Answered step by step

Verified Expert Solution

Question

1 Approved Answer

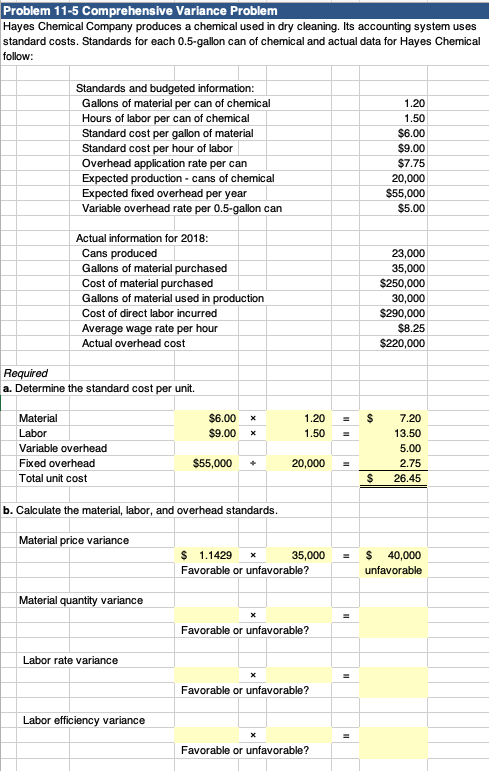

Fill in the yellow blank Problem 11-5 Comprehensive Variance Problem Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses standard

Fill in the yellow blank

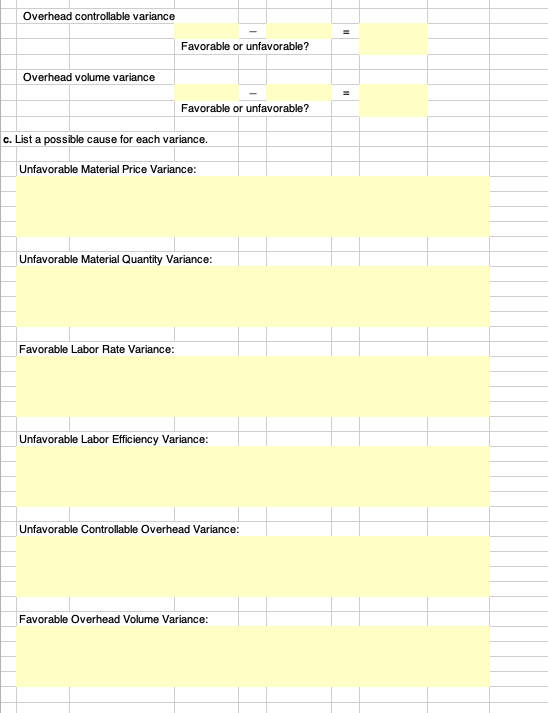

Problem 11-5 Comprehensive Variance Problem Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses standard costs. Standards for each 0.5-gallon can of chemical and actual data for Hayes Chemical follow: Standards and budgeted information: Gallons of material per can of chemical Hours of labor per can of chemical Standard cost per gallon of material Standard cost per hour of labor Overhead application rate per can Expected production - cans of chemical Expected fixed overhead per year Variable overhead rate per 0.5-gallon can 1.20 1.50 $6.00 $9.00 $7.75 20,000 $55,000 $5.00 Actual information for 2018: Cans produced Gallons of material purchased Cost of material purchased Gallons of material used in production Cost of direct labor incurred Average wage rate per hour Actual overhead cost 23,000 35,000 $250,000 30,000 $290,000 $8.25 $220,000 Required a. Determine the standard cost per unit. x $ $6.00 $9.00 1.20 1.50 X Material Labor Variable overhead Fixed overhead Total unit cost 7.20 13.50 5.00 2.75 26.45 $55,000 + 20,000 $ b. Calculate the material, labor, and overhead standards. Material price variance $ 1.1429 35,000 Favorable or unfavorable? $ 40,000 unfavorable Material quantity variance Favorable or unfavorable? Labor rate variance Favorable or unfavorable ? Labor efficiency variance Favorable or unfavorable? Overhead controllable variance Favorable or unfavorable? Overhead volume variance = Favorable or unfavorable? c. List a possible cause for each variance. Unfavorable Material Price Variance: Unfavorable Material Quantity Variance: Favorable Labor Rate Variance: Unfavorable Labor Efficiency Variance: Unfavorable Controllable Overhead Variance: Favorable Overhead Volume Variance: Problem 11-5 Comprehensive Variance Problem Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses standard costs. Standards for each 0.5-gallon can of chemical and actual data for Hayes Chemical follow: Standards and budgeted information: Gallons of material per can of chemical Hours of labor per can of chemical Standard cost per gallon of material Standard cost per hour of labor Overhead application rate per can Expected production - cans of chemical Expected fixed overhead per year Variable overhead rate per 0.5-gallon can 1.20 1.50 $6.00 $9.00 $7.75 20,000 $55,000 $5.00 Actual information for 2018: Cans produced Gallons of material purchased Cost of material purchased Gallons of material used in production Cost of direct labor incurred Average wage rate per hour Actual overhead cost 23,000 35,000 $250,000 30,000 $290,000 $8.25 $220,000 Required a. Determine the standard cost per unit. x $ $6.00 $9.00 1.20 1.50 X Material Labor Variable overhead Fixed overhead Total unit cost 7.20 13.50 5.00 2.75 26.45 $55,000 + 20,000 $ b. Calculate the material, labor, and overhead standards. Material price variance $ 1.1429 35,000 Favorable or unfavorable? $ 40,000 unfavorable Material quantity variance Favorable or unfavorable? Labor rate variance Favorable or unfavorable ? Labor efficiency variance Favorable or unfavorable? Overhead controllable variance Favorable or unfavorable? Overhead volume variance = Favorable or unfavorable? c. List a possible cause for each variance. Unfavorable Material Price Variance: Unfavorable Material Quantity Variance: Favorable Labor Rate Variance: Unfavorable Labor Efficiency Variance: Unfavorable Controllable Overhead Variance: Favorable Overhead Volume VarianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started