Answered step by step

Verified Expert Solution

Question

1 Approved Answer

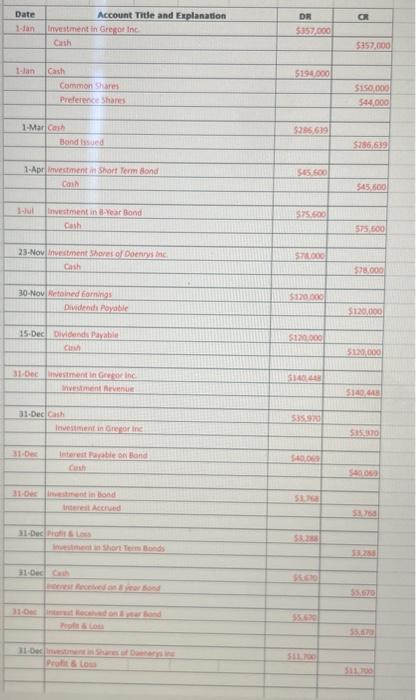

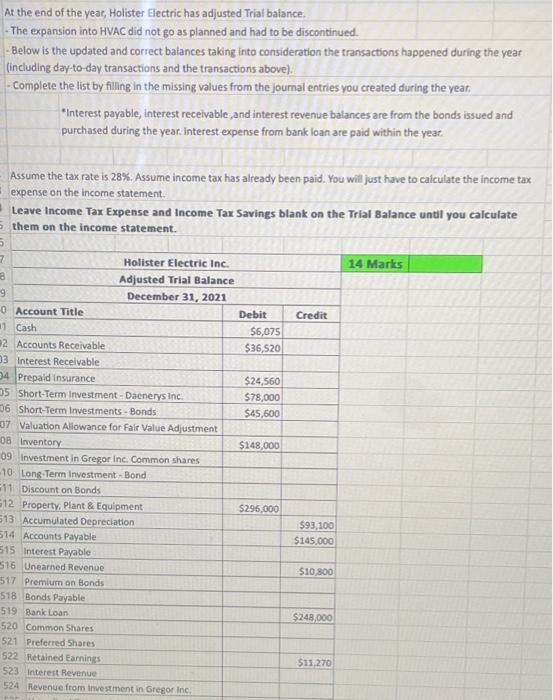

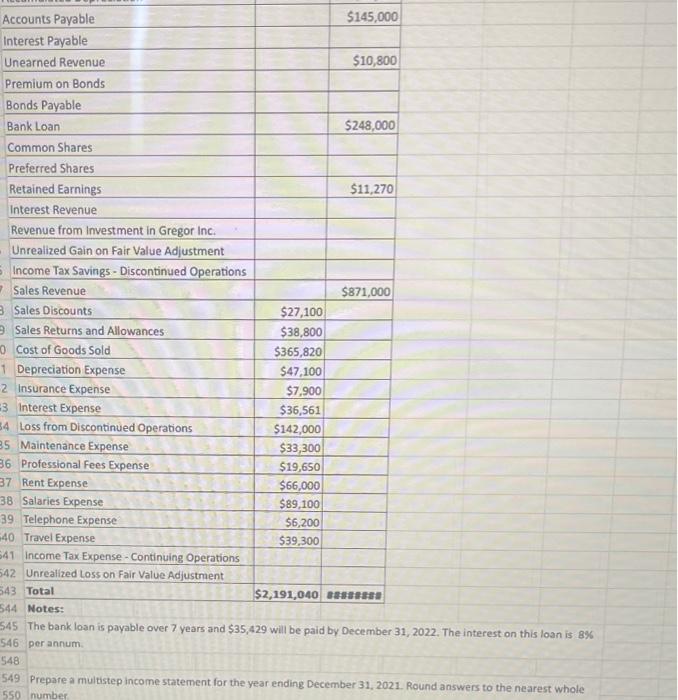

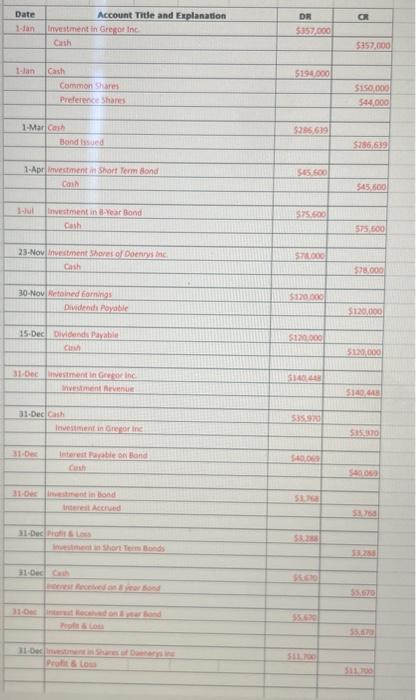

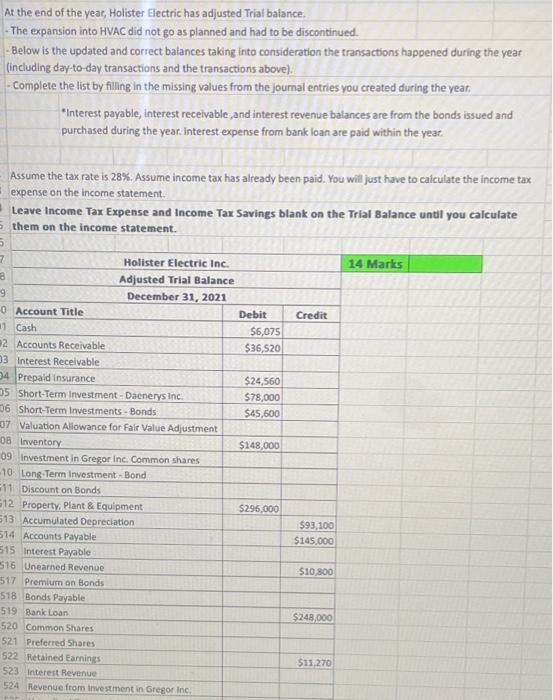

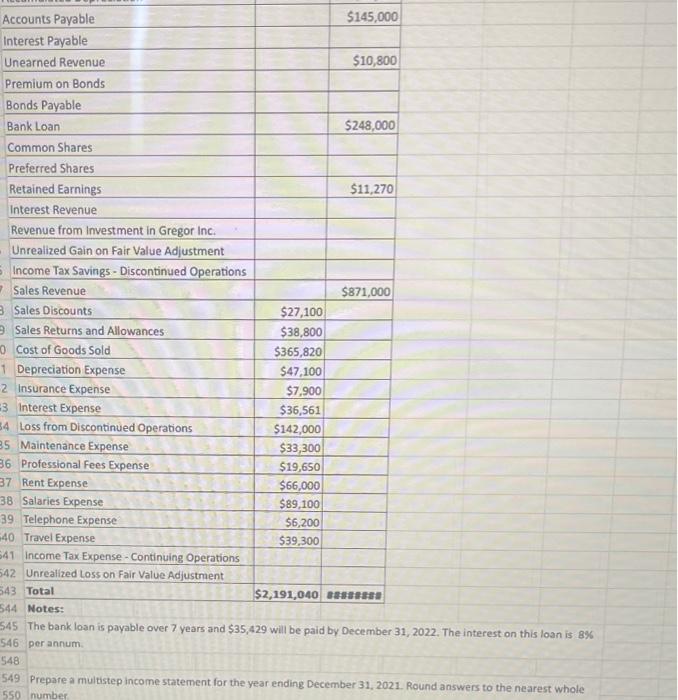

Fill in the blanks on the adjusted Trial Balance At the end of the year, Holister Electric has adjusted Trial balance. - The expansion into

Fill in the blanks on the adjusted Trial Balance

At the end of the year, Holister Electric has adjusted Trial balance. - The expansion into HVAC did not go as planned and had to be discontinued - Below is the updated and correct balances taking into consideration the transactions happened during the year (including day-to-day transactions and the transactions above). - Complete the list by filling in the missing values from the joumal entries you created during the year. "Interest payable, interest receivable, and interest revenue balances are from the bonds issued and purchased during the year, Interest expense from bank loan are paid within the year. Assume the tax rate is 28%. Assume income tax has already been paid. You will just have to calculate the income tax expense on the income statement. Leave Income Tax Expense and Income Tax Savings blank on the Trial Balance until you calculate them on the income statement. 14 Marks per annum 9 Prepare a multistep income statement for the year ending December 31, 2021. Round answers to the nearest whole numbe: At the end of the year, Holister Electric has adjusted Trial balance. - The expansion into HVAC did not go as planned and had to be discontinued - Below is the updated and correct balances taking into consideration the transactions happened during the year (including day-to-day transactions and the transactions above). - Complete the list by filling in the missing values from the joumal entries you created during the year. "Interest payable, interest receivable, and interest revenue balances are from the bonds issued and purchased during the year, Interest expense from bank loan are paid within the year. Assume the tax rate is 28%. Assume income tax has already been paid. You will just have to calculate the income tax expense on the income statement. Leave Income Tax Expense and Income Tax Savings blank on the Trial Balance until you calculate them on the income statement. 14 Marks per annum 9 Prepare a multistep income statement for the year ending December 31, 2021. Round answers to the nearest whole numbe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started