Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill in form 1040A U.S. Individual Income Tax Return 2013 please use all the information given and to find the form simply search up the

fill in form "1040A U.S. Individual Income Tax Return 2013"

please use all the information given and to find the form simply search up the form and fill it in.

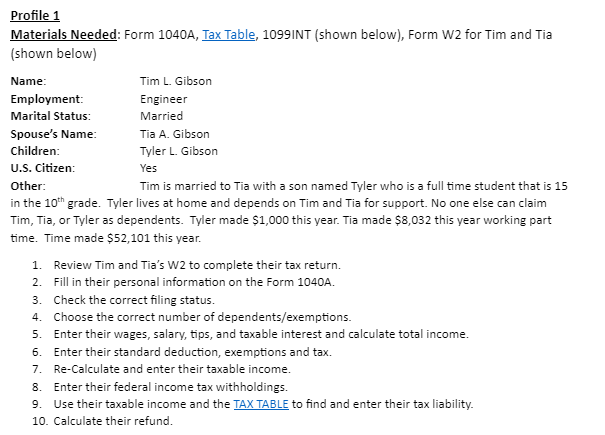

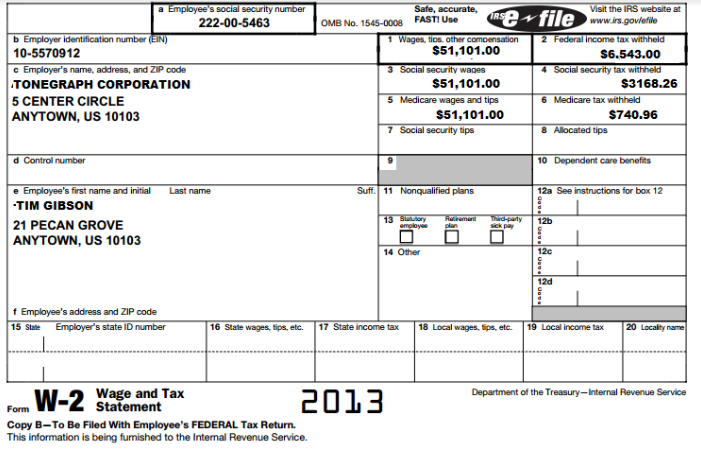

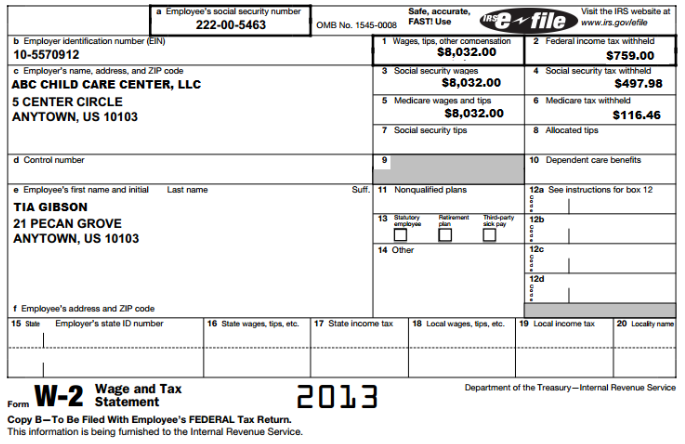

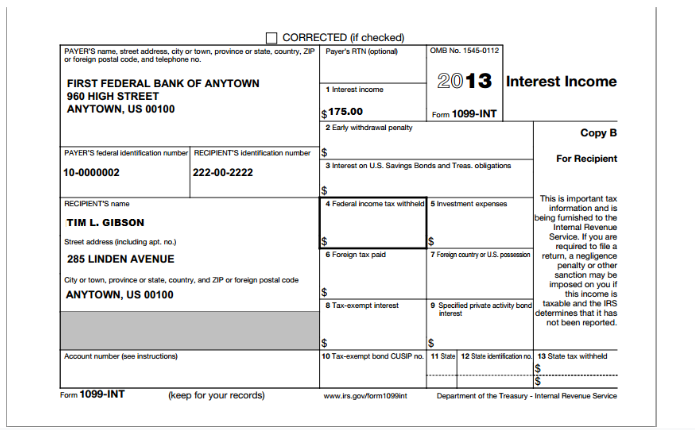

Profile 1 Materials Needed: Form 1040A, Tax Table, 1099INT (shown below), Form W2 for Tim and Tia (shown below) a with a son named Tyler who is a full time student that is 15 In the 1U grade. Iyler IIves at nome and depends on Tim and Tia for support. No one else can claim Tim, Tia, or Tyler as dependents. Tyler made $1,000 this year. Tia made $8,032 this year working part time. Time made $52,101 this year. 1. Review Tim and Tia's W2 to complete their tax return. 2. Fill in their personal information on the Form 1040A. 3. Check the correct filing status. 4. Choose the correct number of dependents/exemptions. 5. Enter their wages, salary, tips, and taxable interest and calculate total income. 6. Enter their standard deduction, exemptions and tax. 7. Re-Calculate and enter their taxable income. 8. Enter their federal income tax withholdings. 9. Use their taxable income and the 10. Calculate their refund. This information is being fumished to the Internal Revenue Service. Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service. CORRECTED (if checked) Profile 1 Materials Needed: Form 1040A, Tax Table, 1099INT (shown below), Form W2 for Tim and Tia (shown below) a with a son named Tyler who is a full time student that is 15 In the 1U grade. Iyler IIves at nome and depends on Tim and Tia for support. No one else can claim Tim, Tia, or Tyler as dependents. Tyler made $1,000 this year. Tia made $8,032 this year working part time. Time made $52,101 this year. 1. Review Tim and Tia's W2 to complete their tax return. 2. Fill in their personal information on the Form 1040A. 3. Check the correct filing status. 4. Choose the correct number of dependents/exemptions. 5. Enter their wages, salary, tips, and taxable interest and calculate total income. 6. Enter their standard deduction, exemptions and tax. 7. Re-Calculate and enter their taxable income. 8. Enter their federal income tax withholdings. 9. Use their taxable income and the 10. Calculate their refund. This information is being fumished to the Internal Revenue Service. Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service. CORRECTED (if checked)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started