Answered step by step

Verified Expert Solution

Question

1 Approved Answer

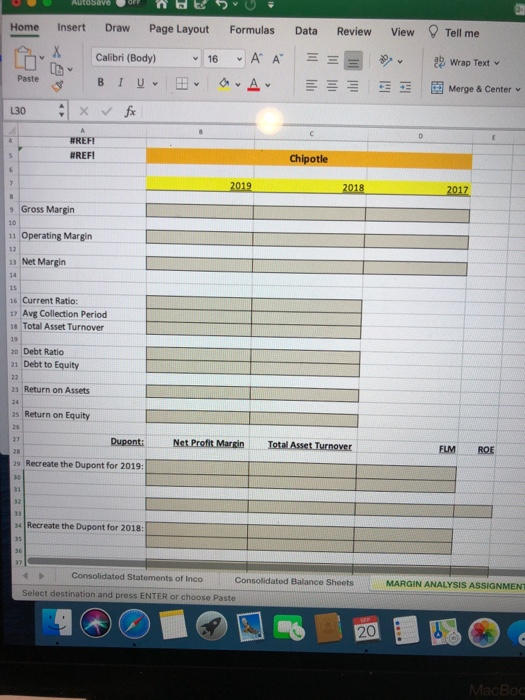

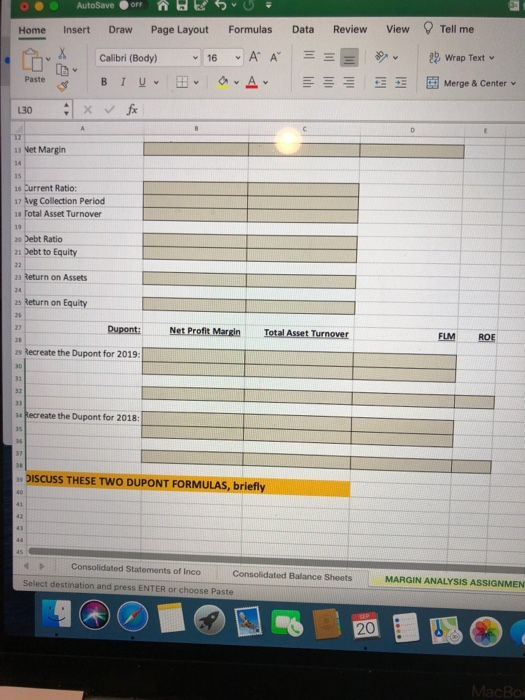

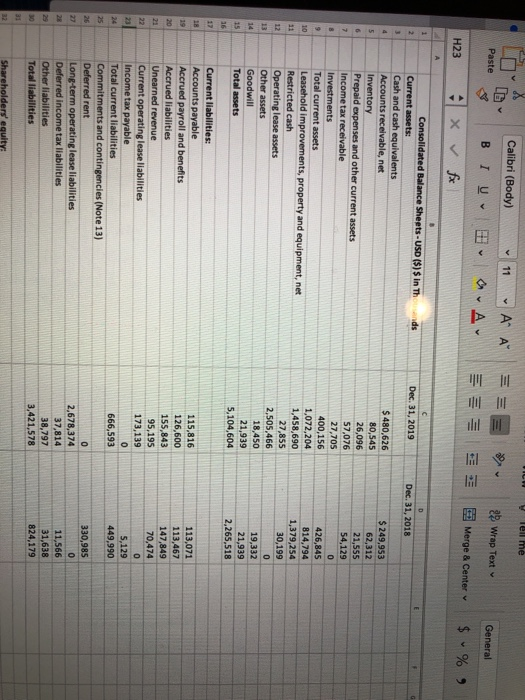

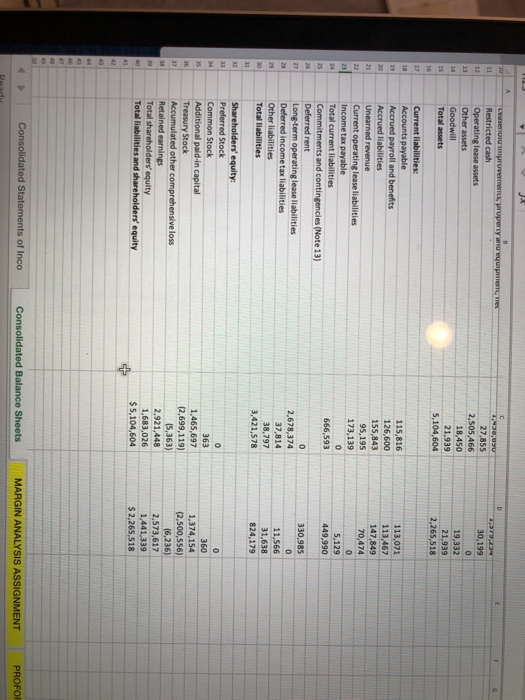

fill in rach of these bumbers in the shaded area using the income statement and balance sheet on the below AUTOSave Home Insert Draw Page

