Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the Blank: 1. Long-term or relatively permanent tangible assets that are used in the normal business operation are called ____assets. 2. The cost

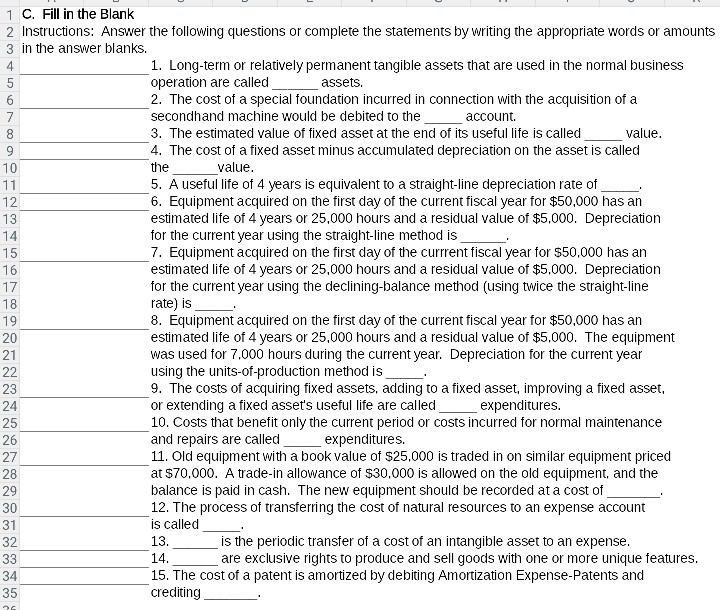

Fill in the Blank: 1. Long-term or relatively permanent tangible assets that are used in the normal business operation are called ____assets. 2. The cost of a special foundation incurred in connection with the acquisition of a secondhand machine would be debited to the____account. 3. The estimated value of fixed asset at the end of its useful life is called____value. 4. The cost of a fixed asset minus accumulated depreciation on the asset is called the____value. 5. A useful life of 4 years is equivalent to a straight-line depreciation rate of____. 6. Equipment acquired on the first day of the current fiscal year for $50,000 has an estimated life of 4 years or 25,000 hours and a residual value of $5,000. Depreciation for the current year using the straight-line method is____. 7. Equipment acquired on the first day of the currrent fiscal year for $50,000 has an estimated life of 4 years or 25,000 hours and a residual value of $5,000. Depreciation for the current year using the declining-balance method (using twice the straight-line rate) is____. 8. Equipment acquired on the first day of the current fiscal year for $50,000 has an estimated life of 4 years or 25,000 hours and a residual value of $5,000. The equipment was used for 7,000 hours during the current year. Depreciation for the current year using the units-of-production method is____. 9. The costs of acquiring fixed assets, adding to a fixed asset, improving a fixed asset or extending a fixed assets useful life are called____expenditures. 10. Costs that benefit only the current period or costs incurred for normal maintenance and repairs are called____ expenditures. 11. Old equipment with a book value of $25,000 is traded in on similar equipment priced at $70,000. A trade-in allowance of $30,000 is allowed on the old equipment, and the balance is paid in cash. The new equipment should be recorded at a cost of____. 12. The process of transferring the cost of natural resources to an expense account is called____. 13____ is the periodic transfer of a cost of an intangible asset to an expense. 14____ exclusive rights to produce and sell goods with one or more unique features. 15. The cost of a patent is amortized by debiting Amortization Expense-Patents and crediting____

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started