fill in the blanks with formulas :)

clearer photo

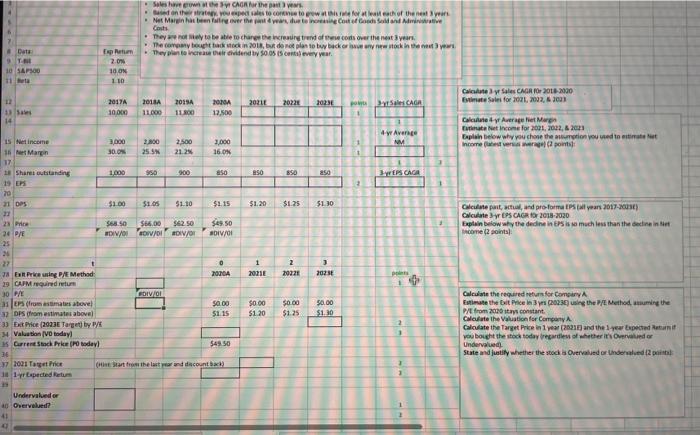

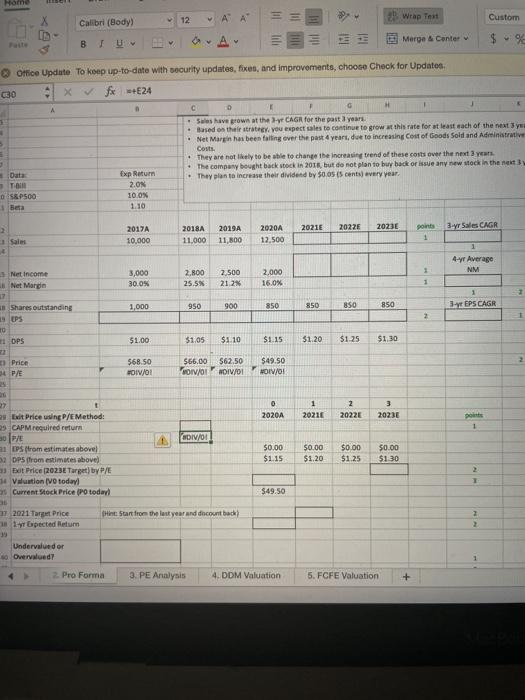

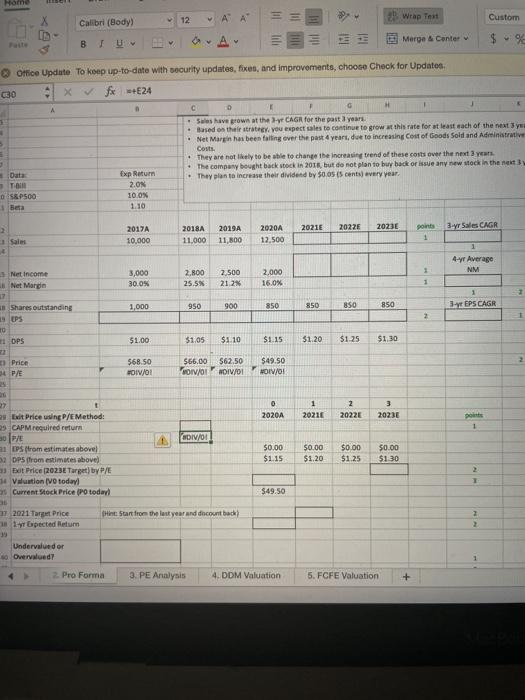

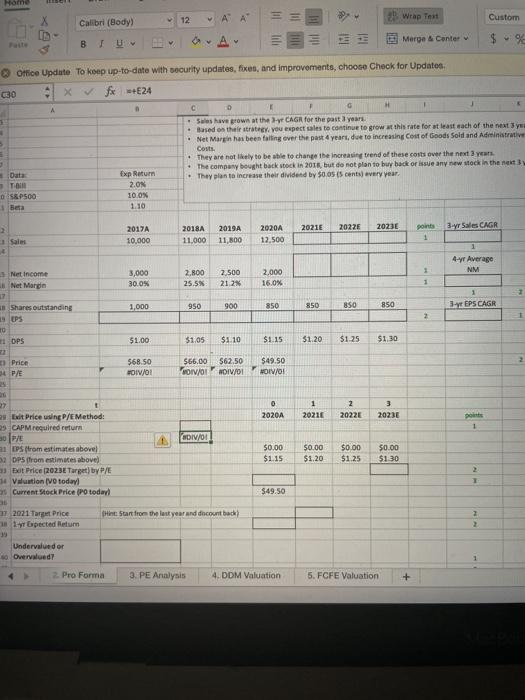

SE CAGR for the Based on the operates to come to row for each of the next year Not Martin hat betale roer the pa&ww.dutorong Conte Bondon and www They were to be able to change the creating trend of records over the next years The company to take in 2018, dolan to whickory work in the years They plan to create the dividend 005 Escorts every year. Data Espen 2.09 10. ON 1 10 10 SAP300 Calculate y Sales CAGR fr 2018-2020 Estimate Sales for 2001, 2002, 2003 12 20310 2017A 10.000 2018 11.000 2019 11.00 2020 12.500 20221 203:30 po CAR 14 4-y Avenue NM Calculate y Average liter tinta et Income for 2001, 2002, 2003 Explain telow why you chose the stution you used to meet Income vergelpoms: 3.000 30.09 2.00 255 2.500 21.2% 3,000 16.ON 15 et income in Margin 17 Share outstanding 19 EPS 70 21 DPS 1,000 100 BSO 850 850 BESCACA 3 5110 $1.15 $1.20 $1.25 $1.30 2 Price 36 PE 25 568.50 DIVO $62.50 DIV/IV/0! $4.50 DIV/01 Calculate past, actual, and proforma Salyans 2017-2008) Calculate yr EPS CAGR 10 2018-2020 Explain Delow why the dedine in EPS is so much less than the dinin Income (2) 1 20210 2 20221 3 2025 $0.00 $1.20 $0.00 $125 50.00 $1.30 0 7 BR Pricing P/E Method: 19 CAPM required 30 P/E GOIVOI ass (from stimates above $0.00 32 DPS from estimates above $1.15 33 Et Price (29336 Targety 4 Valuation [VO today! Current Stock Prodel 549 50 36 37 2021 Tage Price CHE Start the last count) 1 1 yr Expected Retur Calculate the required return for Company Estimate the bil Price 3 yn (2023 using the Method. ming the from 2020 stay constant Calculate the lustion for Company Calculate the Target Price in year 2007) and the 1-year Expected to you bought the stocktoday regardless of whether in Ordor Underval State and justify whether the stock Overvalued or underledI2 Undervalued or Overveld 41 Home 12 Calibri (Body) VA A Wrap Text Custom I Morpe Center B $ % Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 30 Xfx - E24 A . C D Ses have grown at the CAGR for the past years. Based on the strategy you expect sales to continue to grow at this rate for at least each of the next ye Net Margn