fill in blanks for cash budget

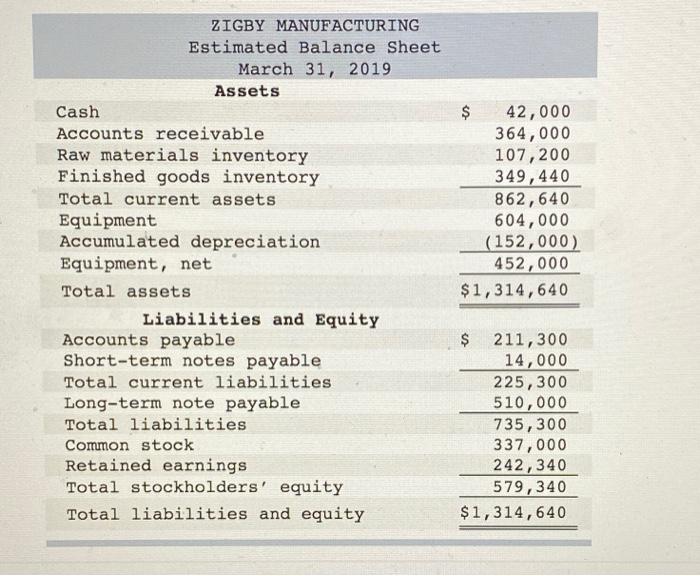

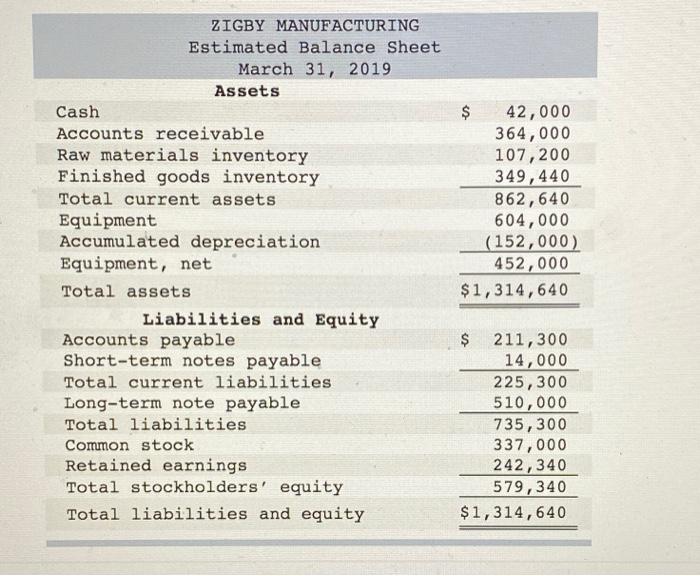

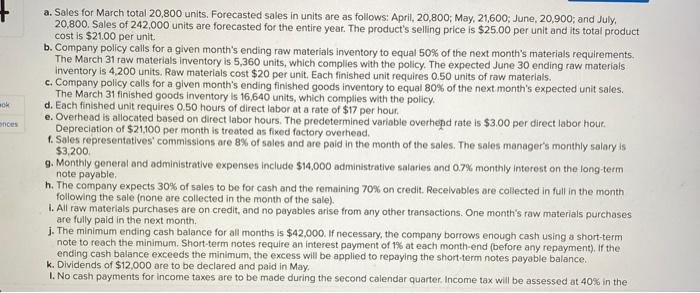

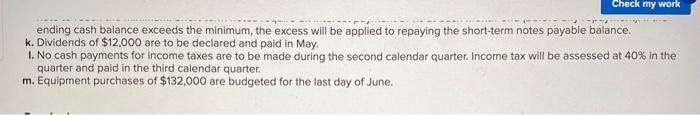

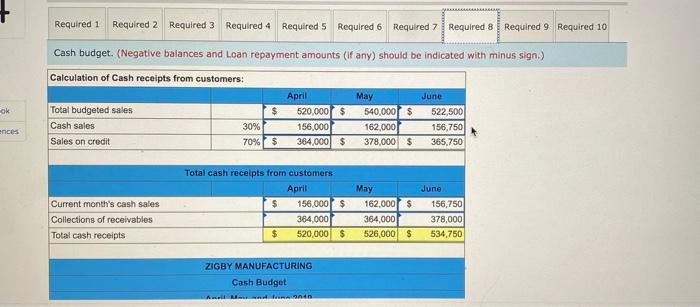

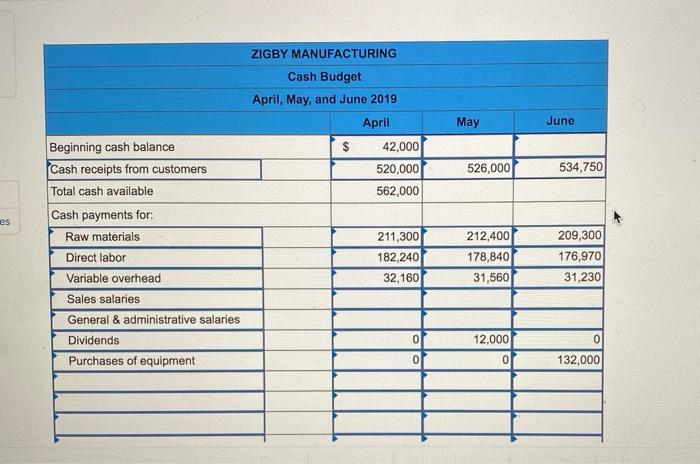

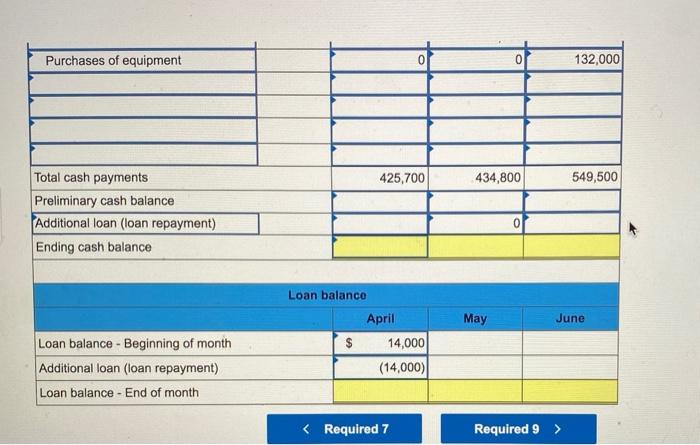

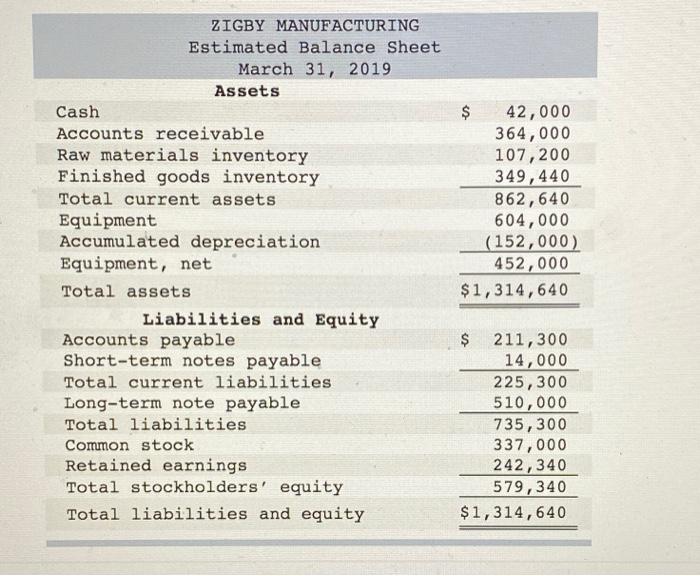

ZIGBY MANUFACTURING Estimated Balance Sheet March 31, 2019 Assets Cash Accounts receivable Raw materials inventory Finished goods inventory Total current assets Equipment Accumulated depreciation Equipment, net Total assets Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-term note payable Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and equity $ 42,000 364,000 107,200 349,440 862,640 604,000 (152,000) 452,000 $1,314,640 $ 211,300 14,000 225, 300 510,000 735,300 337,000 242,340 579,340 $1,314,640 OK onces a. Sales for March total 20,800 units. Forecasted sales in units are as follows: April, 20,800; May, 21,600: June, 20,900; and July, 20,800, Sales of 242,000 units are forecasted for the entire year. The product's selling price is $25.00 per unit and its total product cost is $2100 per unit. b. Company policy calls for a given month's ending raw materials inventory to equal 50% of the next month's materials requirements. The March 31 raw materials Inventory is 5,360 units, which complies with the policy. The expected June 30 ending raw materials inventory is 4,200 units. Raw materials cost $20 per unit. Each finished unit requires 0.50 units of raw materials. c. Company policy calls for a given month's ending finished goods