Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the Blanks Net income = Total assets = Total liabilities = Total SH/E = Working capital = Current ratio = Acid-test ratio =

Fill in the Blanks

Net income =

Total assets =

Total liabilities =

Total SH/E =

Working capital =

Current ratio =

Acid-test ratio =

Profit margin =

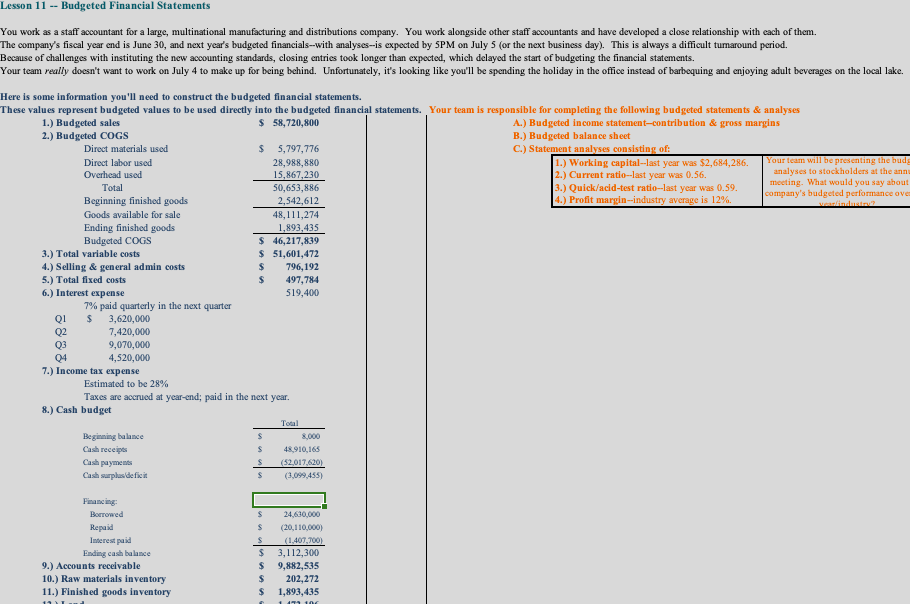

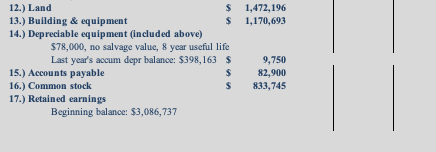

Lesson 11 -Budgeted Financial Statements You work as a staff accountant for a large, multinational manufacturing and distributions company. You work alongside other staff accountants and have developed a close relationship with each of them The company's fiscal year end is June 30, and next years budgeted financials-with analyses-is expected by 5PM on July 5 (or the next business day). This is always a difficult tumaround period. Because of challenges with instituting the new accounting standards, closing entries took longer than expected, which delayed the start of budgeting the financial statements. Your team really doesn't want to work on July 4 to make up for being behind. Unfortunately, it's looking like you'll be spending the holiday in the office instead of barbequing and enjoying adult beverages on the local lake Here is some information you'll need to construct the budgeted financial statements. These values represent budgeted values to be used directly into the budgeted financial statemen ts. Your team is responsible for completing the following budgeted statements& analyses 1.) Budgeted sales 2.) Budgeted COGS 58,720,800 A.) Budgeted income statement-contribution & gross margins B.) Budgeted balance sheet C.) Statement analyses consisting of: Direct materials used Direct labor used Overhead used S 5,797,776 28,988,880 1.) Working capital-last year was $2,684,286, 2.) Current ratio-last year was 0 3.) Quick/acid-test ratio-last year was 0.59 analyses to stockholders at the ann meeting. 0.56 What would you say about Total 50,653,886 2,542,612 48,111,274 Profit margin -industry average is 12% Beginning finished goods Goods available for sale Ending finished goods Budgeted COGS 3.) Total variable costs 4.) Selling& general admin costs 5.) Total flxed costs 6.) Interest expense 46,217,839 S 51,601,472 $ 796,192 $497,784 519,400 7% paid quarterly in the next quarter Q1 S3,620,000 02 Q3 Q4 7,420,000 9,070,000 4,520,000 7.) Income tax expense Estimated to be 28% Taxes are accrued at year-end; paid in the next year. 8.) Cash budget Beginning balance Cash receips Cash payments Cash surplsdeficit 8,000 910,165 S (3,099,455) Francing Borrowed Repaid Interest paid S (20,110,000) (1,407,700} $ 3,112,300 $ 9,882,535 $ 202,272 S 1,893,435 Ending cash balance 9.) Accounts receivable 10.) Raw materials inventory 11.) Finished goods inventory 12.) Land 13.) Building& equipment 14.) Depreclable equipment (Included above) $ 1,472,196 1,170,693 $78,000, no salvage value, 8 ycar useful life 15.) Accounts payable 16.) Common stock 17.) Retained earnings Last year's accum depr balance: $398,163 9,750 $ 82,900 s833,745 Beginning balance: $3,086,737

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started