has been falling over the past year, due to increasing Cost of Goods Sold and Administrative costs. They are not likely to be able to change the increasing trend of these costs over the next The company bought back stock in 2015, but do not plan to buy back or issue any new stock in the next They plan to increase their divided by $0.05 is cents) every year Data TO 0 S&P500 Beta Exp Return 2.ON 10.0% 1.10 2021E 2022 2023E 3 yr Sales CAGR 2017A 10.000 2018A 11.000 2019A 11,800 2020 12,500 points 1 Sales 4- Average NM 1 3,000 30.0% 2.800 25.5% 2 500 21.2 2.000 16.0% 1 Net Income Net Margin 17 an Shares outstanding 19 EPS 0 1 OPS 1 3- EPS CAGR 1,000 950 900 850 850 850 850 2 $1.00 31.05 $1.10 $1.15 $1.20 $1.25 $1.30 Price 4 P/E 568.50 FOIV/01 $66.00 TOIVO: $62.50 NDIV/01 $49.50 HOIV/01 0 1 20210 2 2022 3 20230 2020A po 1 DIV/01 27 2 Exit Price using P/E Method: CAPM required return 30 PE DPStrom estimates above 2DPs from estimates above 3. Bet Price 2023E Target) by P/E 14 Valuation (Vo today Current Stock Price (Po today $0.00 $1.15 $0.00 $1.20 $0.00 $1.25 $0.00 $130 1 $49.50 HintStart from the last year and decont back 1 2021 Target Price 1 lpected Return 2 Undervaluedor 50 Overvalued 2. Pro Forma 3. PE Analysis 4. DDM Valuation 5. FCFE Valuation SE CAGR for the Based on the operates to come to row for each of the next year Not Martin hat betale roer the pa&ww.dutorong Conte Bondon and www They were to be able to change the creating trend of records over the next years The company to take in 2018, dolan to whickory work in the years They plan to create the dividend 005 Escorts every year. Data Espen 2.09 10. ON 1 10 10 SAP300 Calculate y Sales CAGR fr 2018-2020 Estimate Sales for 2001, 2002, 2003 12 20310 2017A 10.000 2018 11.000 2019 11.00 2020 12.500 20221 203:30 po CAR 14 4-y Avenue NM Calculate y Average liter tinta et Income for 2001, 2002, 2003 Explain telow why you chose the stution you used to meet Income vergelpoms: 3.000 30.09 2.00 255 2.500 21.2% 3,000 16.ON 15 et income in Margin 17 Share outstanding 19 EPS 70 21 DPS 1,000 100 BSO 850 850 BESCACA 3 5110 $1.15 $1.20 $1.25 $1.30 2 Price 36 PE 25 568.50 DIVO $62.50 DIV/IV/0! $4.50 DIV/01 Calculate past, actual, and proforma Salyans 2017-2008) Calculate yr EPS CAGR 10 2018-2020 Explain Delow why the dedine in EPS is so