Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the table For the 2-year, 2.5% coupon bond in Part J, fill out the table below regarding what five specific trades you would

Fill in the table

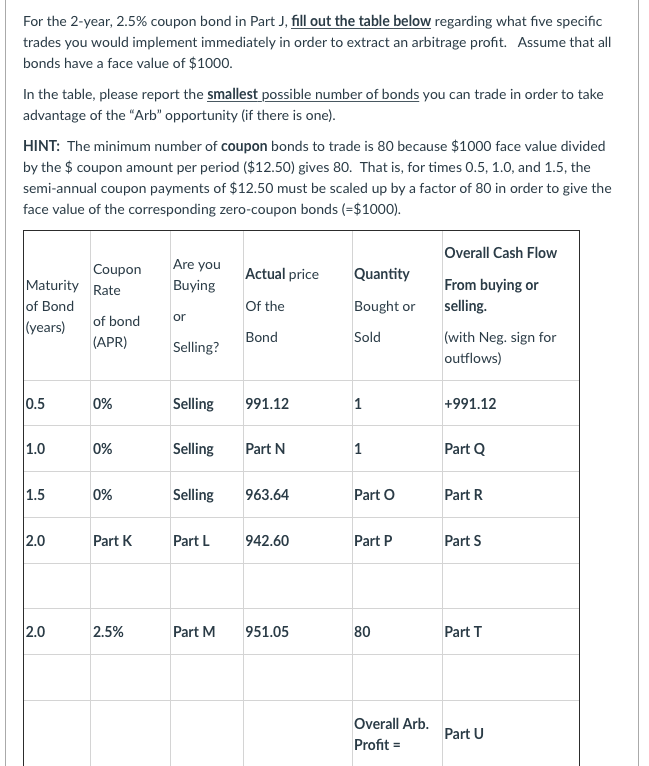

For the 2-year, 2.5% coupon bond in Part J, fill out the table below regarding what five specific trades you would implement immediately in order to extract an arbitrage profit. Assume that all bonds have a face value of $1000. In the table, please report the smallest possible number of bonds you can trade in order to take advantage of the "Arb" opportunity (if there is one). HINT: The minimum number of coupon bonds to trade is 80 because $1000 face value divided by the $ coupon amount per period ($12.50) gives 80 . That is, for times 0.5,1.0, and 1.5, the semi-annual coupon payments of $12.50 must be scaled up by a factor of 80 in order to give the face value of the corresnonding zero-counon bonds (=$1000). For the 2-year, 2.5% coupon bond in Part J, fill out the table below regarding what five specific trades you would implement immediately in order to extract an arbitrage profit. Assume that all bonds have a face value of $1000. In the table, please report the smallest possible number of bonds you can trade in order to take advantage of the "Arb" opportunity (if there is one). HINT: The minimum number of coupon bonds to trade is 80 because $1000 face value divided by the $ coupon amount per period ($12.50) gives 80 . That is, for times 0.5,1.0, and 1.5, the semi-annual coupon payments of $12.50 must be scaled up by a factor of 80 in order to give the face value of the corresnonding zero-counon bonds (=$1000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started