Answered step by step

Verified Expert Solution

Question

1 Approved Answer

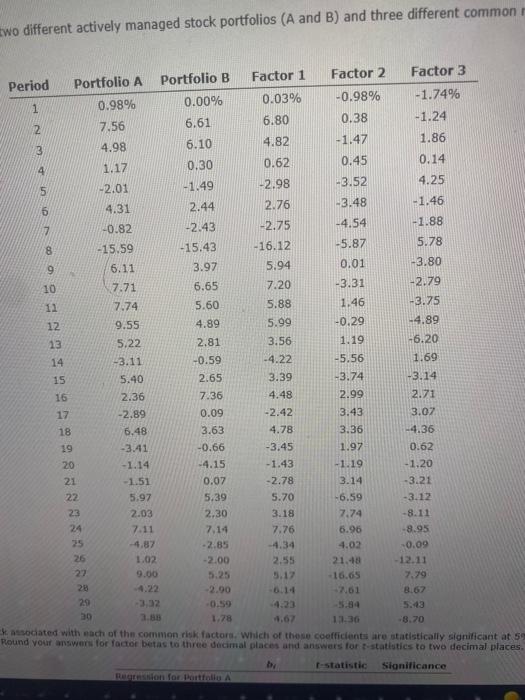

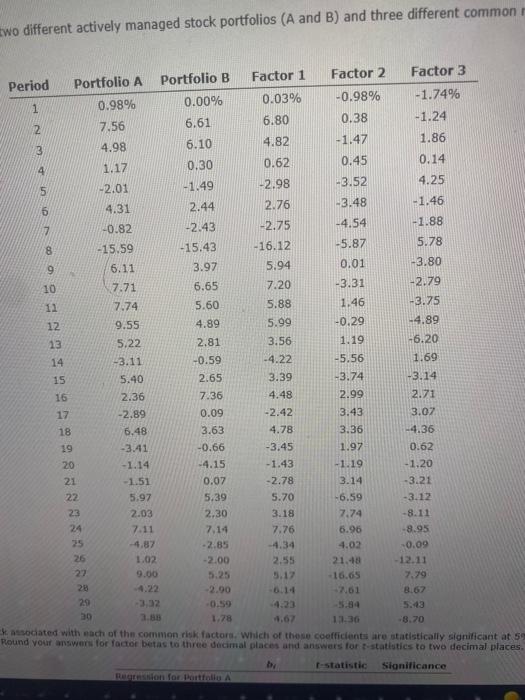

Fill in the blanks two different actively managed stock portfolios (A and B) and three different common Factor 1 Factor 2 Portfolio B Factor 3

