Answered step by step

Verified Expert Solution

Question

1 Approved Answer

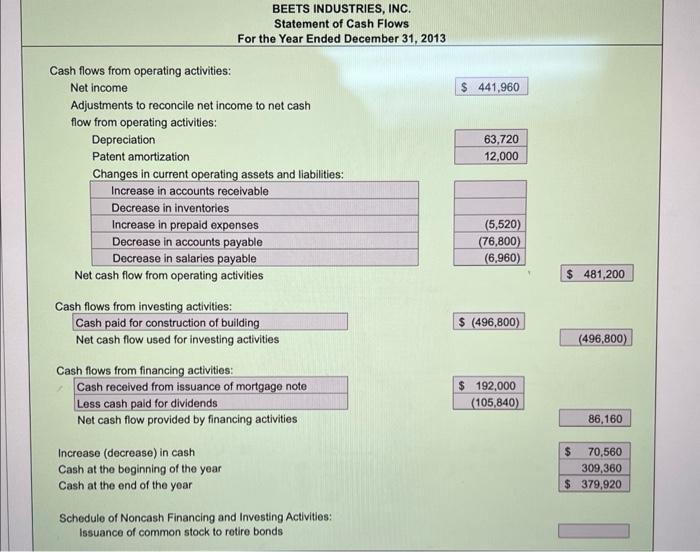

fill in the blanks BEETS INDUSTRIES, INC. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income

fill in the blanks

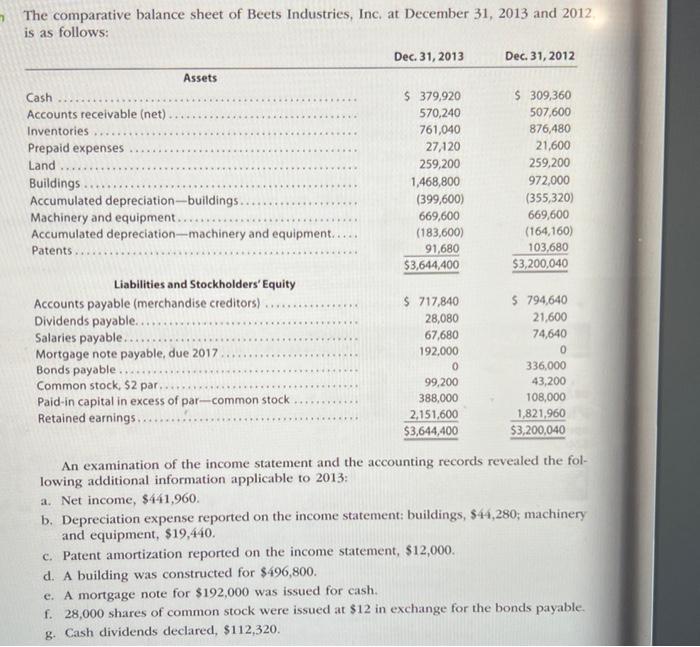

BEETS INDUSTRIES, INC. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Patent amortization Changes in current operating assets and liabilities: \begin{tabular}{l} Increase in accounts receivable \\ \hline Decrease in inventories \\ \hline Increase in prepaid expenses \\ \hline Decrease in accounts payable \\ Decrease in salaries payable \\ Net cash flow from operating activities \\ Cash flows from investing activities: \\ Net cash flow used for investing activities \\ Cash flows from financing activities: \\ \hline Cash received from issuance of mortgage note \\ \hline Less cash paid for dividends \\ Net cash flow provided by financing activities \end{tabular} \begin{tabular}{|} $441,960 \\ \hline 63,720 \\ \hline 12,000 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline \\ \hline(5,520) \\ \hline(76,800) \\ \hline(6,960) \\ \hline \end{tabular} \begin{tabular}{|c|} \hline(6,960) \\ \hline 4481,200 \\ \hline \end{tabular} Increase (decrease) in cash Cash at the beginning of the year Cash at the end of the year Schedule of Noncash Financing and Investing Activities: Issuance of common stock to retire bonds The comparative balance sheet of Beets Industries, Inc. at December 31,2013 and 2012 is as follows: An examination of the income statement and the accounting records revealed the following additional information applicable to 2013 : a. Net income, $441,960. b. Depreciation expense reported on the income statement: buildings, $44,280; machinery and equipment, $19,440. c. Patent amortization reported on the income statement, $12,000. d. A building was constructed for $496,800. e. A mortgage note for $192,000 was issued for cash. f. 28,000 shares of common stock were issued at $12 in exchange for the bonds payable. g. Cash dividends declared, $112,320

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started