fill in the blanks and explain the calculations

fill in the blanks and explain the calculations

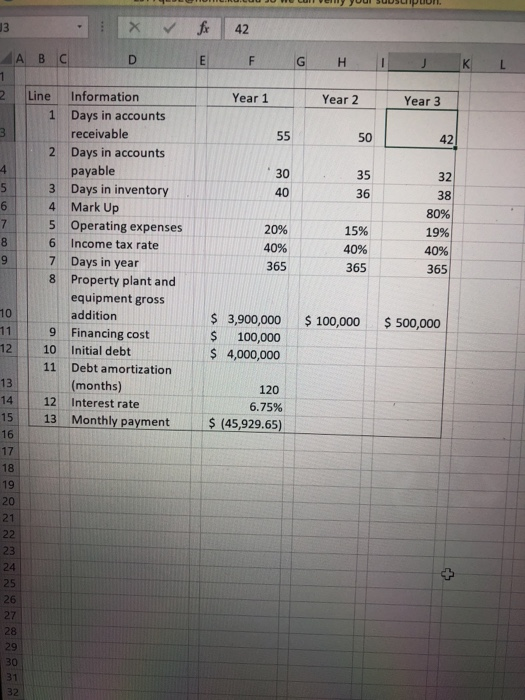

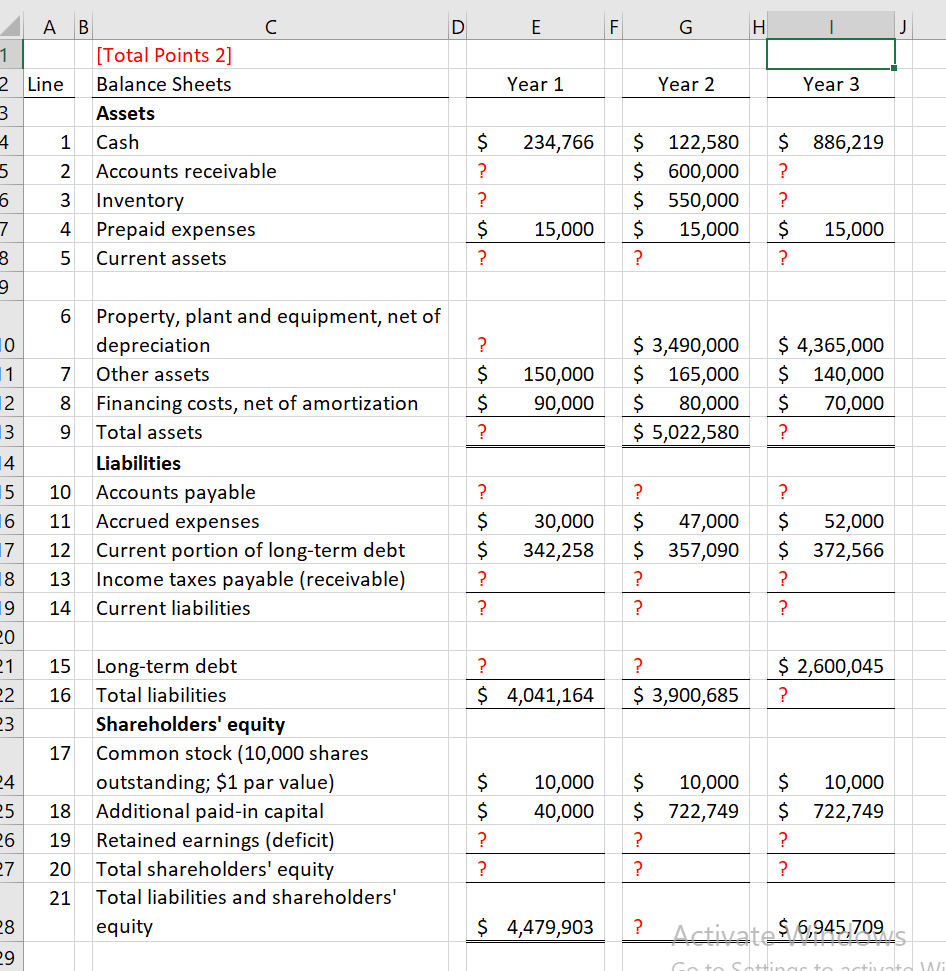

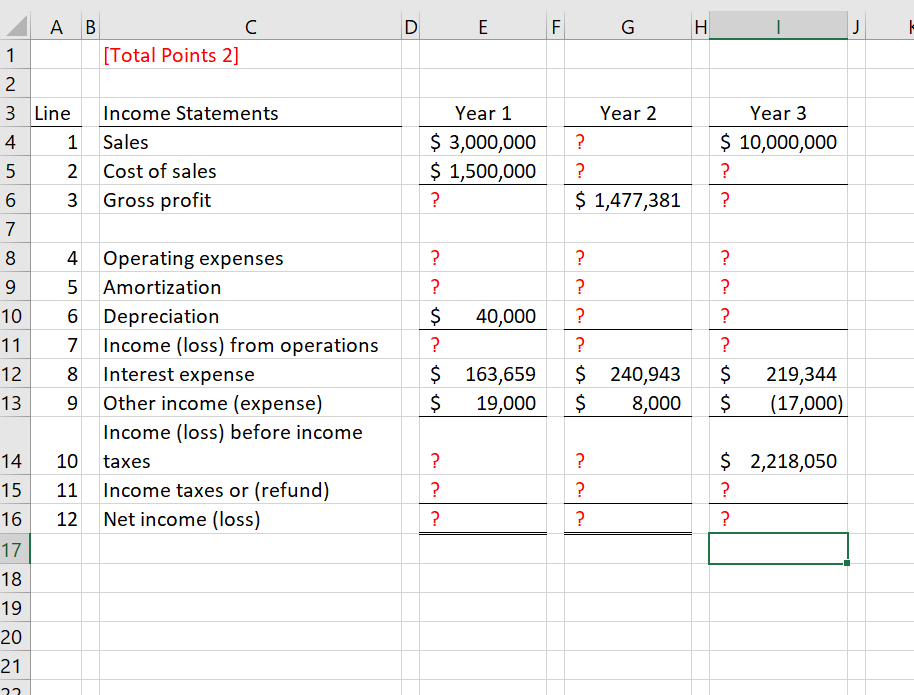

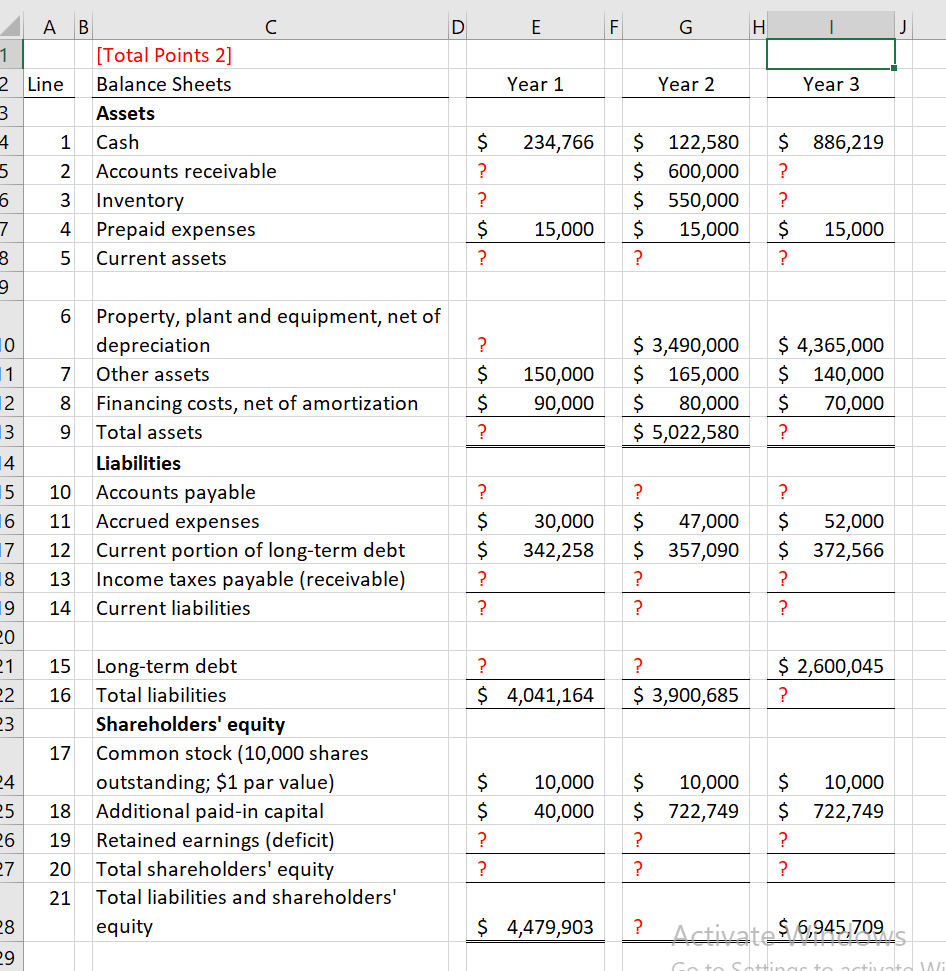

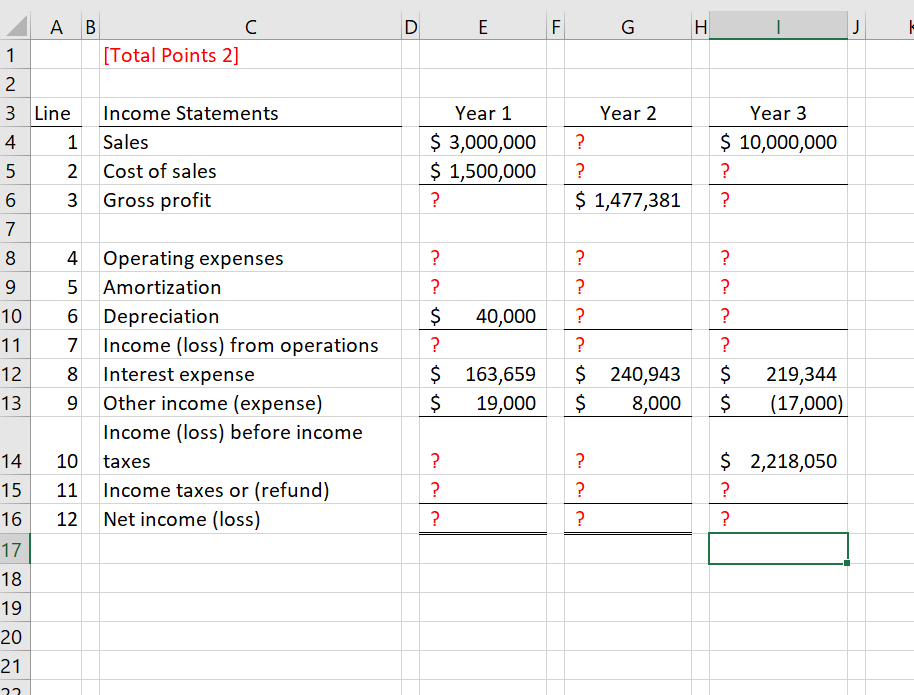

D E F G H J Year 1 Year 2 Year 3 A B 1 [Total Points 2] 2 Line Balance Sheets 3 Assets 4 1 Cash 5 2 Accounts receivable 6 3 Inventory 7 4 Prepaid expenses 8 5 Current assets $ 234,766 $ 886,219 ? $ 122,580 $ 600,000 $ 550,000 $ 15,000 ? ? ? $ ? ? 15,000 15,000 $ ? ? $ $ ? 150,000 90,000 $ 3,490,000 $ 165,000 $ 80,000 $ 5,022,580 $ 4,365,000 $ 140,000 $ 70,000 ? 6 Property, plant and equipment, net of depreciation 7 Other assets 8 Financing costs, net of amortization 9 Total assets Liabilities 10 Accounts payable 11 Accrued expenses 12 Current portion of long-term debt 13 Income taxes payable (receivable) 14 Current liabilities ? ? 15 6 17 18 9 $ $ ? 30,000 342,258 $ 47,000 $ 357,090 ? ? $ 52,000 $ 372,566 ? ? ? ? 15 ? $ 4,041,164 ? $ 3,900,685 $ 2,600,045 ? 16 17 Long-term debt Total liabilities Shareholders' equity Common stock (10,000 shares outstanding; $1 par value) Additional paid-in capital Retained earnings (deficit) Total shareholders' equity Total liabilities and shareholders' equity 10,000 40,000 24 5 26 27 18 $ $ ? ? $ 10,000 $ 722,749 ? ? $ 10,000 $ 722,749 ? ? 