Answered step by step

Verified Expert Solution

Question

1 Approved Answer

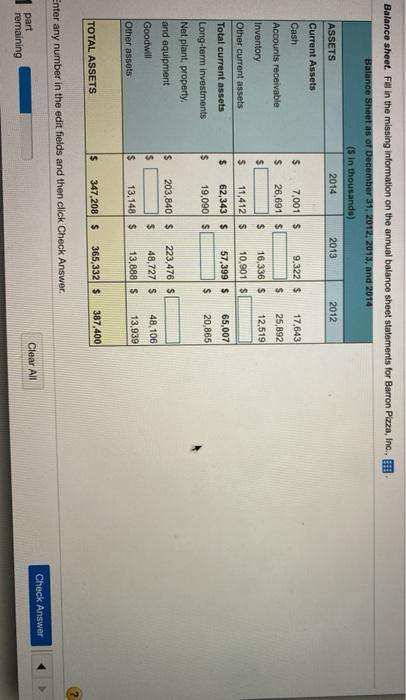

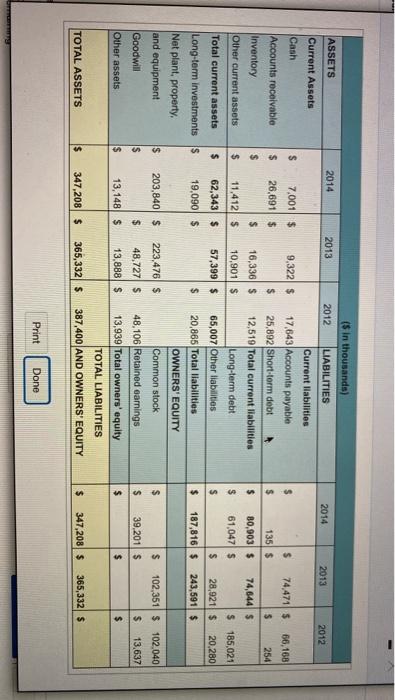

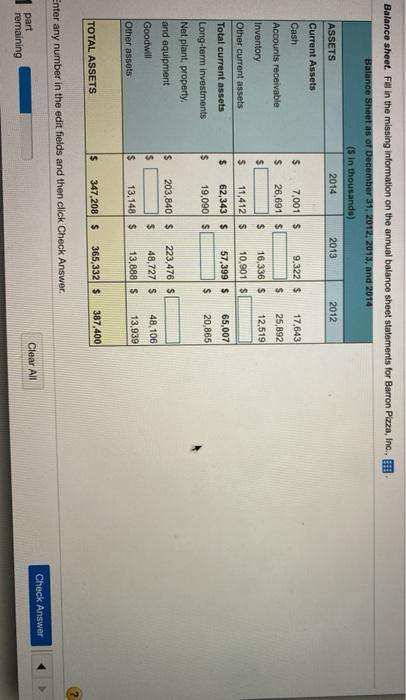

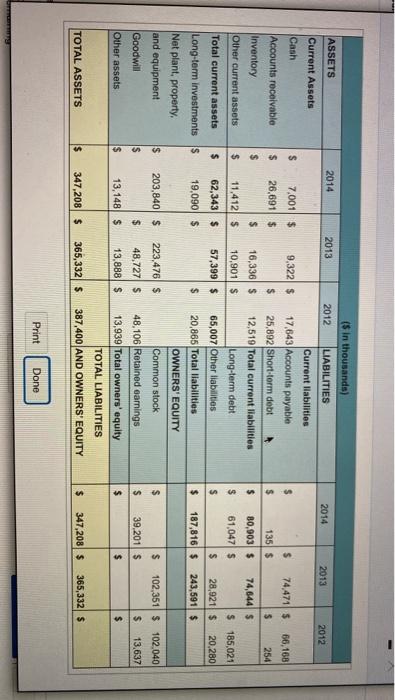

Fill in the missing boxes please. Data table is shown in pictures below. Balance sheet. Fu in the missing information on the annual balance sheet

Fill in the missing boxes please. Data table is shown in pictures below.

Balance sheet. Fu in the missing information on the annual balance sheet statements for Barron Pizza, Inc., Balance sheet as of December 31, 2012, 2013, and 2014 is in thousands) ASSETS 2014 2013 2012 Current Assets Cash $ 7,001 $ 9.322 $ $ 17,643 25,892 Accounts receivable $ $ 26,691 $ $ 12,519 Inventory Other current assets $ 16,336 $ 10.901 57,399 $ $ 11,412 5 62,343 $ 19,090 $ $ 65,007 20,865 s Total current assets Long-term investments Net plant, property and equipment Goodwill Is s 203,840 $ $ 13,148 $ 223,476 S 48,727 $ 13,888 S 48,106 Other assets $ 13,939 TOTAL ASSETS $ 347,208 $ 365,332 $ 387,400 Enter any number in the edit fields and then click Check Answer. part Check Answer Clear All remaining ASSETS ($ in thousands) 2012 LIABILITIES 2014 2013 2014 2013 2012 Current Assets Cash $ $ $ 9,322 $ $ 66,168 $ 7.001 $ 26,691 $ $ $ 135 $ Accounts receivable Inventory Other current assets 74.4715 $ 74,644 $ 254 $ $ 16,336 S 10,901 S Current liabilities 17,643 Accounts payable 25,892 Short-term debt 12,519 Total current liabilities Long-term debit 65,007 Other liabilities 20,865 Total liabilities OWNERS' EQUITY $ 11,412 $ $ 185,021 Total current assets $ 80,903 $ 61,047 S $ 187,816 $ 62,343 $ 57,399 $ $ 28,921 $ 20.280 Long-term investments S 19,090 $ $ $ 243,591 $ Net plant, property, and equipment Goodwill is 203,840 $ $ $ 223,476 $ 48,727 S 102,351 $ 102,040 $ 13,637 Is $ $ 39,2015 Common stock 48,106 Retained earings 13,939 Total owners' equity TOTAL LIABILITIES Other assets $ 13,148) $ 13,888 $ $ $ $ TOTAL ASSETS $ 347,208 $ 365,332 $ 387,400 AND OWNERS' EQUITY $ 347,208 $ 365,332 $ Print Done Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started