Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the table below, using the information below, based on what is best for the client. Steve Alito is 66 and has no

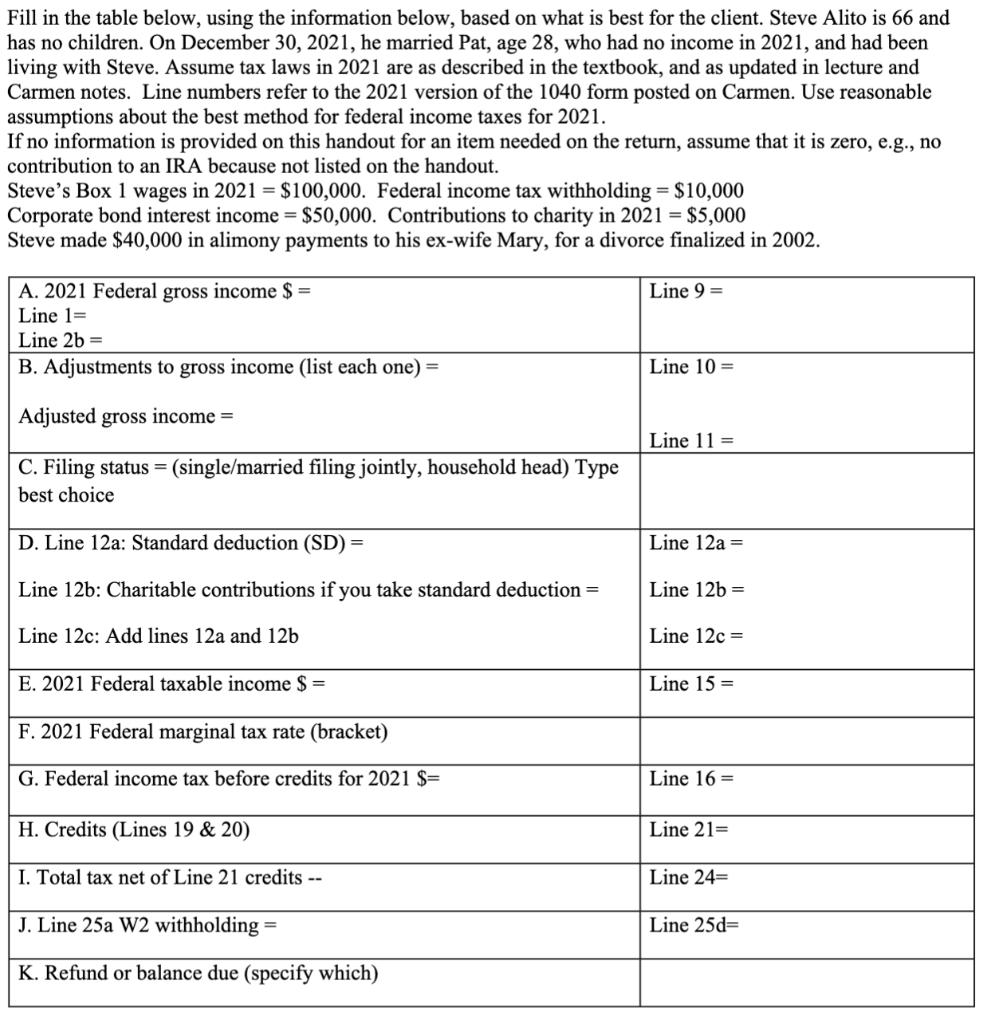

Fill in the table below, using the information below, based on what is best for the client. Steve Alito is 66 and has no children. On December 30, 2021, he married Pat, age 28, who had no income in 2021, and had been living with Steve. Assume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carmen notes. Line numbers refer to the 2021 version of the 1040 form posted on Carmen. Use reasonable assumptions about the best method for federal income taxes for 2021. If no information is provided on this handout for an item needed on the return, assume that it is zero, e.g., no contribution to an IRA because not listed on the handout. Steve's Box 1 wages in 2021 = $100,000. Federal income tax withholding = $10,000 Corporate bond interest income = $50,000. Contributions to charity in 2021 = $5,000 Steve made $40,000 in alimony payments to his ex-wife Mary, for a divorce finalized in 2002. A. 2021 Federal gross income $ = Line 1= Line 2b = B. Adjustments to gross income (list each one) = Adjusted gross income = C. Filing status = (single/married filing jointly, household head) Type best choice D. Line 12a: Standard deduction (SD) = Line 12b: Charitable contributions if you take standard deduction = Line 12c: Add lines 12a and 12b E. 2021 Federal taxable income $ = F. 2021 Federal marginal tax rate (bracket) G. Federal income tax before credits for 2021 $= H. Credits (Lines 19 & 20) I. Total tax net of Line 21 credits -- J. Line 25a W2 withholding = K. Refund or balance due (specify which) Line 9 = Line 10 = Line 11 = Line 12a = Line 12b = Line 12c = Line 15 = Line 16 = Line 21= Line 24= Line 25d=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A 2021 Federal gross income 165000 Line 1 100000 Line 2b 50000 Line 9 5000 B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started