19 20 21 28 $ 4,479,903 ? 6,945,709 29 D E F G H J Year 1 $ 3,000,000 $ 1,500,000 ? Year 2 ? ? $ 1,477,381 Year 3 $ 10,000,000 ? ? 3 ? 8 9 ? ? 1 [Total Points 2] 2 3 Line Income Statements 4 1 Sales 5 2 Cost of sales 6 3 Gross profit 7 8 4 Operating expenses 9 5 Amortization 10 6 Depreciation 11 Income (loss) from operations 8 Interest expense 13 9 Other income (expense) Income (loss) before income 14 10 taxes 15 11 Income taxes or (refund) 16 12 Net income (loss) 17 18 19 20 21 ? ? $ 40,000 ? $ 163,659 $ 19,000 ? ? ? ? $ 240,943 $ 8,000 12 ? $ $ 219,344 (17,000) ? ? ? ? $ 2,218,050 ? ? ? ? ? 22 13 fx 42 E F G H K L Year 1 Year 2 Year 3 55 50 42 30 35 36 40 D 1 2 Line Information 1 Days in accounts 3 receivable 2 Days in accounts 4 payable 5 3 Days in inventory 6 4 Mark Up 7 5 Operating expenses 8 6 Income tax rate 9 7 Days in year 8 Property plant and equipment gross 10 addition 11 9 Financing cost 12 10 Initial debt 11 Debt amortization 13 (months) 14 12 Interest rate 15 13 Monthly payment 20% 40% 365 32 38 80% 19% 40% 365 15% 40% 365 $ 100,000 $ 500,000 $ 3,900,000 $ 100,000 $ 4,000,000 120 6.75% $ (45,929.65) 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 D E F G H J Year 1 Year 2 Year 3 A B 1 [Total Points 2] 2 Line Balance Sheets 3 Assets 4 1 Cash 5 2 Accounts receivable 6 3 Inventory 7 4 Prepaid expenses 8 5 Current assets $ 234,766 $ 886,219 ? $ 122,580 $ 600,000 $ 550,000 $ 15,000 ? ? ? $ ? ? 15,000 15,000 $ ? ? $ $ ? 150,000 90,000 $ 3,490,000 $ 165,000 $ 80,000 $ 5,022,580 $ 4,365,000 $ 140,000 $ 70,000 ? 6 Property, plant and equipment, net of depreciation 7 Other assets 8 Financing costs, net of amortization 9 Total assets Liabilities 10 Accounts payable 11 Accrued expenses 12 Current portion of long-term debt 13 Income taxes payable (receivable) 14 Current liabilities ? ? 15 6 17 18 9 $ $ ? 30,000 342,258 $ 47,000 $ 357,090 ? ? $ 52,000 $ 372,566 ? ? ? ? 15 ? $ 4,041,164 ? $ 3,900,685 $ 2,600,045 ? 16 17 Long-term debt Total liabilities Shareholders' equity Common stock (10,000 shares outstanding; $1 par value) Additional paid-in capital Retained earnings (deficit) Total shareholders' equity Total liabilities and shareholders' equity 10,000 40,000 24 5 26 27 18 $ $ ? ? $ 10,000 $ 722,749 ? ? $ 10,000 $ 722,749 ? ? 19 20 21 28 $ 4,479,903 ? 