Answered step by step

Verified Expert Solution

Question

1 Approved Answer

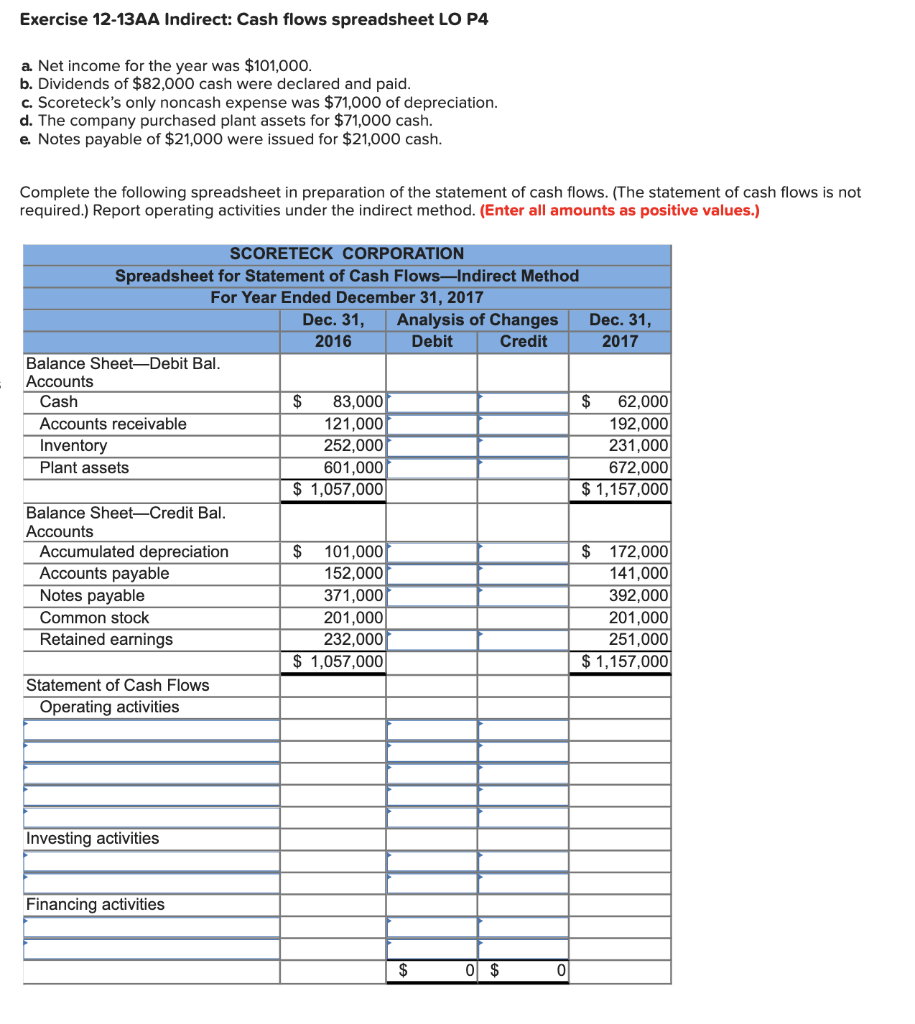

fill in the blank box Exercise 12-13AA Indirect: Cash flows spreadsheet LO P4 a Net income for the year was $101,000. b. Dividends of $82,000

fill in the blank box

Exercise 12-13AA Indirect: Cash flows spreadsheet LO P4 a Net income for the year was $101,000. b. Dividends of $82,000 cash were declared and paid. c. Scoreteck's only noncash expense was $71,000 of depreciation d. The company purchased plant assets for $71,000 cash. e. Notes payable of $21,000 were issued for $21,000 cash Complete the following spreadsheet in preparation of the statement of cash flows. (The statement of cash flows is not required.) Report operating activities under the indirect method. (Enter all amounts as positive values.) SCORETECK CORPORATION Spreadsheet for Statement of Cash Flows-Indirect Method For Year Ended December 31, 2017 Dec. 31, Analysis of Changes Dec. 31, 2016 Debit Credit 2017 Balance Sheet-Debit Bal. Accounts $ Cash 83,000 62,000 121,000 252,000 192,000 231,000 672,000 $1,157,000 Accounts receivable Inventory Plant assets 601,000 $ 1,057,000 Balance Sheet-Credit Bal Accounts 101,000 152,000 371,000 201,000 232,000 172,000 Accumulated depreciation Accounts payable Notes payable $ S 141,000 392,000 201,000 Common stock 251,000 $1,157,000 Retained earnings $1,057,000 Statement of Cash Flows Operating activities Investing activities Financing activities 0$ $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started