Fill in questions based on the data.

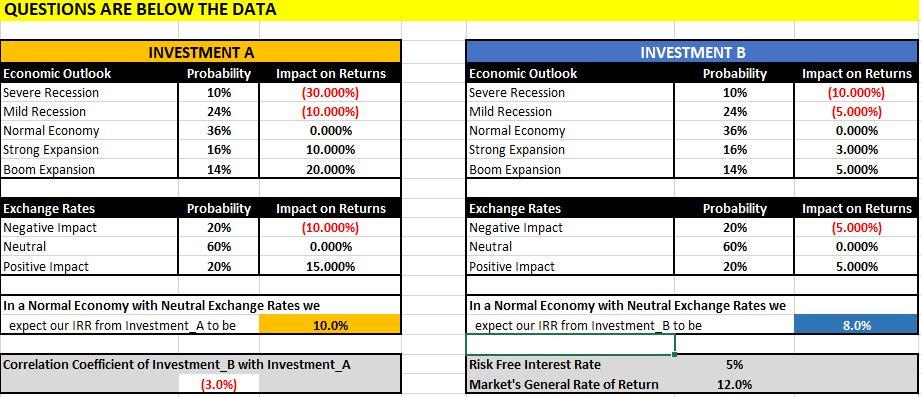

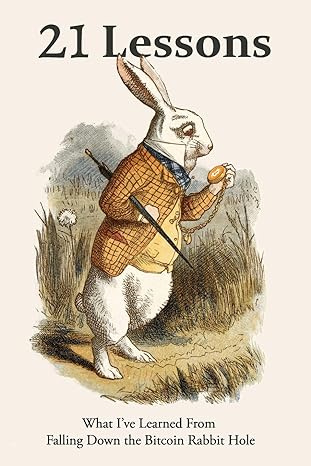

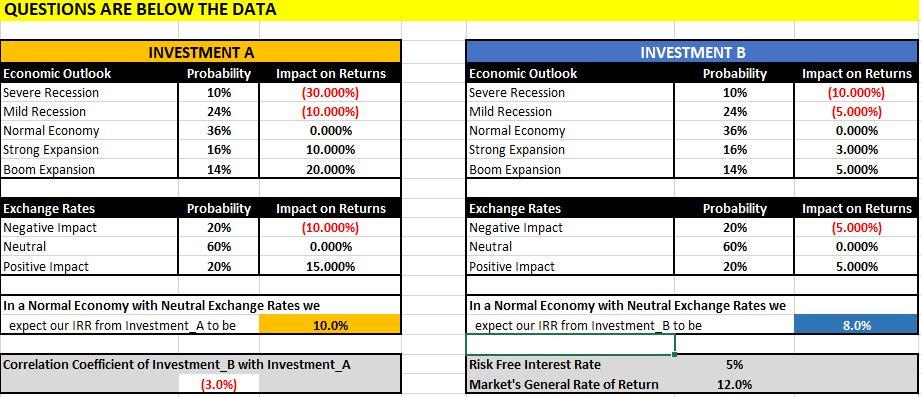

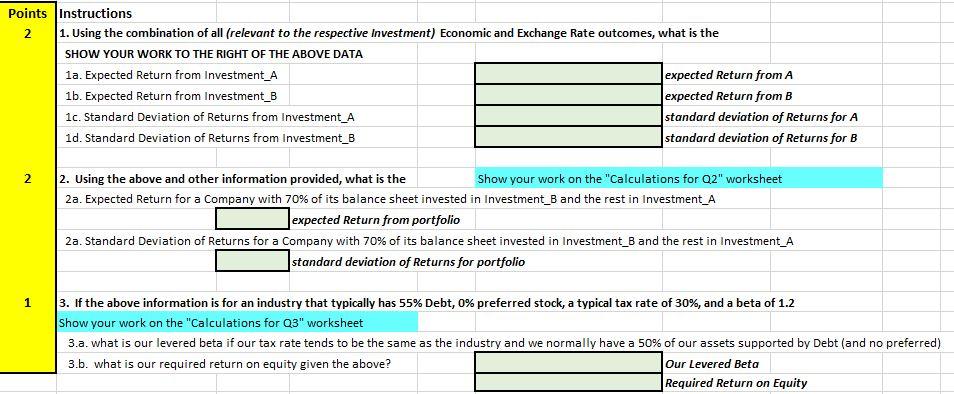

QUESTIONS ARE BELOW THE DATA \begin{tabular}{c|l} \hline Points & Instructions \\ 2 & 1. Using the combination of all (relevant to the respective Investment) Economic and Exchange Rate outcomes, what is the \end{tabular} SHOW YOUR WORK TO THE RIGHT OF THE ABOVE DATA 1a. Expected Return from Investment_A 1b. Expected Return from Investment_B 1c. Standard Deviation of Returns from Investment_A 1d. Standard Deviation of Returns from Investment_B \begin{tabular}{|l|l} \hline & expected Return from A \\ expected Return from B \\ standard deviation of Returns for A \\ standard deviation of Returns for B \end{tabular} 2 2. Using the above and other information provided, what is the Show your work on the "Calculations for Q2 " worksheet 2a. Expected Return for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A 2a. Standard Deviation of Returns for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A standard deviation of Returns for portfolio 1 3. If the above information is for an industry that typically has 55% Debt, 0% preferred stock, a typical tax rate of 30%, and a beta of 1.2 Show your work on the "Calculations for Q " worksheet 3.a. what is our levered beta if our tax rate tends to be the same as the industry and we normally have a 50% of our assets supported by Debt (and no preferred) 3.b. what is our required return on equity given the above? \begin{tabular}{|l|l|} \hline & Our Levered Beta \\ \hline Required Return on Equity \end{tabular} QUESTIONS ARE BELOW THE DATA \begin{tabular}{c|l} \hline Points & Instructions \\ 2 & 1. Using the combination of all (relevant to the respective Investment) Economic and Exchange Rate outcomes, what is the \end{tabular} SHOW YOUR WORK TO THE RIGHT OF THE ABOVE DATA 1a. Expected Return from Investment_A 1b. Expected Return from Investment_B 1c. Standard Deviation of Returns from Investment_A 1d. Standard Deviation of Returns from Investment_B \begin{tabular}{|l|l} \hline & expected Return from A \\ expected Return from B \\ standard deviation of Returns for A \\ standard deviation of Returns for B \end{tabular} 2 2. Using the above and other information provided, what is the Show your work on the "Calculations for Q2 " worksheet 2a. Expected Return for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A 2a. Standard Deviation of Returns for a Company with 70% of its balance sheet invested in Investment_B and the rest in Investment_A standard deviation of Returns for portfolio 1 3. If the above information is for an industry that typically has 55% Debt, 0% preferred stock, a typical tax rate of 30%, and a beta of 1.2 Show your work on the "Calculations for Q " worksheet 3.a. what is our levered beta if our tax rate tends to be the same as the industry and we normally have a 50% of our assets supported by Debt (and no preferred) 3.b. what is our required return on equity given the above? \begin{tabular}{|l|l|} \hline & Our Levered Beta \\ \hline Required Return on Equity \end{tabular}