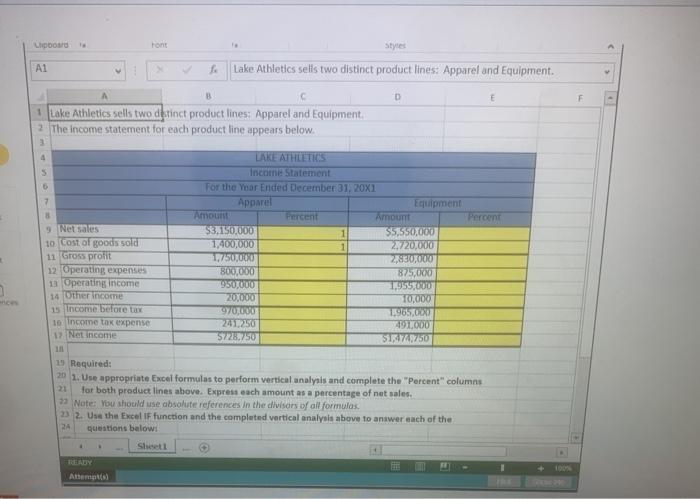

fill in the Excel Formulas

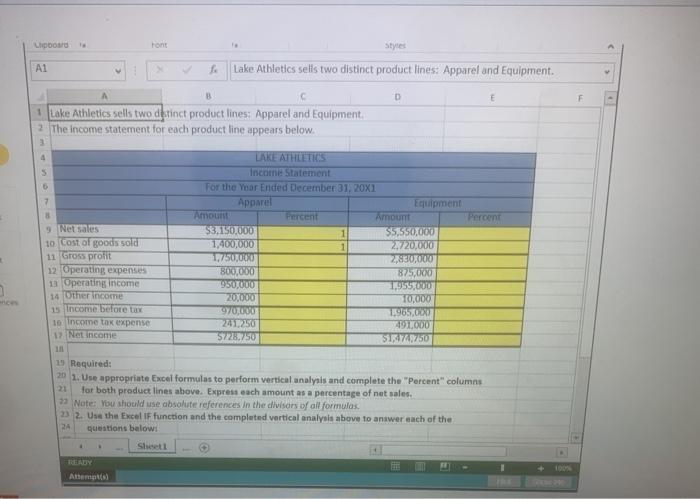

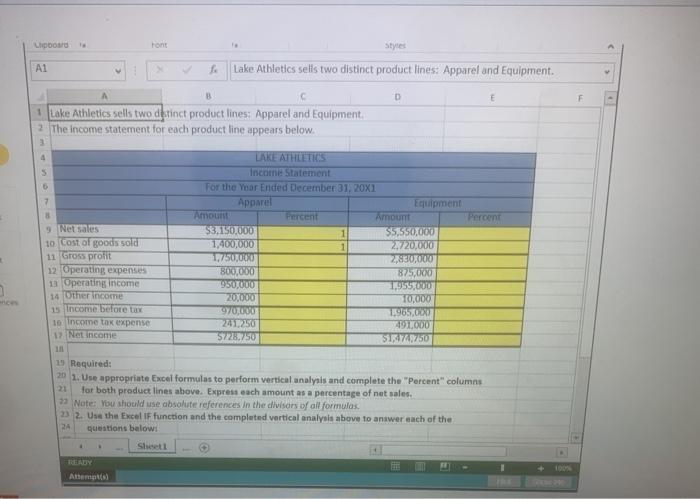

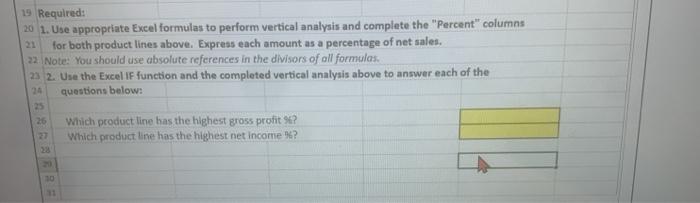

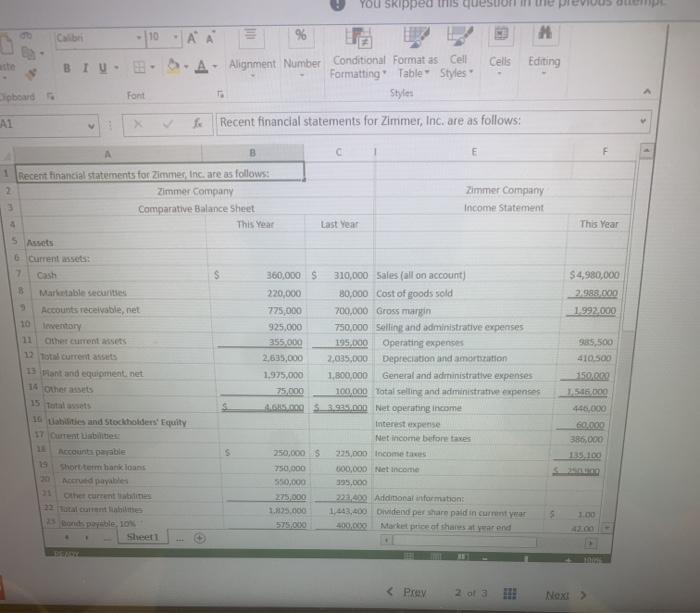

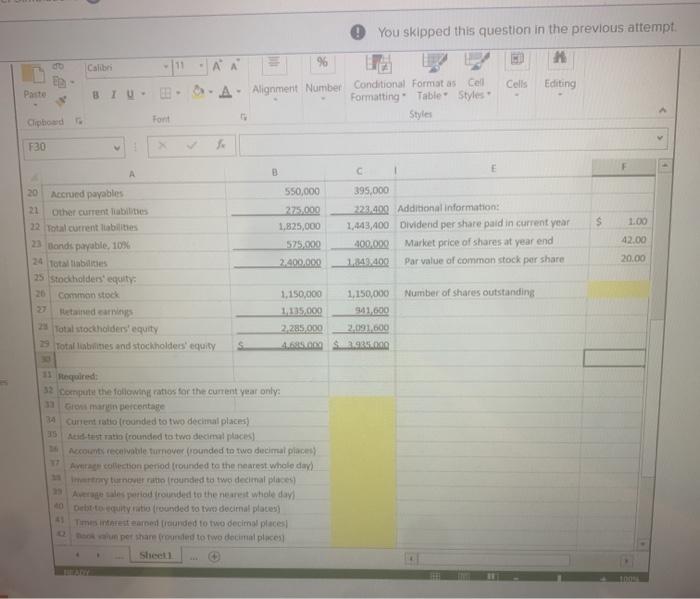

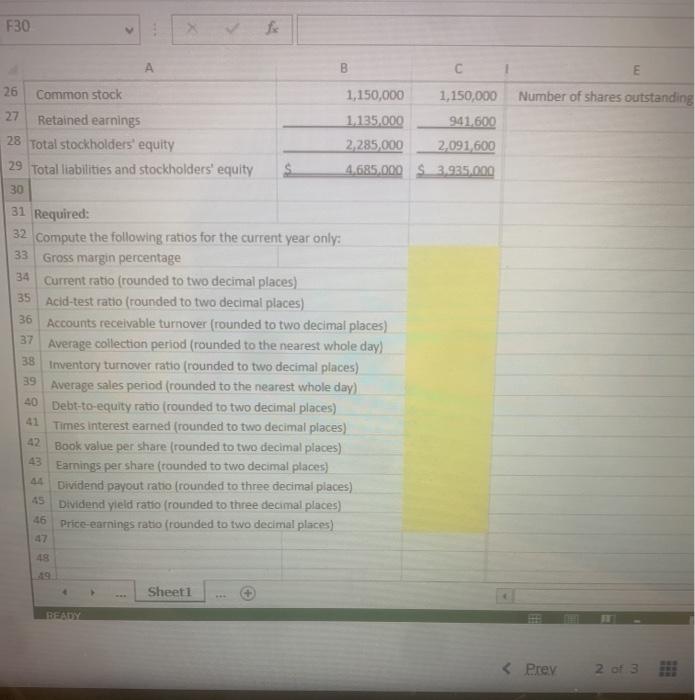

font Styles A1 f Lake Athletics sells two distinct product lines: Apparel and Equipment. B D E F 1 Lake Athletics sells two distinct product lines Apparel and Equipment 2 The income statement for each product line appears below. 4 5 0 7 -Percent 8 9 Netales 10 Cost of goods sold 11 Gross profit 12 Operating expenses u Operating income 14 Other Income 15 Income before tax 10 Income tax expense 1 Net Income LAKE ATHLETICS Income Statement For the Year Ended December 31, 20X1 Apparel Equipment Amour Amount $3,150,000 1 $5.550.000 1,400.000 1 2,720,000 1,750 2850000 800,000 875,000 19STUUD 1,955,000 20,000 70.000 9700 11965,000 2401250 491.000 $728.750 513749750 19 Required: 20 1. Use appropriate Excel formulas to perform vertical analysis and complete the "Percent" columns for both product lines above. Express each amount as a percentage of net sales. 22 Note: You should use absolute references in the divisors of all formulas 23 2. Use the Excel IF function and the completed vertical analysis above to answer each of the 2A questions below Shett READY ADAM 19 Required: 20 1. Use appropriate Excel formulas to perform vertical analysis and complete the "Percent" columns for both product lines above. Express each amount as a percentage of net sales. 