. Mad City Company + Balance Sheet Account Cash Accounts Receivable Allowance for Bad Debts Inventory Trading investments Plant Accumulated Deer Plant Equipment Accumulated Dept. Equipment Land Patents Total assets Accounts Payable Wages Payable Dividend payable Notes Payable, Long Term Common Stock par Paid in Capital in excess of par Retained Eamings Total liabilities and equity Income Statement Account Sales Cost of Goods Sold Depreciation and Amortization Exp Other Expenses Bad debt expense Lower of cost or market adjustment Gain on the sale of coment 12/31/X1 22,000 28,000 4,000) 10,000 20,000 60,000 (20,000) 44.000 (16,000) 60,000 14.000 218,000 4,000 0 12/31/X2 108,500 36,500 (5,000) 8,000 0 47,000 (26,000) 48,000 (12,000) 125,000 12.000 334,500 22,000 2,000 4,000 51,000 65,000 85.000 113.000 324.500 Change Dr (6) 86,500 8,500 (1,000) 2,000 (20,000) (13,000) (6,000) 4.000 4,000 65,000 (2,000) 38,000 50.000 40.000 86.000 218.000 (18,000) (2.000) (4,000) (13,000 (15.000) (45,000 (27,000) 225.000 110.000 12.000 39,000 9.000 4,000 13.000 old Focus Type here to search Impairment loss on plant 13,000 Gain on the sale of trading investments (3.500) Loss on non-recourse factoring of AR 1,500 Income Tax expense 12.000 194.000 Net Income 31.000 Other Information: 1. During the year the company declared dividends totaling $4,000 2. At the end of the year, sold equipment that cost $16.000 (50% depreciated) 3. Purchased land that cost $25,000, paid cash of $7.000. gave a long term note for the balance 4. Paid $5,000 to retire a long-term note payable. 5. Issued 3.000 shares of stock with a fair value of $20 per share, 2.000 issued for land. 1,000 issued for cash 6. Sold a long-term investment with a cost of $20,000. 7. Accounts receivable of $35.000 were sold to a finance company on a non-recourse basis. D Cure Vert Muchy Neil Art Net CEN MA MARCH Flow Assal 6.100 LAR Opties 100 100 Mures E 4,000 4.200 cha de Pal 2. Met Pub RR V 29 Oddwl 3.000 40 Top Note Cod PE To 21.000 37 Two 30: Totul 100.150.200 36,500 Tot To see 40 31 A CAT A Merge & Center $ - % alpboard 15 Font Conditional Format as Formatting - Table Style Styles Alignment Number A B Not Change De M NonCash Account Active 0 N Balance Esplanation DI CH CH Cash Flows Increases Dperations Lo Amount Decreases Rey Amon Arad wenton Tem 0.500 YLON B000 Lio 1300 Accided Depreciation Equipment 6.000 4000 6000 Acontecation Parts 1 Acos Payable 2.000 18.000 2000 4000 Owidend posible Tot operations Investing 05 Notepable fi 13.000 Common och 1000 4500 31 Total investing Financing 33 Eige 27.000 or Treatstock Torta Change 40 8000 16 500 Tofinancing Totale how Files Styles 5 Voice Sensitivity 34 Editor Reuse Files 2. F 5. Mad City Company + Balance Sheet Account Cash Accounts Receivable Allowance for Bad Debts Inventory Trading investments Plant Accumulated Deer Plant Equipment Accumulated Dept. Equipment Land Patents Total assets Accounts Payable Wages Payable Dividend payable Notes Payable, Long Term Common Stock par Paid in Capital in excess of par Retained Eamings Total liabilities and equity Income Statement Account Sales Cost of Goods Sold Depreciation and Amortization Exp Other Expenses Bad debt expense Lower of cost or market adjustment Gain on the sale of coment 12/31/X1 22,000 28,000 4,000) 10,000 20,000 60,000 (20,000) 44.000 (16,000) 60,000 14.000 218,000 4,000 0 12/31/X2 108,500 36,500 (5,000) 8,000 0 47,000 (26,000) 48,000 (12,000) 125,000 12.000 334,500 22,000 2,000 4,000 51,000 65,000 85.000 113.000 324.500 Change Dr (6) 86,500 8,500 (1,000) 2,000 (20,000) (13,000) (6,000) 4.000 4,000 65,000 (2,000) 38,000 50.000 40.000 86.000 218.000 (18,000) (2.000) (4,000) (13,000 (15.000) (45,000 (27,000) 225.000 110.000 12.000 39,000 9.000 4,000 13.000 old Focus Type here to search Impairment loss on plant 13,000 Gain on the sale of trading investments (3.500) Loss on non-recourse factoring of AR 1,500 Income Tax expense 12.000 194.000 Net Income 31.000 Other Information: 1. During the year the company declared dividends totaling $4,000 2. At the end of the year, sold equipment that cost $16.000 (50% depreciated) 3. Purchased land that cost $25,000, paid cash of $7.000. gave a long term note for the balance 4. Paid $5,000 to retire a long-term note payable. 5. Issued 3.000 shares of stock with a fair value of $20 per share, 2.000 issued for land. 1,000 issued for cash 6. Sold a long-term investment with a cost of $20,000. 7. Accounts receivable of $35.000 were sold to a finance company on a non-recourse basis. D Cure Vert Muchy Neil Art Net CEN MA MARCH Flow Assal 6.100 LAR Opties 100 100 Mures E 4,000 4.200 cha de Pal 2. Met Pub RR V 29 Oddwl 3.000 40 Top Note Cod PE To 21.000 37 Two 30: Totul 100.150.200 36,500 Tot To see 40 31 A CAT A Merge & Center $ - % alpboard 15 Font Conditional Format as Formatting - Table Style Styles Alignment Number A B Not Change De M NonCash Account Active 0 N Balance Esplanation DI CH CH Cash Flows Increases Dperations Lo Amount Decreases Rey Amon Arad wenton Tem 0.500 YLON B000 Lio 1300 Accided Depreciation Equipment 6.000 4000 6000 Acontecation Parts 1 Acos Payable 2.000 18.000 2000 4000 Owidend posible Tot operations Investing 05 Notepable fi 13.000 Common och 1000 4500 31 Total investing Financing 33 Eige 27.000 or Treatstock Torta Change 40 8000 16 500 Tofinancing Totale how