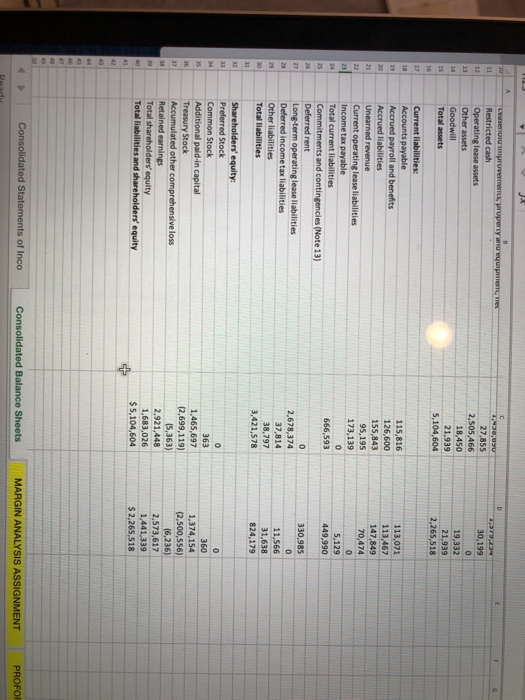

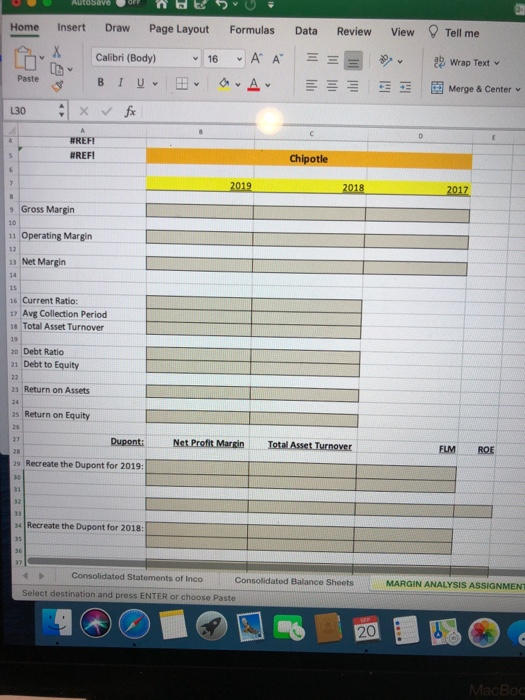

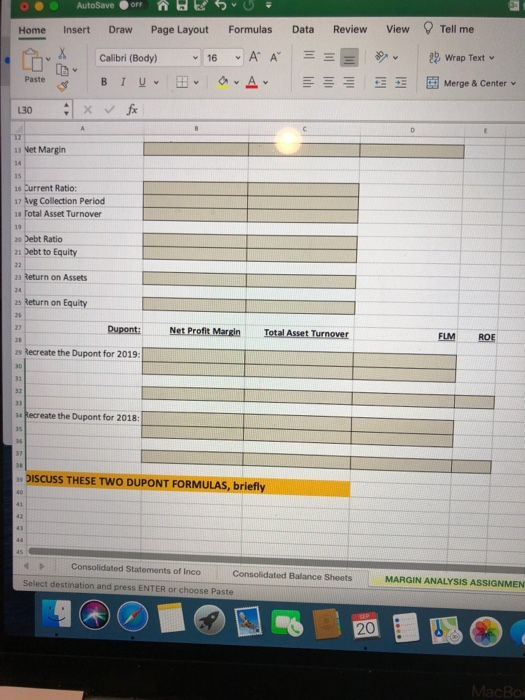

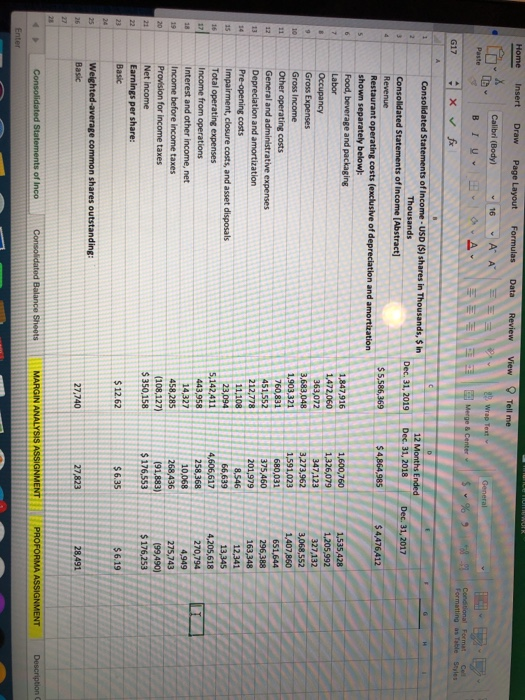

fill in rach of these bumbers in the shaded area using the income statement and balance sheet on the below

