Fill in all yellow blanks. Thank You

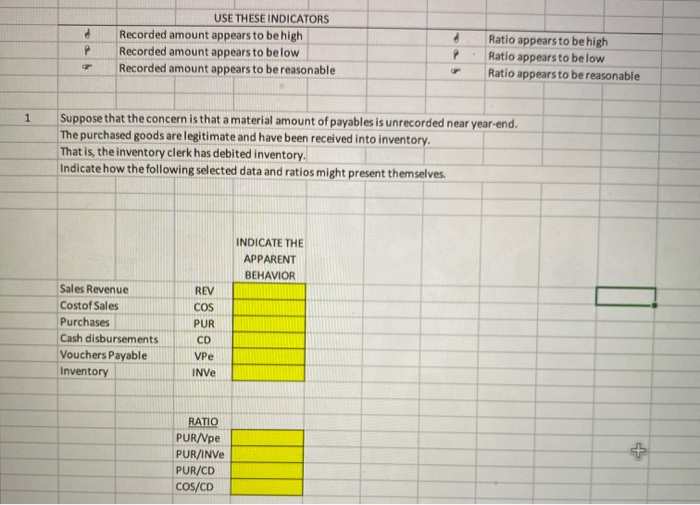

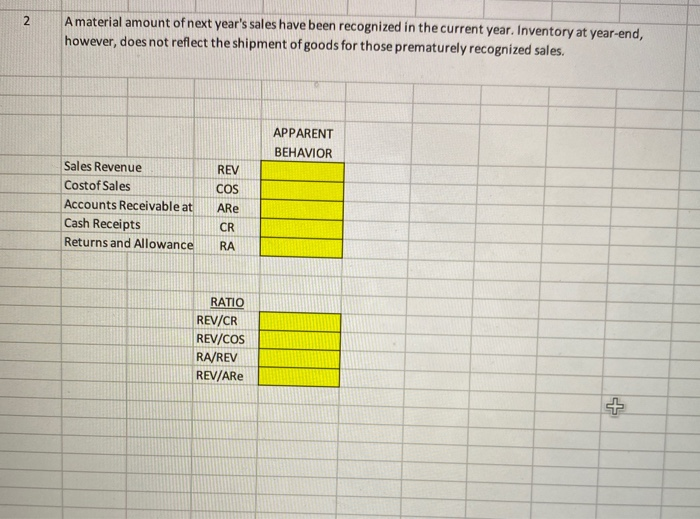

use the indicators to answer all the yellow blanks

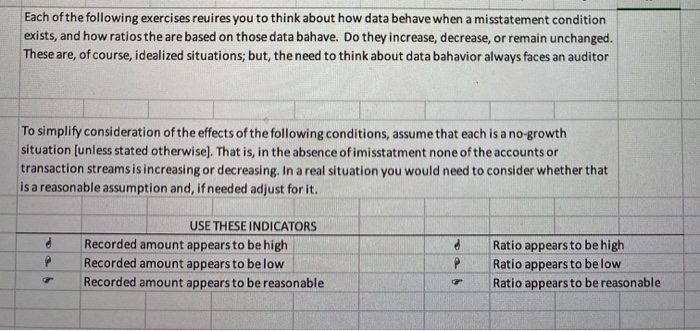

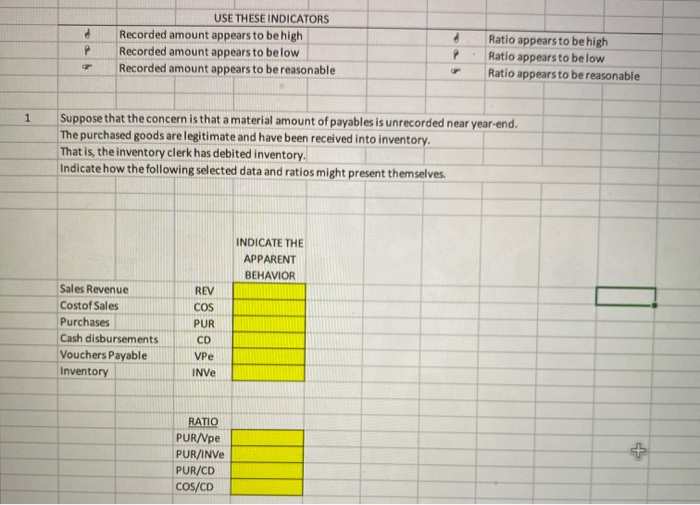

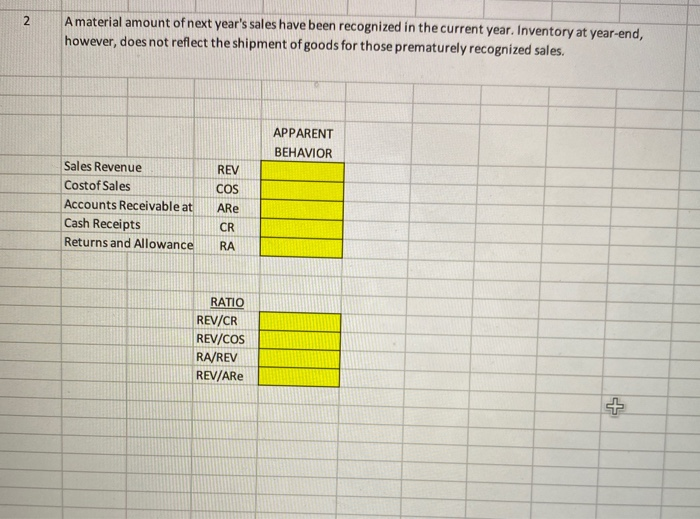

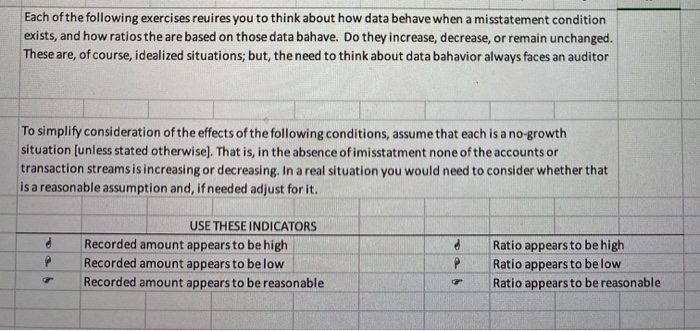

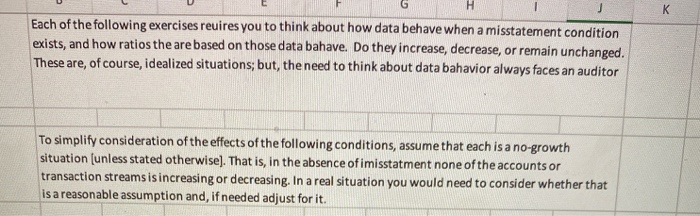

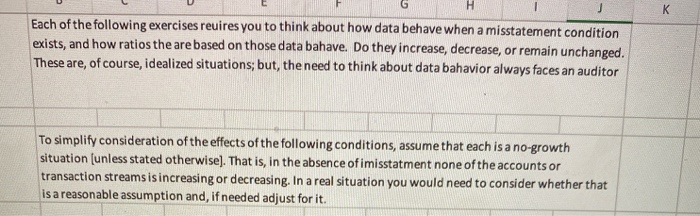

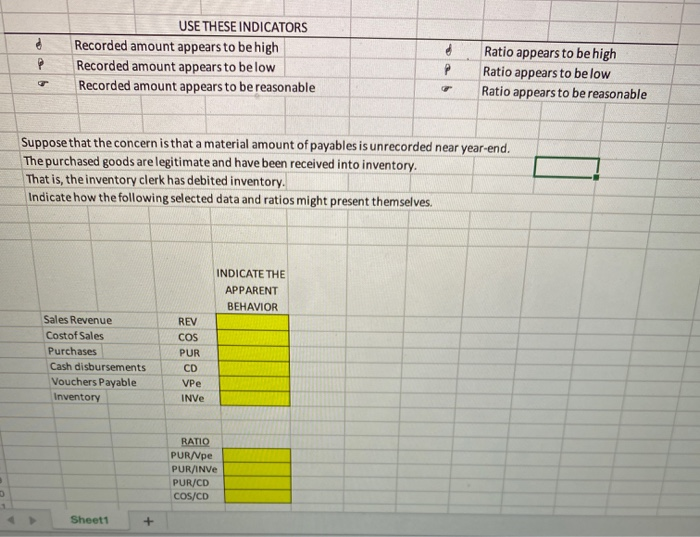

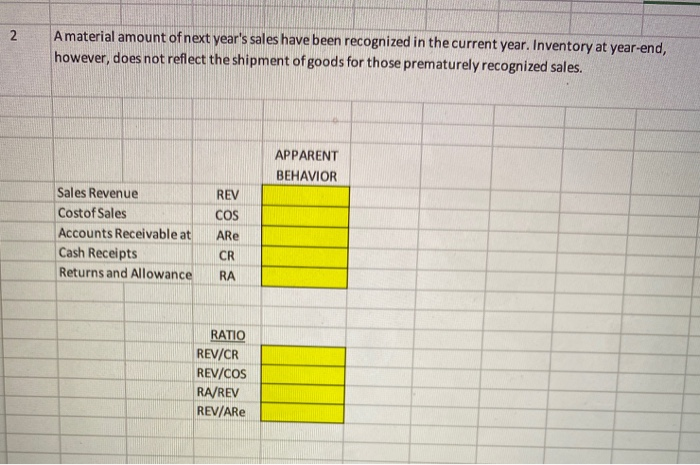

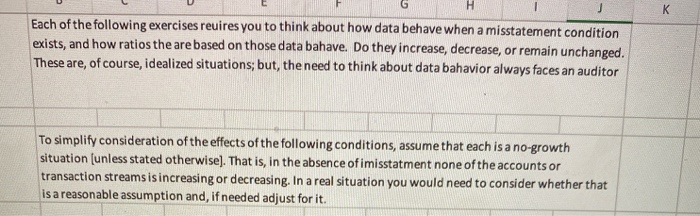

Each of the following exercises reuires you to think about how data behave when a misstatement condition exists, and how ratios the are based on those data bahave. Do they increase, decrease, or remain unchanged. These are, of course, idealized situations, but the need to think about data bahavior always faces an auditor To simplify consideration of the effects of the following conditions, assume that each is a no-growth situation (unless stated otherwise). That is, in the absence of imisstatment none of the accounts or transaction streams is increasing or decreasing. In a real situation you would need to consider whether that is a reasonable assumption and, if needed adjust for it. . P USE THESE INDICATORS Recorded amount appears to be high Recorded amount appears to be low Recorded amount appears to be reasonable 9a Ratio appears to be high Ratio