Answered step by step

Verified Expert Solution

Question

1 Approved Answer

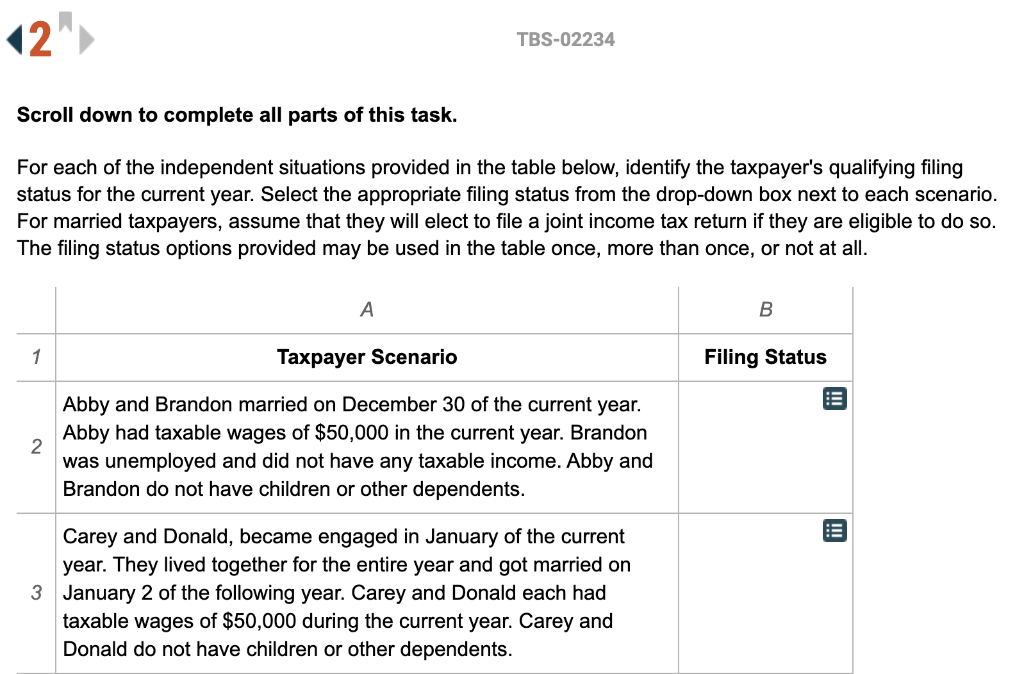

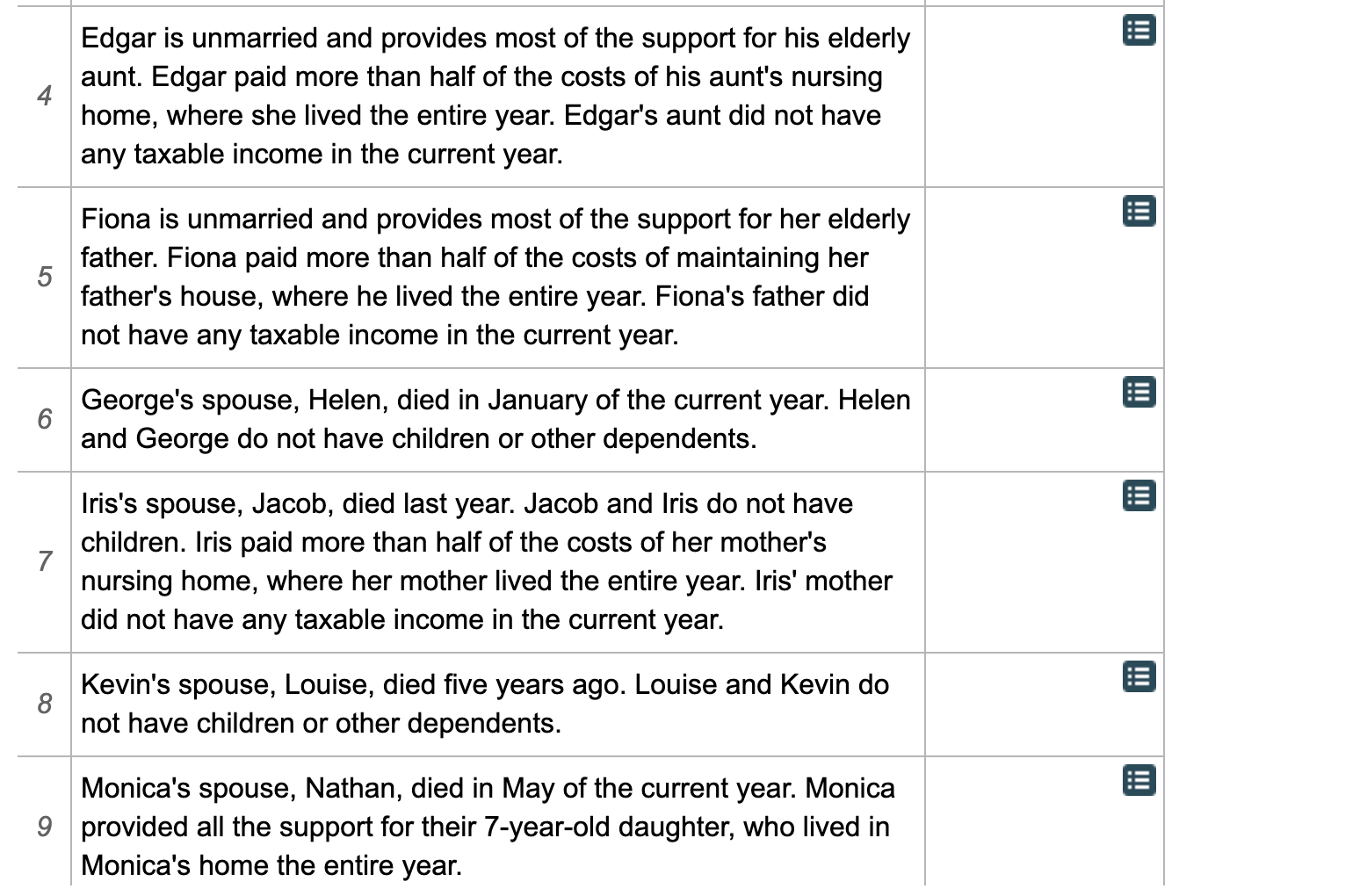

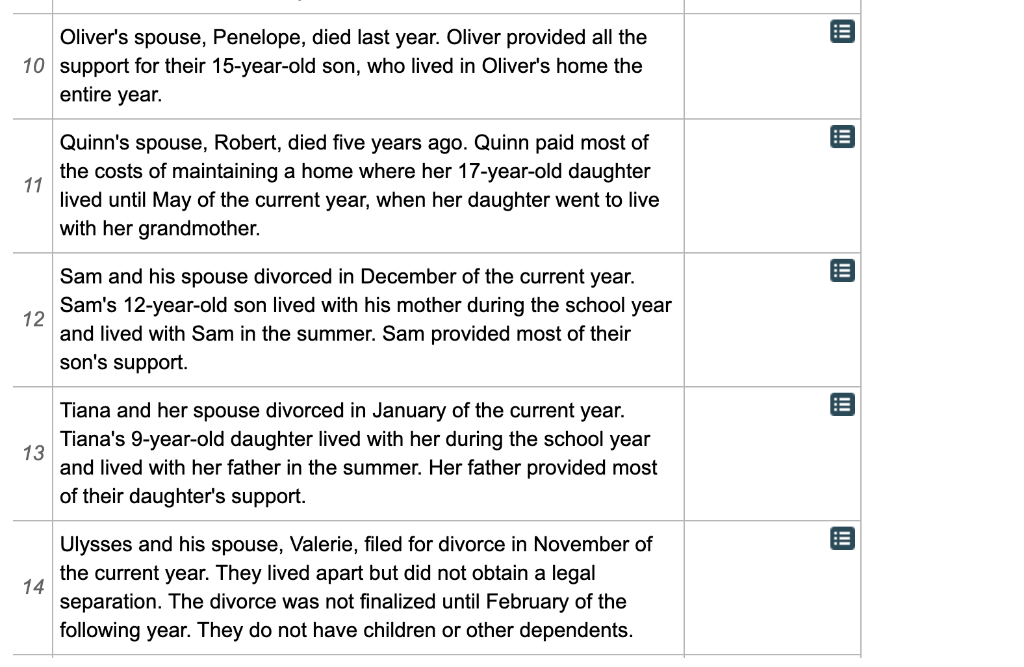

Filing Status Options: Single Head of household Qualifying widow(er) Married filing jointly Married filing separately 12 TBS-02234 Scroll down to complete all parts of this

Filing Status Options:

Single

Head of household

Qualifying widow(er)

