Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the blanks for the year 2016, then use those values to forecast the values for the year 2017 while also answering the questions

Fill in the blanks for the year 2016, then use those values to forecast the values for the year 2017 while also answering the questions that are asked at the bottom if it is needed.

Fill in the blanks for the year 2016, then use those values to forecast the values for the year 2017 while also answering the questions that are asked at the bottom if it is needed.

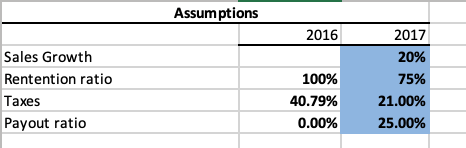

Use these percentages to calculate the forecasted values. PLEASE ANSWER WITH EXCEL

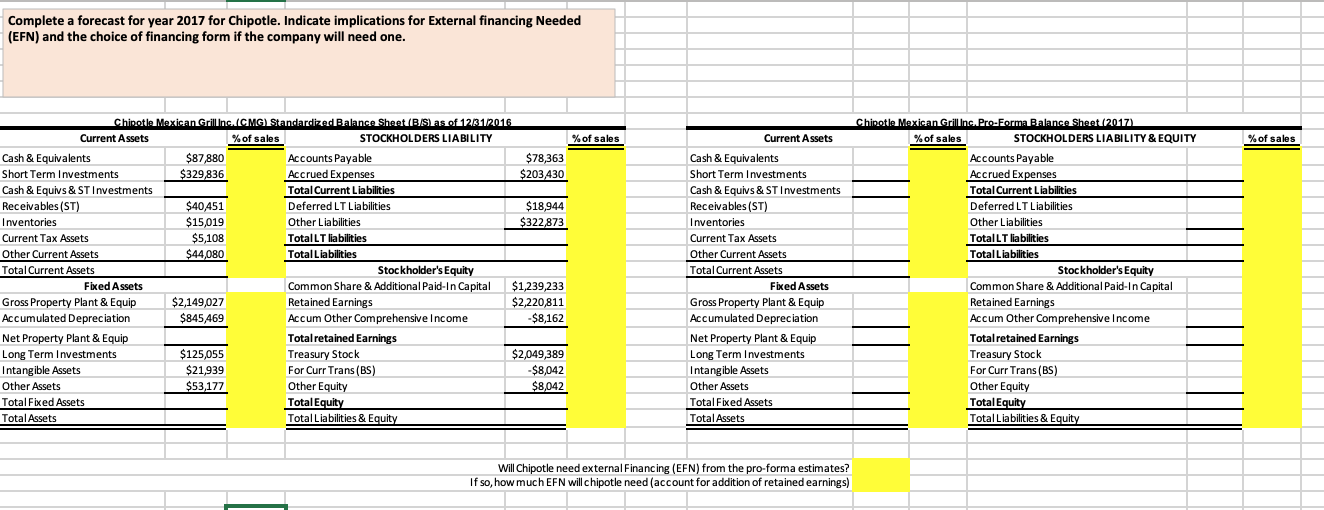

Complete a forecast for year 2017 for Chipotle. Indicate implications for External financing Needed (EFN) and the choice of financing form if the company will need one. % of sales % of sales Chipotle Mexican Grilling, (CMGStandardized Balance Sheet (B/s) as of 1281/2016 Current Assets % of sales STOCKHOLDERS LIABILITY Cash & Equivalents $87,880 Accounts Payable $78,363 Short Term Investments $329,836 Accrued Expenses $203,430 Cash & Equivs & ST Investments Total Current Liabilities Receivables (ST) $40,451 Deferred LT Liabilities $18,944 Inventories $15,019 Other Liabilities $322,873 Current Tax Assets $5,108 TotalLT liabilities Other Current Assets $44,080 Total Liabilities Total Current Assets Stockholder's Equity Fixed Assets Common Share & Additional Paid-In Capital $1,239,233 Gross Property Plant & Equip $2,149,027 Retained Earnings $2,220,811 Accumulated Depreciation $845,469 Accum Other Comprehensive Income $8,162 Net Property Plant & Equip Total retained Earnings Long Term Investments $125,055 Treasury Stock $2,049,389 Intangible Assets $21,939 For Curr Trans (BS) -$8,042 Other Assets $53,177 Other Equity $8,042 Total Fixed Assets Total Equity Total Assets Total Liabilities & Equity Current Assets Cash & Equivalents Short Term Investments Cash & Equivs & ST Investments Receivables (ST) Inventories Current Tax Assets Other Current Assets Total Current Assets Fixed Assets Gross Property Plant & Equip Accumulated Depreciation Net Property Plant & Equip Long Term Investments Intangible Assets Other Assets Total Fixed Assets Total Assets Chipotle Mexican Grillinc, Pro-Forma Balance Sheet (2017) % of sales STOCKHOLDERS LIABILITY & EQUITY Accounts Payable Accrued Expenses Total Current Liabilities Deferred LT Liabilities Other Liabilities TotalLT liabilities TotalLiabilities Stockholder's Equity Common Share & Additional Paid-In Capital Retained Earnings Accum Other Comprehensive Income Total retained Earnings Treasury Stock For Curr