appears to be low Ratio appears to be reasonable d USE THESE INDICATORS Recorded amount appears to be high Recorded amount appears to below Recorded amount appears to be reasonable P Ratio appears to be high Ratio appears to be low Ratio appears to be reasonable 1 Suppose that the concern is that a material amount of payables is unrecorded near year-end. The purchased goods are legitimate and have been received into inventory. That is, the inventory clerk has debited inventory Indicate how the following selected data and ratios might present themselves. INDICATE THE APPARENT BEHAVIOR Sales Revenue Costof Sales Purchases Cash disbursements Vouchers Payable Inventory REV COS PUR CD VPe INVe RATIO PUR/Vpe PUR/INVe PUR/CD COS/CD + 2 Amaterial amount of next year's sales have been recognized in the current year. Inventory at year-end, however, does not reflect the shipment of goods for those prematurely recognized sales. APPARENT BEHAVIOR REV Sales Revenue Costof Sales Accounts Receivable at Cash Receipts Returns and Allowance COS ARE CR RA RATIO REV/CR REV/COS RA/REV REV/ARE + K Each of the following exercises reuires you to think about how data behave when a misstatement condition exists, and how ratios the are based on those data bahave. Do they increase, decrease, or remain unchanged. These are, of course, idealized situations, but the need to think about data bahavior always faces an auditor