Answered step by step

Verified Expert Solution

Question

1 Approved Answer

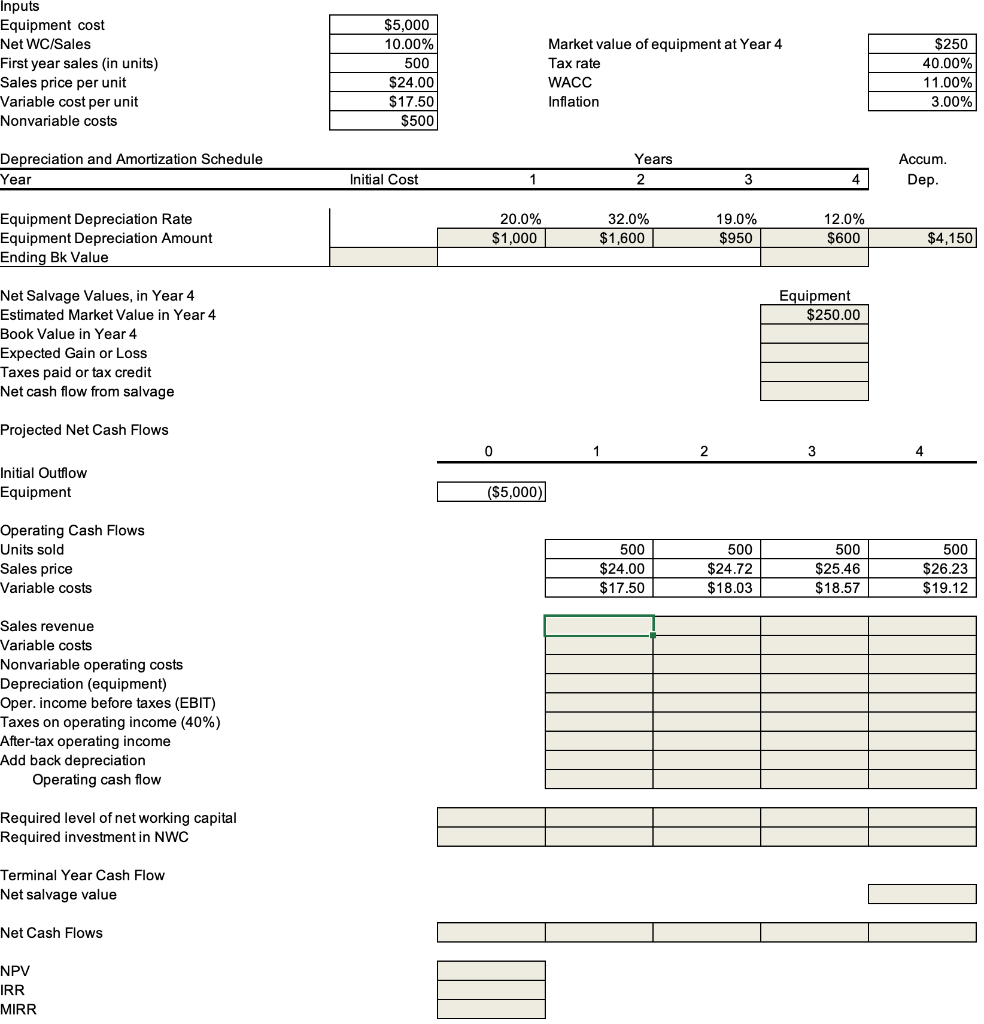

Fill in all the gold-filled boxes with how you did it to conclude Inputs Equipment cost Net WC/Sales First year sales in units) Sales price

Fill in all the gold-filled boxes with how you did it to conclude

Inputs Equipment cost Net WC/Sales First year sales in units) Sales price per unit Variable cost per unit Nonvariable costs $5,000 10.00% 500 $24.00 $17.50 $500 Market value of equipment at Year 4 Tax rate WACC Inflation $250 40.00% 11.00% 3.00% Depreciation and Amortization Schedule Year Years 2 Accum. Dep. Initial Cost 3 4 Equipment Depreciation Rate Equipment Depreciation Amount Ending Bk Value 20.0% $1,000 32.0% $1,600 19.0% $950 12.0% $600 $4,150 Equipment $250.00 Net Salvage Values, in Year 4 Estimated Market value in Year 4 Book Value in Year 4 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage Projected Net Cash Flows 0 1 2 3 4 Initial Outflow Equipment ($5,000) 500 Operating Cash Flows Units sold Sales price Variable costs 500 $24.00 $17.50 500 $24.72 $18.03 500 $25.46 $18.57 $26.23 $19.12 Sales revenue Variable costs Nonvariable operating costs Depreciation (equipment) Oper. income before taxes (EBIT) Taxes on operating income (40%) After-tax operating income Add back depreciation Operating cash flow Required level of net working capital Required investment in NWC Terminal Year Cash Net salvage value Net Cash Flows NPV IRR MIRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started