Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the blanks, Thank you! Question Z questions that give you two For the following, fill in the blanks with the appropriate term(s). For

Fill in the blanks, Thank you!

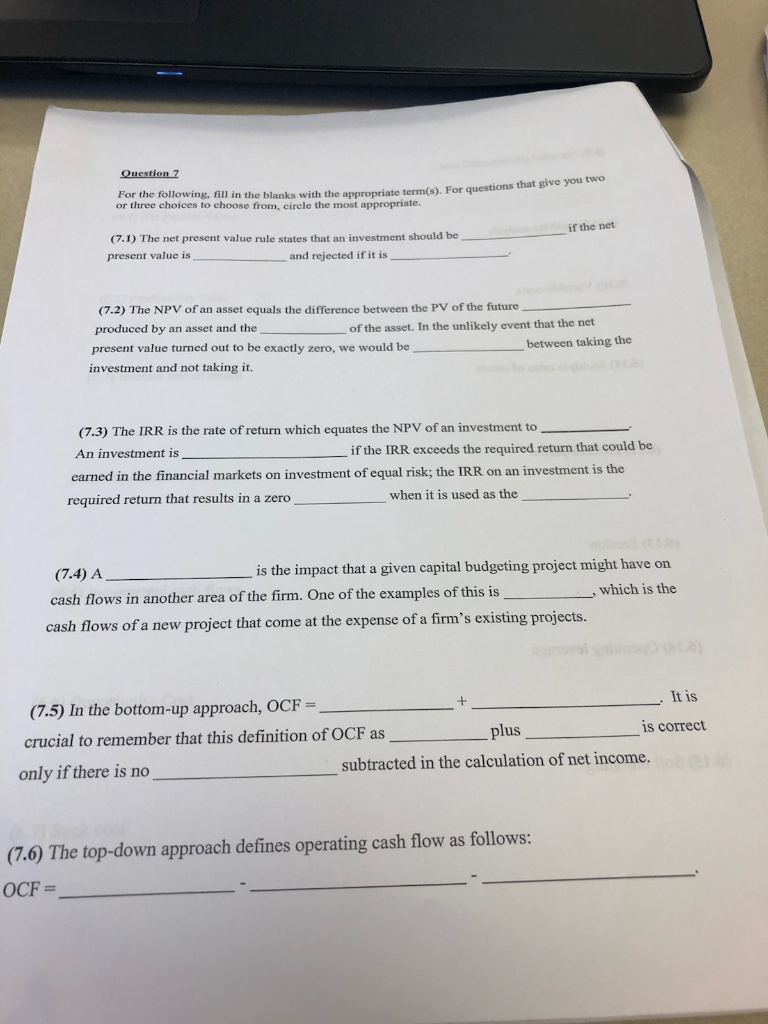

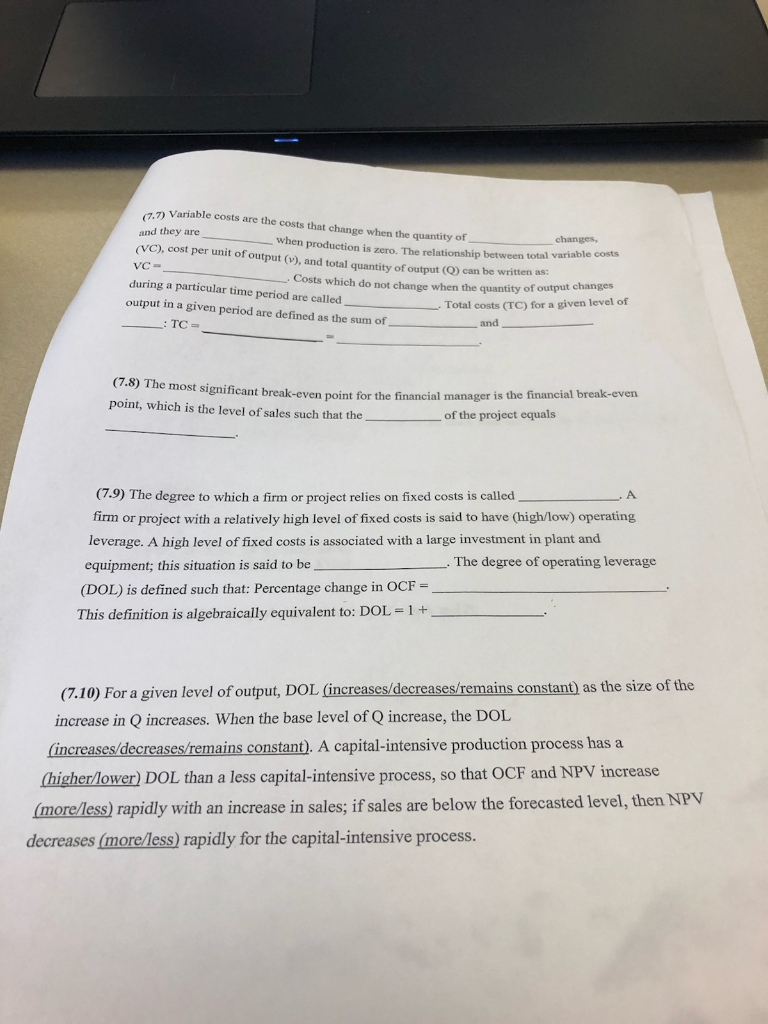

Question Z questions that give you two For the following, fill in the blanks with the appropriate term(s). For or three choices to choose from, cirele the most appropriate. if the net (7.1) The net present value rule states that an investment should be present value is and rejected if it is (7.2) The NPV ofan asset equals the difference between the PV of the future produced by an asset and the present value turned out to be exactly zero, we would be investment and not taking it. of the asset. In the unlikely event that the net between taking the (7.3) The IRR is the rate of return which equates the NPV of an investment to if the IRR exceeds the required return that could be An investment is earned in the financial markets on investment of equal risk; the IRR on an investment is the required return that results in a zero when it is used as the is the impact that a given capital budgeting project might have on ,which is the (7.4) A cash flows in another area of the firm. One of the examples of this is cash flows of a new project that come at the expense of a firm's existing projects. It is (7.5) In the bottom-up approach, OCF crucial to remember that this definition of OCF as only if there is no pl subtracted in the calculation of net income (7.6) The top-down approach defines operating cash flow as follows OCF- 7.7) Variable costs are the costs that change when the quantity of and they are when production is zero. The relationship between (vC), cost per unit of output (o), and total quantity of output (0) can VC- during a particular time period are called changes total variable costs Costs which do not change when the quantity of output changes output in a given period are defined as the sum of Total costs (TC) for a given level of and . (7.8) The most significant break-even point for the financial manager i point, which is the level of sales such that theo the projeet equals (7.9) The degree to which a firm or project relies on fixed costs is calledA firm or project with a relatively high level of fixed costs is said to have (high/low) operating leverage. A high level of fixed costs is associated with a large investment in plant and equipment; this situation is said to beThe degree of operating leverage (DOL) is defined such that: Percentage change in OCF- This definition is algebraically equivalent to: DOL-1+ (7.10) For a given level of output, DOL (increases/d increase in Q increases. When the base level of Q increase, the DOL (increases/decreases/remains constant). A capital-intensive production process hasa (higher/ower) DOL than a less capital-intensive process, so that OCF and NPV increase moreless) rapidly with an increase in sales; if sales are below the forecasted level reases/remains constant) as the size of the decreases (moreless) rapidly for the capital-intensive processStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started