inventory to equal 80% of the next month's expected unit sales. The March 31 finished goods inventory is 16,640 units, which complies with the policy. d. Each finished unit requires 0.50 hours of direct laborat a rate of $17 per hour. e. Overhead is allocated based on direct labor hours. The predetermined variable overhepd rate is $3.00 per direct labor hour. 1. sales representatives commissions are 8% of sales and are pold in the month of the sales. The soles manager's monthly salory is 9. Monthly general and administrative expenses include $14,000 administrative salaries and 0.7% monthly interest on the long-term h. The company expects 30% of sales to be for cash and the remaining 70% on credit. Receivables are collected in full in the month following the sale (none are collected in the month of the sale). I. All raw materials purchases are on credit, and no payables arise from any other transactions. One month's raw materials purchases are fully paid in the next month. j. The minimum ending cash balance for all months is $42,000. If necessary, the company borrows enough cash using a short-term note to reach the minimum. Short-term notes require an interest payment of 1% at each month-end (before any repayment). If the ending cash balance exceeds the minimum, the excess will be applied to repaying the short-term notes payable balance. k. Dividends of $12,000 are to be declared and paid in May. 1. No cash payments for Income taxes are to be made during the second calendar quarter Income tax will be assessed at 40% in the Check my work ending cash balance exceeds the minimum, the excess will be