Trans (BS) Other Equity Total Equity Total Liabilities & Equity Will Chipotle need external Financing (EFN) from the pro-forma estimates? If so, how much EFN will chipotle need (account for addition of retained earnings) Assumptions 2016 2017 20% 75% Sales Growth Rentention ratio Taxes Payout ratio 100% 40.79% 0.00% 21.00% 25.00% Complete a forecast for year 2017 for Chipotle. Indicate implications for External financing Needed (EFN) and the choice of financing form if the company will need one. % of sales % of sales Chipotle Mexican Grilling, (CMGStandardized Balance Sheet (B/s) as of 1281/2016 Current Assets % of sales STOCKHOLDERS LIABILITY Cash & Equivalents $87,880 Accounts Payable $78,363 Short Term Investments $329,836 Accrued Expenses $203,430 Cash & Equivs & ST Investments Total Current Liabilities Receivables (ST) $40,451 Deferred LT Liabilities $18,944 Inventories $15,019 Other Liabilities $322,873 Current Tax Assets $5,108 TotalLT liabilities Other Current Assets $44,080 Total Liabilities Total Current Assets Stockholder's Equity Fixed Assets Common Share & Additional Paid-In Capital $1,239,233 Gross Property Plant & Equip $2,149,027 Retained Earnings $2,220,811 Accumulated Depreciation $845,469 Accum Other Comprehensive Income $8,162 Net Property Plant & Equip Total retained Earnings Long Term Investments $125,055 Treasury Stock $2,049,389 Intangible Assets $21,939 For Curr Trans (BS) -$8,042 Other Assets $53,177 Other Equity $8,042 Total Fixed Assets Total Equity Total Assets Total Liabilities & Equity Current Assets Cash & Equivalents Short Term Investments Cash & Equivs & ST Investments Receivables (ST) Inventories Current Tax Assets Other Current Assets Total Current Assets Fixed Assets Gross Property Plant & Equip Accumulated Depreciation Net Property Plant & Equip Long Term Investments Intangible Assets Other Assets Total Fixed Assets Total Assets Chipotle Mexican Grillinc, Pro-Forma Balance Sheet (2017) % of sales STOCKHOLDERS LIABILITY & EQUITY Accounts Payable Accrued Expenses Total Current Liabilities Deferred LT Liabilities Other Liabilities TotalLT liabilities TotalLiabilities Stockholder's Equity Common Share & Additional Paid-In Capital Retained Earnings Accum Other Comprehensive Income Total retained Earnings Treasury Stock For Curr Trans (BS) Other Equity Total Equity Total Liabilities & Equity Will Chipotle need external Financing (EFN) from the pro-forma estimates? If so, how much EFN will chipotle need (account for addition of retained earnings) Assumptions 2016 2017 20% 75% Sales Growth Rentention ratio Taxes Payout ratio 100% 40.79% 0.00% 21.00% 25.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started