22. Note: You should use absolute references in the divisors of all formulas. 23 2. Use the Excel IF function and the completed vertical analysis above to answer each of the questions below: 26 Which product line has the highest gross profit ? Which product line has the highest net income? 11 YOU Skipped this questio Calibri M the A A 96 A Alignment Number Conditional Format as Cell Formatting Table Styles Style Cells BIU Editing This Year $4,980,000 2,998.000 1.992.000 1 Recent financial statements for Zimmer, Inc. are as follows: Zimmer Company Zimmer Company Comparative Balance Sheet Income Statement This Year Last Year s Assets Current sets: Cash S 360,000 $ 310,000 Sales (all on account) Marketable secure 220,000 80,000 Cost of goods sold Accounts receivable, net 775 000 700,000 Gross margin 10 Inventory 925,000 750,000 Selling and administrative expenses Other current sets 355.000 195.000 Operating expenses 12 tot current at 2,835,000 2,035,000 Depreciation and amortization 13 want and equipment.net 1.975,000 1,800,000 General and administrative expenses 14 others 75,000 100.000 Total selling and administrare expenses A00053935.000 Net operating income 16 Laites and stockholders' Equity Interest expense 17 Current bles Net income before taxes Accounts payable 250,000 229,000 income Short term han loans 750.000 000,000 Net Income Accrued payables 550,000 335.000 Other current 275.000 223,00 Additional information 1.000 1,443,400 Dividend per share paid in current year Bondable. 10 575.000 Marketproof that year and SES 500 410.500 150.22 A516.000 446, 60.000 385.000 9.100 3 1.00