Fill in the blanks

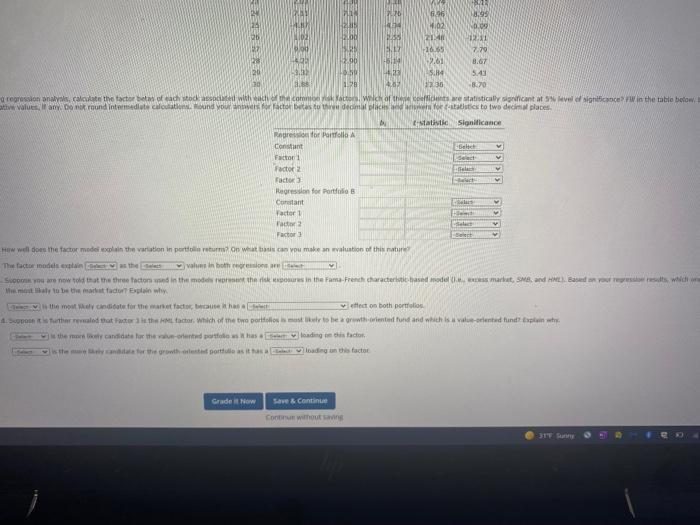

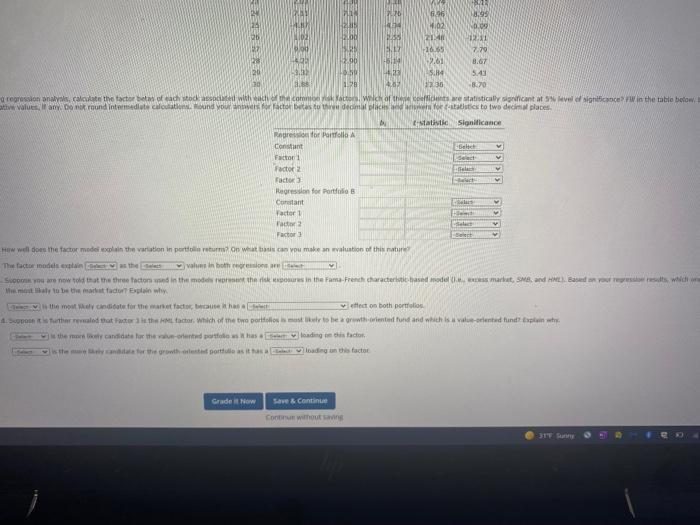

two different actively managed stock portfolios (A and B) and three different common Factor 1 Factor 2 Portfolio B Factor 3 Period Portfolio A 0.03% 0.00% 0.98% -0.98% -1.74% 1 7.56 6.61 6.80 0.38 2 -1.24 4.82 6.10 4.98 -1.47 1.86 3 1.17 0.30 0.62 0.45 0.14 -2.01 -1.49 -3.52 -2.98 4.25 4.31 2.44 2.76 3.48 -1.46 -0.82 -2.43 -2.75 -4.54 -1.88 -15.59 -15.43 -16.12 -5.87 5.78 6.11 3.97 5.94 0.01 -3.80 7.71 6.65 7.20 -3.31 -2.79 7.74 5.60 5.88 1.46 -3.75 9.55 4.89 5.99 -0.29 -4.89 5.22 2.81 3.56 1.19 H6.20 -3.11 -0.59 -4.22 -5.56 1.69 5.40 2.65 3.39 -3.74 -3.14 2.36 7.36 4.48 2.99 2.71 -2.89 0.09 -2.42 3.43 3.07 6.48 3.63 4.78 3.36 -4.36 -3.41 -0.66 -3.45 1.97 0.62 -1.14 -4.15 -1.43 -1.19 - 1.20 -1.51 0.07 -2.78 3.14 -3.21 5.97 5.39 5.70 -6.59 -3.12 2.03 2.30 3.18 -8.11 7.11 7.14 7.76 6.96 -8.95 -4.87 -2.85 -4.34 4.02 -0.09 1.02 -2.00 21.48 -12.11 9.00 5.25 5.17 16.65 7.79 2.90 6.14 7.01 8.67 -3.32 -0.59 4:23 ag 2.85 1.78 11.36 8.70 kassociated with each of the common risk factors. Which of these coefficients are statistically significant at 5 Round your answers for factor betas to three decimal places and answers for statistics to two decimal places -statistic Significance Woo ASSENS 7.74 5.43 V BAN HIN 2016 6.96 18.99 7.02 0.09 LID 200 255 ZIAR 121 9.17 16.65 7.79 23 12.30 -5114 2.61 8.67 53.3 43 $.114 5.45 128 203 17.30 -8.70 a regression analyse the factors of each stod associated with a comiatto Which of the coeffle statistically incantat el biglicance in the title below Waves, I am round intermediate and your eyes for actor bothwe decimal ediyor tasties to two decimal places statistic Significance Regression for Portfolio Constant Factor 1 Factor 2 Factor 3 ht Repression for Patio Constant Tacter1 Factor 2 del Factor How well does the factor model in the variation in portreturn what can you make an evaluation of this nature The factor modes the values in both resort So you are now told that the three factors in the moderns the nicks in the Fama French characteristic-based model market, B. and H. Based on your wide to be the facer Explain why the mostly indicate for the factors vett on both portfolio So is tarther realed that for the factor, which of the two partidos skar to be growth-cented fund and which is a violented unit? Explain who theme candidate for the crew has a leading distado est to the growth est portalading on this facto Grude i Now Save & Continue Continue without two different actively managed stock portfolios (A and B) and three different common Factor 1 Factor 2 Portfolio B Factor 3 Period Portfolio A 0.03% 0.00% 0.98% -0.98% -1.74% 1 7.56 6.61 6.80 0.38 2 -1.24 4.82 6.10 4.98 -1.47 1.86 3 1.17 0.30 0.62 0.45 0.14 -2.01 -1.49 -3.52 -2.98 4.25 4.31 2.44 2.76 3.48 -1.46 -0.82 -2.43 -2.75 -4.54 -1.88 -15.59 -15.43 -16.12 -5.87 5.78 6.11 3.97 5.94 0.01 -3.80 7.71 6.65 7.20 -3.31 -2.79 7.74 5.60 5.88 1.46 -3.75 9.55 4.89 5.99 -0.29 -4.89 5.22 2.81 3.56 1.19 H6.20 -3.11 -0.59 -4.22 -5.56 1.69 5.40 2.65 3.39 -3.74 -3.14 2.36 7.36 4.48 2.99 2.71 -2.89 0.09 -2.42 3.43 3.07 6.48 3.63 4.78 3.36 -4.36 -3.41 -0.66 -3.45 1.97 0.62 -1.14 -4.15 -1.43 -1.19 - 1.20 -1.51 0.07 -2.78 3.14 -3.21 5.97 5.39 5.70 -6.59 -3.12 2.03 2.30 3.18 -8.11 7.11 7.14 7.76 6.96 -8.95 -4.87 -2.85 -4.34 4.02 -0.09 1.02 -2.00 21.48 -12.11 9.00 5.25 5.17 16.65 7.79 2.90 6.14 7.01 8.67 -3.32 -0.59 4:23 ag 2.85 1.78 11.36 8.70 kassociated with each of the common risk factors. Which of these coefficients are statistically significant at 5 Round your answers for factor betas to three decimal places and answers for statistics to two decimal places -statistic Significance Woo ASSENS 7.74 5.43 V BAN HIN 2016 6.96 18.99 7.02 0.09 LID 200 255 ZIAR 121 9.17 16.65 7.79 23 12.30 -5114 2.61 8.67 53.3 43 $.114 5.45 128 203 17.30 -8.70 a regression analyse the factors of each stod associated with a comiatto Which of the coeffle statistically incantat el biglicance in the title below Waves, I am round intermediate and your eyes for actor bothwe decimal ediyor tasties to two decimal places statistic Significance Regression for Portfolio Constant Factor 1 Factor 2 Factor 3 ht Repression for Patio Constant Tacter1 Factor 2 del Factor How well does the factor model in the variation in portreturn what can you make an evaluation of this nature The factor modes the values in both resort So you are now told that the three factors in the moderns the nicks in the Fama French characteristic-based model market, B. and H. Based on your wide to be the facer Explain why the mostly indicate for the factors vett on both portfolio So is tarther realed that for the factor, which of the two partidos skar to be growth-cented fund and which is a violented unit? Explain who theme candidate for the crew has a leading distado est to the growth est portalading on this facto Grude i Now Save & Continue Continue without

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started