Married filing jointly

Married filing separately

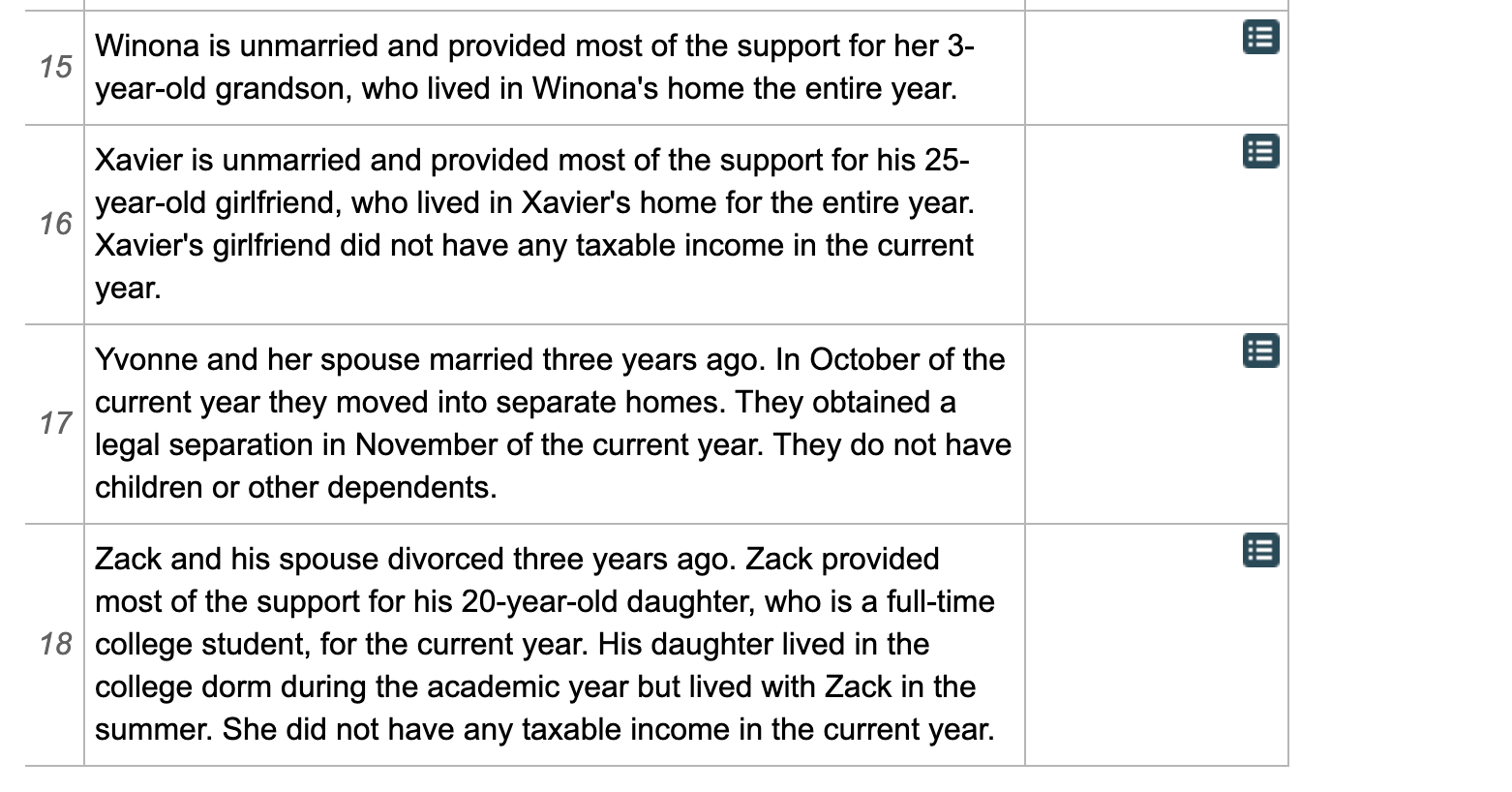

12 TBS-02234 Scroll down to complete all parts of this task. For each of the independent situations provided in the table below, identify the taxpayer's qualifying filing status for the current year. Select the appropriate filing status from the drop-down box next to each scenario. For married taxpayers, assume that they will elect to file a joint income tax return if they are eligible to do so. The filing status options provided may be used in the table once, more than once, or not at all. A B 1 Taxpayer Scenario Filing Status . 2 Abby and Brandon married on December 30 of the current year. Abby had taxable wages of $50,000 in the current year. Brandon unen loyed and did not have any taxable income. Abby and Brandon do not have children or other dependents. : Carey and Donald, became engaged in January of the current year. They lived together for the entire year and got married on 3 January 2 of the following year. Carey and Donald each had taxable wages of $50,000 during the current year. Carey and Donald do not have children or other dependents. 4 Edgar is unmarried and provides most of the support for his elderly aunt. Edgar paid more than half of the costs of his aunt's nursing home, where she lived the entire year. Edgar's aunt did not have any taxable income in the current year. iii 5 Fiona is unmarried and provides most of the support for her elderly father. Fiona paid more than half of the costs of maintaining her father's house, where he lived the entire year. Fiona's father did not have any taxable income in the current year. 6 George's spouse, Helen, died in January of the current year. Helen and George do not have children or other dependents. 7 Iris's spouse, Jacob, died last year. Jacob and Iris do not have children. Iris paid more than half of the costs of her mother's nursing home, where her mother lived the entire year. Iris' mother did not have any taxable income in the current year. 8 Kevin's spouse, Louise, died five years ago. Louise and Kevin do not have children or other dependents. iii Monica's