Answered step by step

Verified Expert Solution

Question

1 Approved Answer

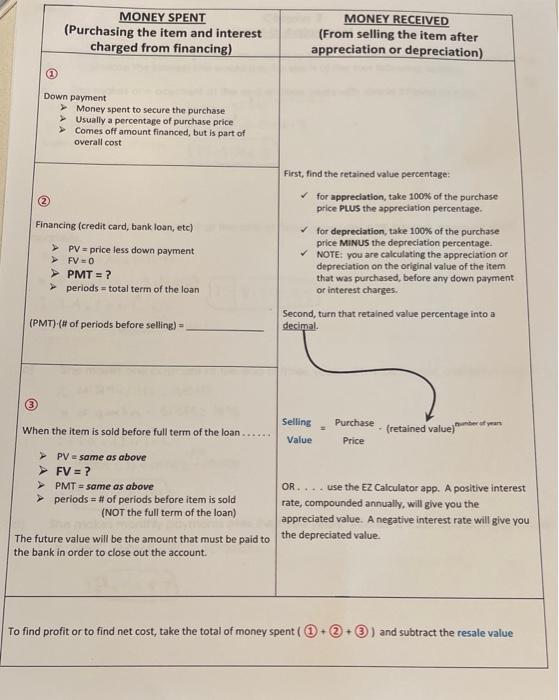

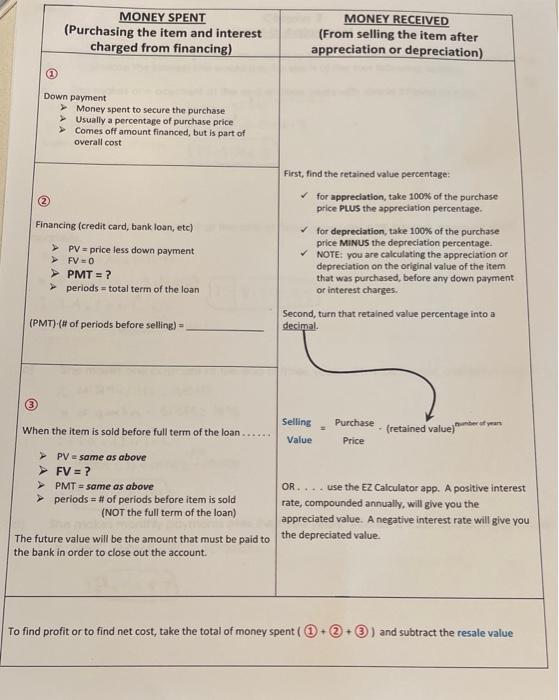

fill in the blanks MONEY SPENT (Purchasing the item and interest charged from financing) MONEY RECEIVED (From selling the item after appreciation or depreciation) Down

fill in the blanks

MONEY SPENT (Purchasing the item and interest charged from financing) MONEY RECEIVED (From selling the item after appreciation or depreciation) Down payment > Money spent to secure the purchase Usually a percentage of purchase price Comes off amount financed, but is part of overall cost Financing (credit card, bank loan, etc) PV = price less down payment > FV=0 PMT = ? periods = total term of the loan First, find the retained value percentage: for appreciation, take 100% of the purchase price PLUS the appreciation percentage for depreciation, take 100% of the purchase price MINUS the depreciation percentage. NOTE: you are calculating the appreciation or depreciation on the original value of the item that was purchased, before any down payment or interest charges. Second, turn that retained value percentage into a decimal (PMT).(# of periods before selling) Selling Purchase When the item is sold before full term of the loan..... (retained value)" Value Price PV - same as above FV = ? PMT = same as above OR. ... use the Ez Calculator app. A positive interest periods = # of periods before item is sold rate, compounded annually, will give you the (NOT the full term of the loan) appreciated value. A negative interest rate will give you The future value will be the amount that must be paid to the depreciated value. the bank in order to close out the account. To find profit or to find net cost, take the total of money spent () and subtract the resale value MONEY SPENT (Purchasing the item and interest charged from financing) MONEY RECEIVED (From selling the item after appreciation or depreciation) Down payment > Money spent to secure the purchase Usually a percentage of purchase price Comes off amount financed, but is part of overall cost Financing (credit card, bank loan, etc) PV = price less down payment > FV=0 PMT = ? periods = total term of the loan First, find the retained value percentage: for appreciation, take 100% of the purchase price PLUS the appreciation percentage for depreciation, take 100% of the purchase price MINUS the depreciation percentage. NOTE: you are calculating the appreciation or depreciation on the original value of the item that was purchased, before any down payment or interest charges. Second, turn that retained value percentage into a decimal (PMT).(# of periods before selling) Selling Purchase When the item is sold before full term of the loan..... (retained value)" Value Price PV - same as above FV = ? PMT = same as above OR. ... use the Ez Calculator app. A positive interest periods = # of periods before item is sold rate, compounded annually, will give you the (NOT the full term of the loan) appreciated value. A negative interest rate will give you The future value will be the amount that must be paid to the depreciated value. the bank in order to close out the account. To find profit or to find net cost, take the total of money spent () and subtract the resale value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started