Answered step by step

Verified Expert Solution

Question

1 Approved Answer

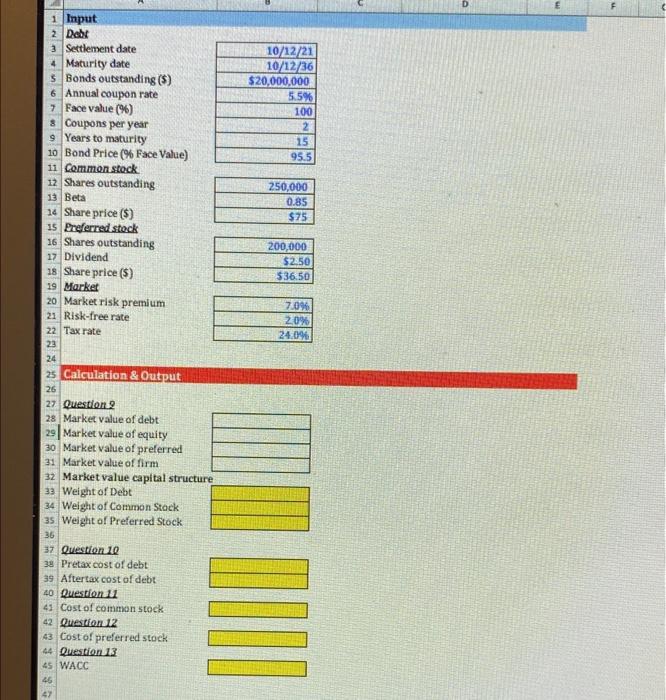

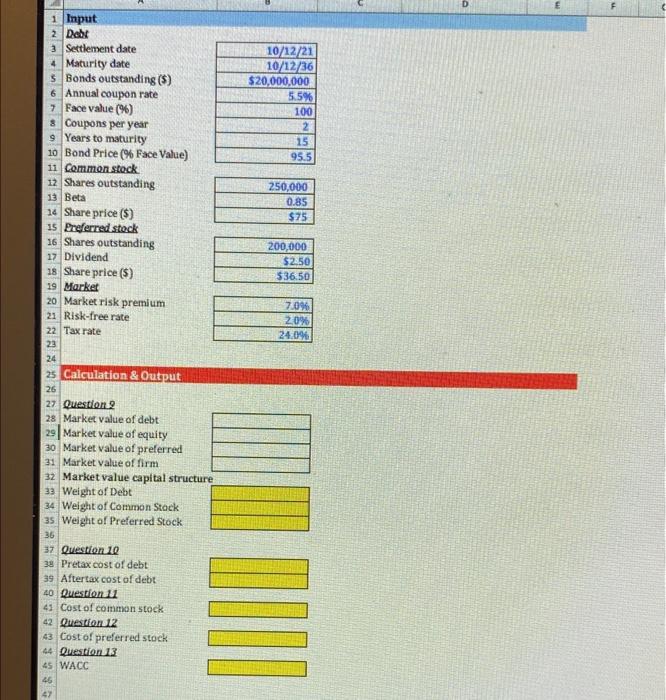

fill in all blanks w 10/12/21 10/12/26 $20.000.000 5.5% 100 2 15 95.5 250,000 0.85 $75 200,000 $2.50 536.50 7.0% 20% 24.0% 1 Input 2

fill in all blanks

w 10/12/21 10/12/26 $20.000.000 5.5% 100 2 15 95.5 250,000 0.85 $75 200,000 $2.50 536.50 7.0% 20% 24.0% 1 Input 2 Debt 3 Settlement date 4 Maturity date s Bonds outstanding (S) 6 Annual coupon rate 7 Face value (%) & Coupons per year 9 Years to maturity 10 Bond Price% Face Value) 11 common stock 12 Shares outstanding 13 Beta 14 Share price (8) 15 Preferred stock 16 Shares outstanding 17 Dividend 18 Share price (5) 19 Market 20 Market risk premium 21 Risk-free rate 22 Tax rate 23 24 25 Calculation & Output 26 27 Question 28 Market value of debt 29 Market value of equity 30 Market value of preferred 31 Market value of firm 32 Market value capital structure 33 Weight of Debt 34 Weight of Common Stock 3 Weight of Preferred Stock 36 37 Question 10 38 Pretax cost of debt 39 Aftertax cost of debt 40 Question 11 43 Cost of common stock 42 Question 12 43 Cost of preferred stock 44 Question 13 45 WACC 46 47 DITU ETA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started