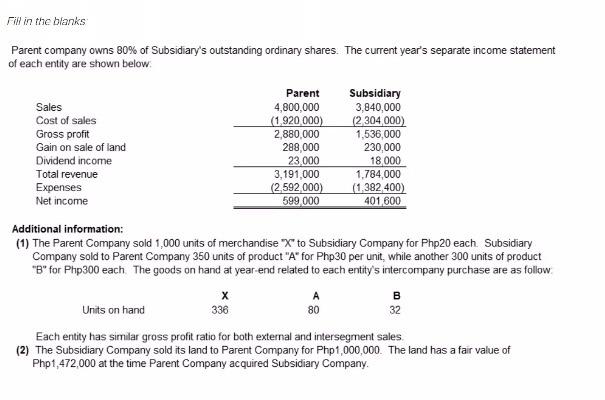

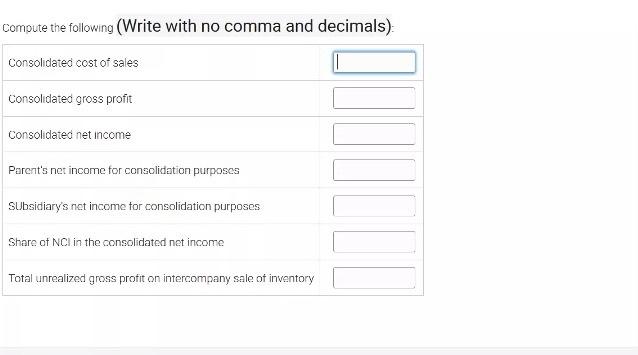

Fill in the blanks Parent company owns 80% of Subsidiary's outstanding ordinary shares. The current year's separate income statement of each entity are shown below Parent Subsidiary Sales 4,800,000 3,840,000 Cost of sales (1.920 000) (2 304000) Gross profit 2.880,000 1,536,000 Gain on sale of land 288,000 230,000 Dividend income 23.000 18000 Total revenue 3,191,000 1,784,000 Expenses (2.592 000) (1,382,400) Net income 599 000 401 600 Additional information: (1) The Parent Company sold 1,000 units of merchandise X to Subsidiary Company for Php20 each Subsidiary Company sold to Parent Company 350 units of product "A" for Php30 per unit, while another 300 units of product "B" for Php300 each The goods on hand at year-end related to each entity's intercompany purchase are as follow A B Units on hand 336 80 32 Each entity has similar gross profit ratio for both external and intersegment sales (2) The Subsidiary Company sold its land to Parent Company for Php 1,000,000. The land has a fair value of Php1,472,000 at the time Parent Company acquired Subsidiary Company Compute the following (Write with no comma and decimals) Consolidated cost of sales Consolidated gross profit Consolidated net income Parent's net income for consolidation purposes Subsidiary's not income for consolidation purposes Share of NC in the consolidated net income Total unrealized gross profit on intercompany sale of inventory Fill in the blanks Parent company owns 80% of Subsidiary's outstanding ordinary shares. The current year's separate income statement of each entity are shown below Parent Subsidiary Sales 4,800,000 3,840,000 Cost of sales (1.920 000) (2 304000) Gross profit 2.880,000 1,536,000 Gain on sale of land 288,000 230,000 Dividend income 23.000 18000 Total revenue 3,191,000 1,784,000 Expenses (2.592 000) (1,382,400) Net income 599 000 401 600 Additional information: (1) The Parent Company sold 1,000 units of merchandise X to Subsidiary Company for Php20 each Subsidiary Company sold to Parent Company 350 units of product "A" for Php30 per unit, while another 300 units of product "B" for Php300 each The goods on hand at year-end related to each entity's intercompany purchase are as follow A B Units on hand 336 80 32 Each entity has similar gross profit ratio for both external and intersegment sales (2) The Subsidiary Company sold its land to Parent Company for Php 1,000,000. The land has a fair value of Php1,472,000 at the time Parent Company acquired Subsidiary Company Compute the following (Write with no comma and decimals) Consolidated cost of sales Consolidated gross profit Consolidated net income Parent's net income for consolidation purposes Subsidiary's not income for consolidation purposes Share of NC in the consolidated net income Total unrealized gross profit on intercompany sale of inventory