Answered step by step

Verified Expert Solution

Question

1 Approved Answer

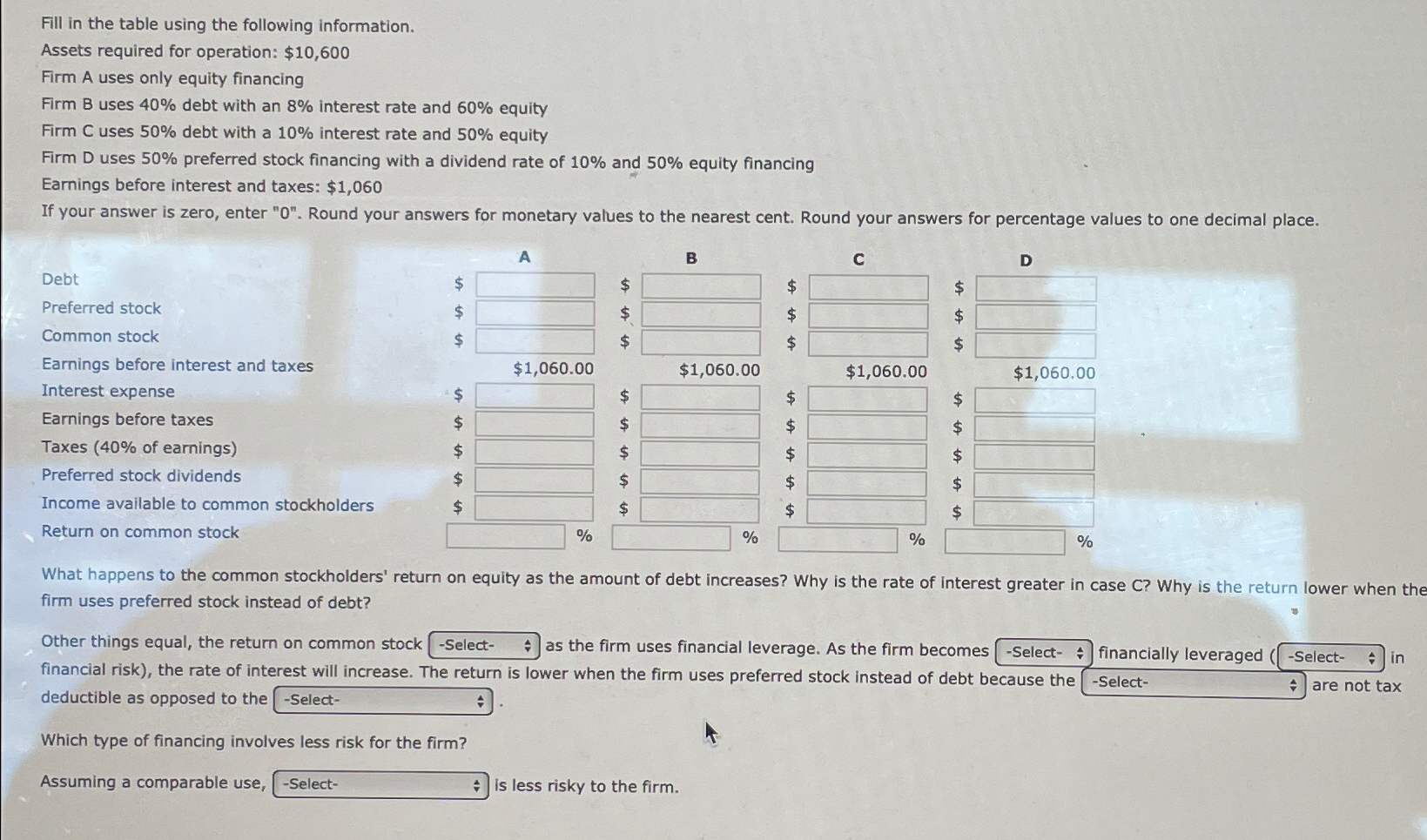

Fill in the table using the following information. Assets required for operation: $ 1 0 , 6 0 0 Firm A uses only equity financing

Fill in the table using the following information.

Assets required for operation: $

Firm A uses only equity financing

Firm B uses debt with an interest rate and equity

Firm C uses debt with a interest rate and equity

Firm D uses preferred stock financing with a dividend rate of and equity financing

Earnings before interest and taxes: $

If your answer is zero, enter Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place.

What happens to the common stockholders' return on equity as the amount of debt increases? Why is the rate of interest greater in case C Why is the return lower when the firm uses preferred stock instead of debt?

Other things equal, the return on common stock as the firm uses financial leverage. As the firm becomes financial risk the rate of interest will increase. The return is lower when the firm uses preferred stock instead of debt because the deductible as opposed to the financially leveraged in are not tax

Which type of financing involves less risk for the firm?

Assuming a comparable use, is less risky to the firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started