applied to repaying the short-term notes payable balance, k. Dividends of $12.000 are to be declared and paid in May. 1. No cash payments for income taxes are to be made during the second calendar quarter. Income tax will be assessed at 40% in the quarter and paid in the third calendar quarter. m. Equipment purchases of $132.000 are budgeted for the last day of June. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Required 8 Required 9 Required 10 Cash budget. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Calculation of Cash receipts from customers: April May June Total budgeted sales $ 520,000 $ 540,000 $ 522,500 Cash sales 30% 156,000 162,000 156,750 Sales on credit 70% $ 364,000 $ 378,000 $ 365.750 ok ences Current month's cash sales Collections of receivables Total cash receipts Total cash receipts from customers April $ 156,000 $ 364,000 $ 520,000 $ May 162,000 $ 364,000 526,000 $ June 156,750 378,000 534,750 ZIGBY MANUFACTURING Cash Budget ennn ZIGBY MANUFACTURING May June Cash Budget April, May, and June 2019 April 42,000 520,000 562,000 526,000 534,750 Beginning cash balance Cash receipts from customers Total cash available Cash payments for: Raw materials es Direct labor 211,300 182,240 32,160 212,400 178,840 31,560 209,300 176,970 31,230 Variable overhead Sales salaries General & administrative salaries Dividends Purchases of equipment 0 12,000 0 0 0 132,000 Purchases of equipment 0 132,000 425,700 434,800 549,500 Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance May June Loan balance April $ 14,000 (14,000) Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of month