spouse, Nathan, died in May of the current year. Monica 9 provided all the support for their 7-year-old daughter, who lived in Monica's home the entire year. Oliver's spouse, Penelope, died last year. Oliver provided all the 10 support for their 15-year-old son, who lived in Oliver's home the entire year. 11 Quinn's spouse, Robert, died five years ago. Quinn paid most of the costs of maintaining a home where her 17-year-old daughter lived until May of the current year, when her daughter went to live with her grandmother. 12 Sam and his spouse divorced in December of the current year. Sam's 12-year-old son lived with his mother during the school year and lived with Sam in the summer. Sam provided most of their son's support. 13 Tiana and her spouse divorced in January of the current year. Tiana's 9-year-old daughter lived with her during the school year and lived with her father in the summer. Her father provided most of their daughter's support. 14 Ulysses and his spouse, Valerie, filed for divorce in November of the current year. They lived apart but did not obtain a legal separation. The divorce was not finalized until February of the following year. They do not have children or other dependents. 15 Winona is unmarried and provided most of the support for her 3- year-old grandson, who lived in Winona's home the entire year. 16 Xavier is unmarried and provided most of the support for his 25- year-old girlfriend, who lived in Xavier's home for the entire year. Xavier's girlfriend did not have any taxable income in the current year. 17 Yvonne and her spouse married three years ago. In October of the current year they moved into separate homes. They obtained a legal separation in November of the current year. They do not have children or other dependents. Zack and his spouse divorced three years ago. Zack provided most of the support for his 20-year-old daughter, who is a full-time 18 college student, for the current year. His daughter lived in the college dorm during the academic year but lived with Zack in the summer. She did not have any taxable income in the current yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started