much less than the dinin Income (2) 1 20210 2 20221 3 2025 $0.00 $1.20 $0.00 $125 50.00 $1.30 0 7 BR Pricing P/E Method: 19 CAPM required 30 P/E GOIVOI ass (from stimates above $0.00 32 DPS from estimates above $1.15 33 Et Price (29336 Targety 4 Valuation [VO today! Current Stock Prodel 549 50 36 37 2021 Tage Price CHE Start the last count) 1 1 yr Expected Retur Calculate the required return for Company Estimate the bil Price 3 yn (2023 using the Method. ming the from 2020 stay constant Calculate the lustion for Company Calculate the Target Price in year 2007) and the 1-year Expected to you bought the stocktoday regardless of whether in Ordor Underval State and justify whether the stock Overvalued or underledI2 Undervalued or Overveld 41 Home 12 Calibri (Body) VA A Wrap Text Custom I Morpe Center B $ % Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates 30 Xfx - E24 A . C D Ses have grown at the CAGR for the past years. Based on the strategy you expect sales to continue to grow at this rate for at least each of the next ye Net Margn has been falling over the past year, due to increasing Cost of Goods Sold and Administrative costs. They are not likely to be able to change the increasing trend of these costs over the next The company bought back stock in 2015, but do not plan to buy back or issue any new stock in the next They plan to increase their divided by $0.05 is cents) every year Data TO 0 S&P500 Beta Exp Return 2.ON 10.0% 1.10 2021E 2022 2023E 3 yr Sales CAGR 2017A 10.000 2018A 11.000 2019A 11,800 2020 12,500 points 1 Sales 4- Average NM 1 3,000 30.0% 2.800 25.5% 2 500 21.2 2.000 16.0% 1 Net Income Net Margin 17 an Shares outstanding 19 EPS 0 1 OPS 1 3- EPS CAGR 1,000 950 900 850 850 850 850 2 $1.00 31.05 $1.10 $1.15 $1.20 $1.25 $1.30 Price 4 P/E 568.50 FOIV/01 $66.00 TOIVO: $62.50 NDIV/01 $49.50 HOIV/01 0 1 20210 2 2022 3 20230 2020A po 1 DIV/01 27 2 Exit Price using P/E Method: CAPM required return 30 PE DPStrom estimates above 2DPs from estimates above 3. Bet Price 2023E Target) by P/E 14 Valuation (Vo today Current Stock Price (Po today $0.00 $1.15 $0.00 $1.20 $0.00 $1.25 $0.00 $130 1 $49.50 HintStart from the last year and decont back 1 2021 Target Price 1 lpected Return 2 Undervaluedor 50 Overvalued 2. Pro Forma 3. PE Analysis 4. DDM Valuation 5. FCFE Valuation