fill in 6 for the X, please help

fill in 6 for the X, please help

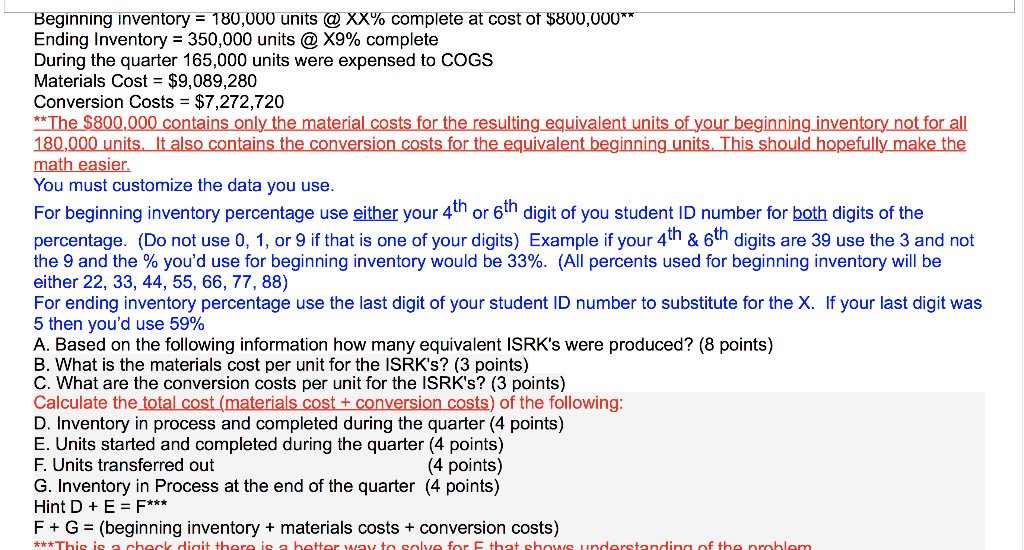

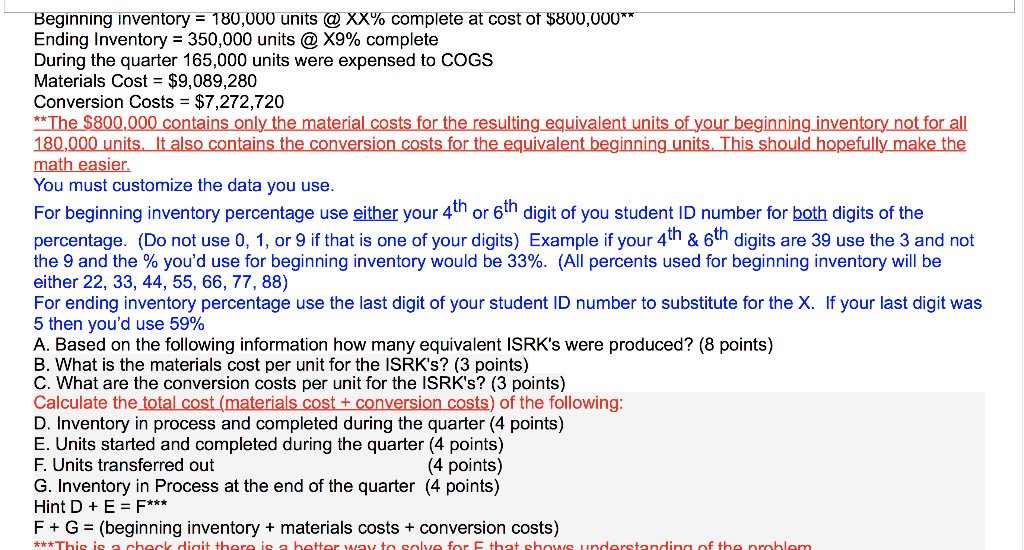

Beginning inventory = 180,000 units @ XX% complete at cost of $800,000** Ending Inventory = 350,000 units @ X9% complete During the quarter 165,000 units were expensed to COGS Materials Cost = $9,089,280 Conversion Costs = $7,272,720 ** The $800,000 contains only the material costs for the resulting equivalent units of your beginning inventory not for all 180,000 units. It also contains the conversion costs for the equivalent beginning units. This should hopefully make the math easier. You must customize the data you use. For beginning inventory percentage use either your 4th or 6th digit of you student ID number for both digits of the percentage. (Do not use 0, 1, or 9 if that is one of your digits) Example if your 4th & 6th digits are 39 use the 3 and not the 9 and the % you'd use for beginning inventory would be 33%. (All percents used for beginning inventory will be either 22, 33, 44, 55, 66, 77, 88) For ending inventory percentage use the last digit of your student ID number to substitute for the X. If your last digit was 5 then you'd use 59% A. Based on the following information how many equivalent ISRK's were produced? (8 points) B. What is the materials cost per unit for the ISRK's? (3 points) C. What are the conversion costs per unit for the ISRK's? (3 points) Calculate the total cost (materials cost + conversion costs) of the following: D. Inventory in process and completed during the quarter (4 points) E. Units started and completed during the quarter (4 points) F. Units transferred out (4 points) G. Inventory in Process at the end of the quarter (4 points) Hint D + E = F*** F+ G = (beginning inventory + materials costs + conversion costs) ***This is a check dicit there is a better way to solve for that shows understanding of the problem Beginning inventory = 180,000 units @ XX% complete at cost of $800,000** Ending Inventory = 350,000 units @ X9% complete During the quarter 165,000 units were expensed to COGS Materials Cost = $9,089,280 Conversion Costs = $7,272,720 ** The $800,000 contains only the material costs for the resulting equivalent units of your beginning inventory not for all 180,000 units. It also contains the conversion costs for the equivalent beginning units. This should hopefully make the math easier. You must customize the data you use. For beginning inventory percentage use either your 4th or 6th digit of you student ID number for both digits of the percentage. (Do not use 0, 1, or 9 if that is one of your digits) Example if your 4th & 6th digits are 39 use the 3 and not the 9 and the % you'd use for beginning inventory would be 33%. (All percents used for beginning inventory will be either 22, 33, 44, 55, 66, 77, 88) For ending inventory percentage use the last digit of your student ID number to substitute for the X. If your last digit was 5 then you'd use 59% A. Based on the following information how many equivalent ISRK's were produced? (8 points) B. What is the materials cost per unit for the ISRK's? (3 points) C. What are the conversion costs per unit for the ISRK's? (3 points) Calculate the total cost (materials cost + conversion costs) of the following: D. Inventory in process and completed during the quarter (4 points) E. Units started and completed during the quarter (4 points) F. Units transferred out (4 points) G. Inventory in Process at the end of the quarter (4 points) Hint D + E = F*** F+ G = (beginning inventory + materials costs + conversion costs) ***This is a check dicit there is a better way to solve for that shows understanding of the

fill in 6 for the X, please help

fill in 6 for the X, please help