fill in cash flow statement

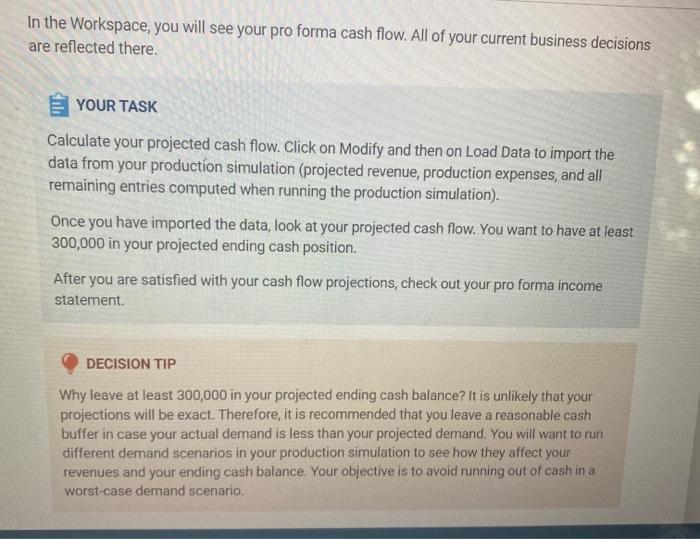

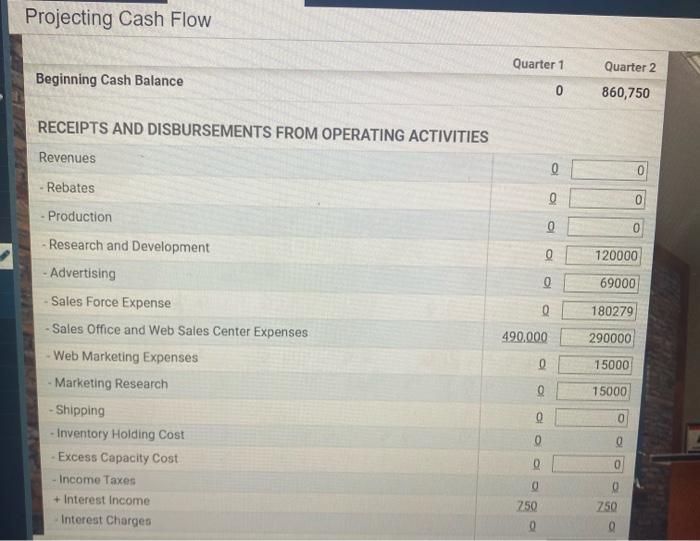

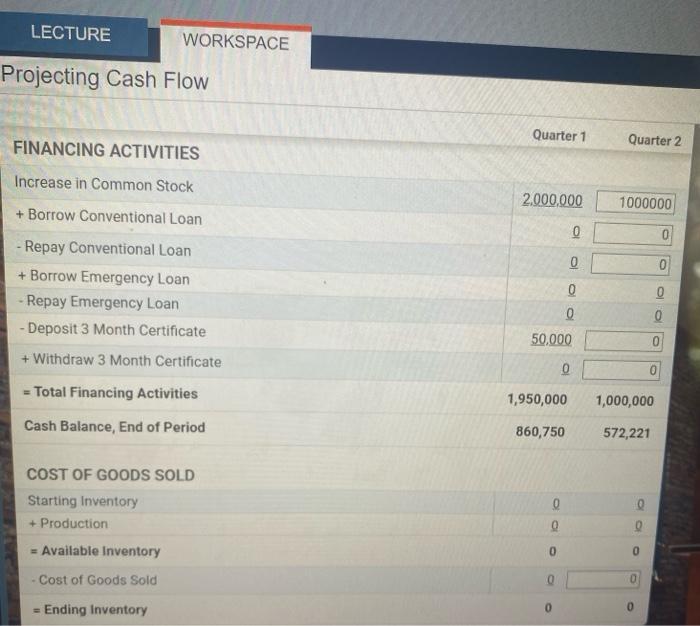

In the Workspace, you will see your pro forma cash flow. All of your current business decisions are reflected there. YOUR TASK Calculate your projected cash flow. Click on Modify and then on Load Data to import the data from your production simulation (projected revenue, production expenses, and all remaining entries computed when running the production simulation). Once you have imported the data, look at your projected cash flow. You want to have at least 300,000 in your projected ending cash position. After you are satisfied with your cash flow projections, check out your pro forma income statement DECISION TIP Why leave at least 300,000 in your projected ending cash balance? It is unlikely that your projections will be exact. Therefore, it is recommended that you leave a reasonable cash buffer in case your actual demand is less than your projected demand. You will want to run different demand scenarios in your production simulation to see how they affect your revenues and your ending cash balance. Your objective is to avoid running out of cash in a worst-case demand scenario. Projecting Cash Flow Quarter 1 Quarter 2 Beginning Cash Balance 0 860,750 RECEIPTS AND DISBURSEMENTS FROM OPERATING ACTIVITIES Revenues 0 - Rebates Q 0 0 0 120000 0 69000 0 180279 490,000 290000 Production Research and Development - Advertising Sales Force Expense -Sales Office and Web Sales Center Expenses Web Marketing Expenses Marketing Research - Shipping Inventory Holding Cost Excess Capacity Cost Income Taxes + Interest Income Interest Charges 15000 0 15000 0 0 0 0 0 250 250 0 LECTURE WORKSPACE Projecting Cash Flow Quarter 1 FINANCING ACTIVITIES Quarter 2 Increase in Common Stock 2.000.000 1000000 + Borrow Conventional Loan 0 0 0 - Repay Conventional Loan + Borrow Emergency Loan Repay Emergency Loan - Deposit 3 Month Certificate 0 0 50,000 0 + Withdraw 3 Month Certificate 0 Total Financing Activities 1,950,000 1,000,000 Cash Balance, End of Period 860,750 572,221 COST OF GOODS SOLD Starting Inventory + Production = Available Inventory 0 0 0 0 Cost of Goods Sold 0 0 Ending Inventory 0 0 Quarter 1 FINANCING ACTIVITIES Quarter 2 Increase in Common Stock 2,000,000 1000000 + Borrow Conventional Loan 0 0 Repay Conventional Loan + Borrow Emergency Loan - Repay Emergency Loan - Deposit 3 Month Certificate 0 0 0 0 50,000 + Withdraw 3 Month Certificate Q = Total Financing Activities 1,950,000 1,000,000 Cash Balance, End of Period 860,750 572,221 COST OF GOODS SOLD Starting Inventory + Production