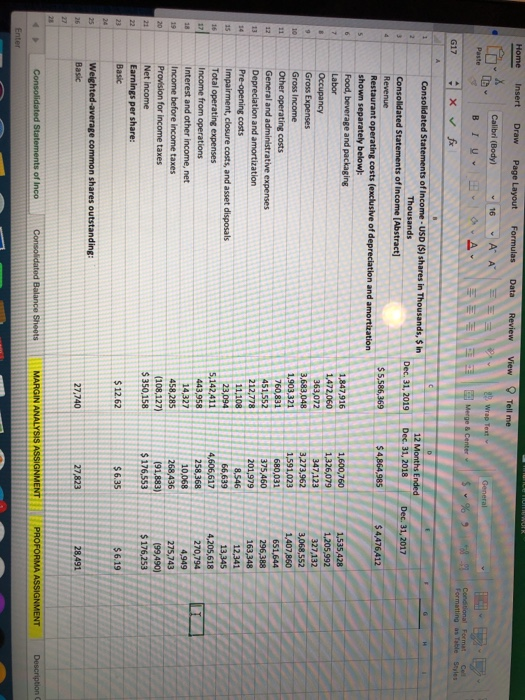

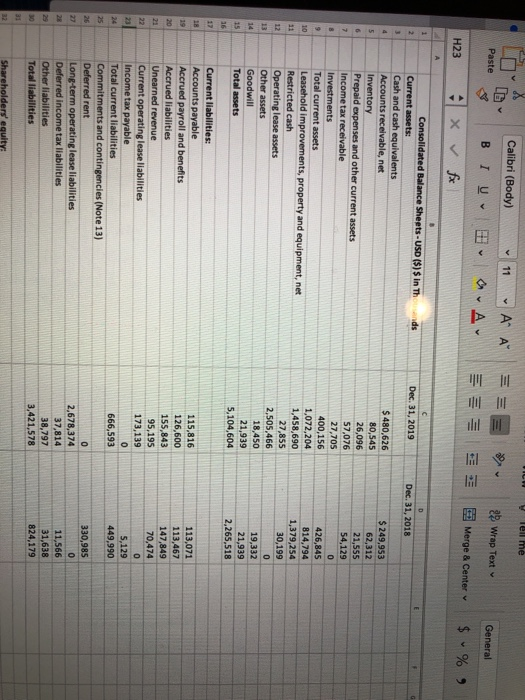

AUTOSave Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 16 ' " == v a Wrap Text Paste BIU a A Merge & Center 30 fx E #REFI #REFI 5 Chipotle 6 7 2019 2018 2017 8 Gross Margin 10 11 Operating Margin 12 11 Net Margin 14 15 16 Current Ratio: 17 Avg Collection Period 18 Total Asset Turnover 19 20 Debt Ratio 21 Debt to Equity 22 23 Return on Assets 24 as Return on Equity 26 Dupont: 28 29 Recreate the Dupont for 2019: 23 Net Profit Margin Total Asset Turnover FLM ROE 19 31 32 33 34 Recreate the Dupont for 2018: 35 36 37 Consolidated Statements of Inco Consolidated Balance Sheets Select destination and press ENTER or choose Paste MARGIN ANALYSIS ASSIGNMENT 20 MacBog Home AutoSave OP Insert Draw Page Layout X Calibri (Body) 16 Formulas Data Review View Tell me 2 Wrap Text - A A avau Paste BIU lili Merge & Center L30 E 13 Net Margin 14 15 16 Current Ratio: 17 Avg Collection Period 13 Total Asset Turnover 19 20 Debt Ratio 21 Debt to Equity 22 23 Return on Assets 24 25 Return on Equity 26 22 Dupont: Net Profit Margin Total Asset Turnover FLM ROE 29 Recreate the Dupont for 2019: 31 13 34 Recreate the Dupont for 2018: 35 15 > DISCUSS THESE TWO DUPONT FORMULAS, briefly 40 41 44 45 Consolidated Statements of Inco Consolidated Balance Sheets Select destination and press ENTER or choose Paste MARGIN ANALYSIS ASSIGNMEN 20 MacBod LUHUR Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body 16 - A a-A- 2 Wrap Text General B TU Merge & Center $% 9 Conditional Format Cel Formatting as Table Styles G17 Xfx 1 2 Dec 31, 2019 12 Months Ended Dec 31, 2018 Dec 31, 2017 3 $ 5,586,369 $4,864,985 $4,476,412 5 6 7 1 11 Consolidated Statements of Income - USD ($) shares in Thousands, $ in Thousands Consolidated Statements of income (Abstract] Revenue Restaurant operating costs (exclusive of depreciation and amortization shown separately below): Food, beverage and packaging Labor Occupancy Gross Expenses Gross income Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs, and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net Income Earnings per share: Basic 12 14 1,847,916 1,472,060 363,072 3,683 048 1,903,321 760,831 451,552 212,778 11,108 23,094 5,142411 443,958 14,327 458,285 (108,127) $ 350,158 1,600,760 1,326,079 347,123 3,273,962 1,591,023 680,031 375,460 201,979 8.546 66,639 4,606,617 258,368 10,068 268,436 (91,883) $ 176,553 1,535,428 1,205,992 327,132 3,068,552 1,407,850 651,644 296,388 163,348 12,341 13,345 4,205,618 270,794 4,949 275,743 (99,490) $ 176,253 15 16 17 E. 18 19 20 21 23 $ 12.62 $6.35 $6.19 24 25 Weighted-average common