To simplify consideration of the effects of the following conditions, assume that each is a no-growth situation (unless stated otherwise). That is, in the absence of imisstatment none of the accounts or transaction streams is increasing or decreasing. In a real situation you would need to consider whether that is a reasonable assumption and, if needed adjust for it. P USE THESE INDICATORS Recorded amount appears to be high Recorded amount appears to below Recorded amount appears to be reasonable P. Ratio appears to be high Ratio appears to be low Ratio appears to be reasonable Suppose that the concern is that a material amount of payables is unrecorded near year-end. The purchased goods are legitimate and have been received into inventory. That is, the inventory clerk has debited inventory. Indicate how the following selected data and ratios might present themselves. INDICATE THE APPARENT BEHAVIOR Sales Revenue Costof Sales Purchases Cash disbursements Vouchers Payable Inventory REV COS PUR CD VPe INVe RATIO PUR/pe PUR/INVe PUR/CD COS/CD Sheet1 + 2 Amaterial amount of next year's sales have been recognized in the current year. Inventory at year-end, however, does not reflect the shipment of goods for those prematurely recognized sales. APPARENT BEHAVIOR Sales Revenue Costof Sales Accounts Receivable at Cash Receipts Returns and Allowance REV COS ARE CR RA RATIO REV/CR REV/COS RA/REV REV/ARE