Q 0 0 Available Inventory 0 0 Cost of Goods Sold 0 0 Ending Inventory D In the Workspace, you will see your pro forma cash flow. All of your current business decisions are reflected there. YOUR TASK Calculate your projected cash flow. Click on Modify and then on Load Data to import the data from your production simulation (projected revenue, production expenses, and all remaining entries computed when running the production simulation). Once you have imported the data, look at your projected cash flow. You want to have at least 300,000 in your projected ending cash position. After you are satisfied with your cash flow projections, check out your pro forma income statement DECISION TIP Why leave at least 300,000 in your projected ending cash balance? It is unlikely that your projections will be exact. Therefore, it is recommended that you leave a reasonable cash buffer in case your actual demand is less than your projected demand. You will want to run different demand scenarios in your production simulation to see how they affect your revenues and your ending cash balance. Your objective is to avoid running out of cash in a worst-case demand scenario. Projecting Cash Flow Quarter 1 Quarter 2 Beginning Cash Balance 0 860,750 RECEIPTS AND DISBURSEMENTS FROM OPERATING ACTIVITIES Revenues 0 - Rebates Q 0 0 0 120000 0 69000 0 180279 490,000 290000 Production Research and Development - Advertising Sales Force Expense -Sales Office and Web Sales Center Expenses Web Marketing Expenses Marketing Research - Shipping Inventory Holding Cost Excess Capacity Cost Income Taxes + Interest Income Interest Charges 15000 0 15000 0 0 0 0 0 250 250 0 LECTURE WORKSPACE Projecting Cash Flow Quarter 1 FINANCING ACTIVITIES Quarter 2 Increase in Common Stock 2.000.000 1000000 + Borrow Conventional Loan 0 0 0 - Repay Conventional Loan + Borrow Emergency Loan Repay Emergency Loan - Deposit 3 Month Certificate 0 0 50,000 0 + Withdraw 3 Month Certificate 0 Total Financing Activities 1,950,000 1,000,000 Cash Balance, End of Period 860,750 572,221 COST OF GOODS SOLD Starting Inventory + Production = Available Inventory 0 0 0 0 Cost of Goods Sold 0 0 Ending Inventory 0 0 Quarter 1 FINANCING ACTIVITIES Quarter 2 Increase in Common Stock 2,000,000 1000000 + Borrow Conventional Loan 0 0 Repay Conventional Loan + Borrow Emergency Loan - Repay Emergency Loan - Deposit 3 Month Certificate 0 0 0 0 50,000 + Withdraw 3 Month Certificate Q = Total Financing Activities 1,950,000 1,000,000 Cash Balance, End of Period 860,750 572,221 COST OF GOODS SOLD Starting Inventory + Production Q 0 0 Available Inventory 0 0 Cost of Goods Sold 0 0 Ending Inventory D