shares outstanding: Basic 26 27,740 27,823 28,491 Consolidated Statements of Inco Consolidated Balance Sheets MARGIN ANALYSIS ASSIGNMENT PROFORMA ASSIGNMENT Description Enter Tell me Calibri (Body) 11 y = = Paste ' ' ~ 25 Wrap Text BIU General Merge & Center H23 x $ % ) A 1 2 ds Dec 31, 2019 D Dec 31, 2018 1 4 5 6 7 8 Consolidated Balance Sheets - USD ($) $ In Th Current assets: Cash and cash equivalents Accounts receivable, net Inventory Prepaid expenses and other current assets Income tax receivable Investments Total current assets Leasehold improvements, property and equipment, net Restricted cash Operating lease assets Other assets Goodwill Total assets $ 480,626 80,545 26,096 57,076 27,705 400,156 1,072,204 1,458,690 27,855 2,505,466 18,450 21,939 5,104,604 10 $ 249,953 62,312 21,555 54,129 0 426,845 814,794 1,379,254 30,199 0 19,332 21,939 2,265,518 11 12 13 14 15 16 17 18 19 20 115,816 126,600 155,843 95,195 173,139 0 666,593 Current liabilities: Accounts payable Accrued payroll and benefits Accrued liabilities Unearned revenue Current operating lease liabilities Income tax payable Total current liabilities Commitments and contingencies (Note 13) Deferred rent Long-term operating lease liabilities Deferred income tax liabilities Other liabilities Total liabilities 113,071 113,467 147,849 70,474 0 5,129 449,990 22 23 25 25 22 0 2,678,374 37,814 38,797 3,421,578 330,985 0 11,566 31,638 824,179 25 31 32 Shareholders' equity D 11 12 Soru proves, property requerer Restricted cash Operating lease assets Other assets Goodwill Total assets 13 2.930,00 27.855 2,505,466 18,450 21,939 5,104,604 1,79 30,199 0 19,332 21.939 2,265,518 14 36 12 12 19 20 23 115,816 126,600 155,843 95,195 173,139 0 666,593 Current liabilities: Accounts payable Accrued payroll and benefits Accrued liabilities Unearned revenue Current operating lease liabilities Income tax payable Total current liabilities Commitments and contingencies (Note 13) Deferred rent Long-term operating lease liabilities Deferred income tax liabilities Other liabilities Total liabilities 113,071 113,467 147,849 70,474 0 5,129 449,990 22 23 24 26 27 0 2,678,374 37,814 38,797 3,421,578 330,985 0 11,566 31,638 824,179 31 33 10 0 M 3 Shareholders' equity: Preferred Stock Common Stock Additional paid in capital Treasury Stock Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 363 1,465,697 12,699,119) 15,363) 2.921,448 1,683,026 $ 5,104,604 0 360 1,374,154 (2,500,556) 16,236) 2,573,617 1,441,339 $ 2,265,518 40 50 Consolidated Statements of Inco Consolidated Balance Sheets MARGIN ANALYSIS ASSIGNMENT PROFOF

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started