6,945,709 29 D E F G H J Year 1 $ 3,000,000 $ 1,500,000 ? Year 2 ? ? $ 1,477,381 Year 3 $ 10,000,000 ? ? 3 ? 8 9 ? ? 1 [Total Points 2] 2 3 Line Income Statements 4 1 Sales 5 2 Cost of sales 6 3 Gross profit 7 8 4 Operating expenses 9 5 Amortization 10 6 Depreciation 11 Income (loss) from operations 8 Interest expense 13 9 Other income (expense) Income (loss) before income 14 10 taxes 15 11 Income taxes or (refund) 16 12 Net income (loss) 17 18 19 20 21 ? ? $ 40,000 ? $ 163,659 $ 19,000 ? ? ? ? $ 240,943 $ 8,000 12 ? $ $ 219,344 (17,000) ? ? ? ? $ 2,218,050 ? ? ? ? ? 22 13 fx 42 E F G H K L Year 1 Year 2 Year 3 55 50 42 30 35 36 40 D 1 2 Line Information 1 Days in accounts 3 receivable 2 Days in accounts 4 payable 5 3 Days in inventory 6 4 Mark Up 7 5 Operating expenses 8 6 Income tax rate 9 7 Days in year 8 Property plant and equipment gross 10 addition 11 9 Financing cost 12 10 Initial debt 11 Debt amortization 13 (months) 14 12 Interest rate 15 13 Monthly payment 20% 40% 365 32 38 80% 19% 40% 365 15% 40% 365 $ 100,000 $ 500,000 $ 3,900,000 $ 100,000 $ 4,000,000 120 6.75% $ (45,929.65) 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32

fill in the blanks and explain the calculations

fill in the blanks and explain the calculations