Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill in this sheet given the following information July 18. Received invoice from consultants Wadsley and Harden for $30,000 for expert testimony related to the

fill in this sheet given the following information

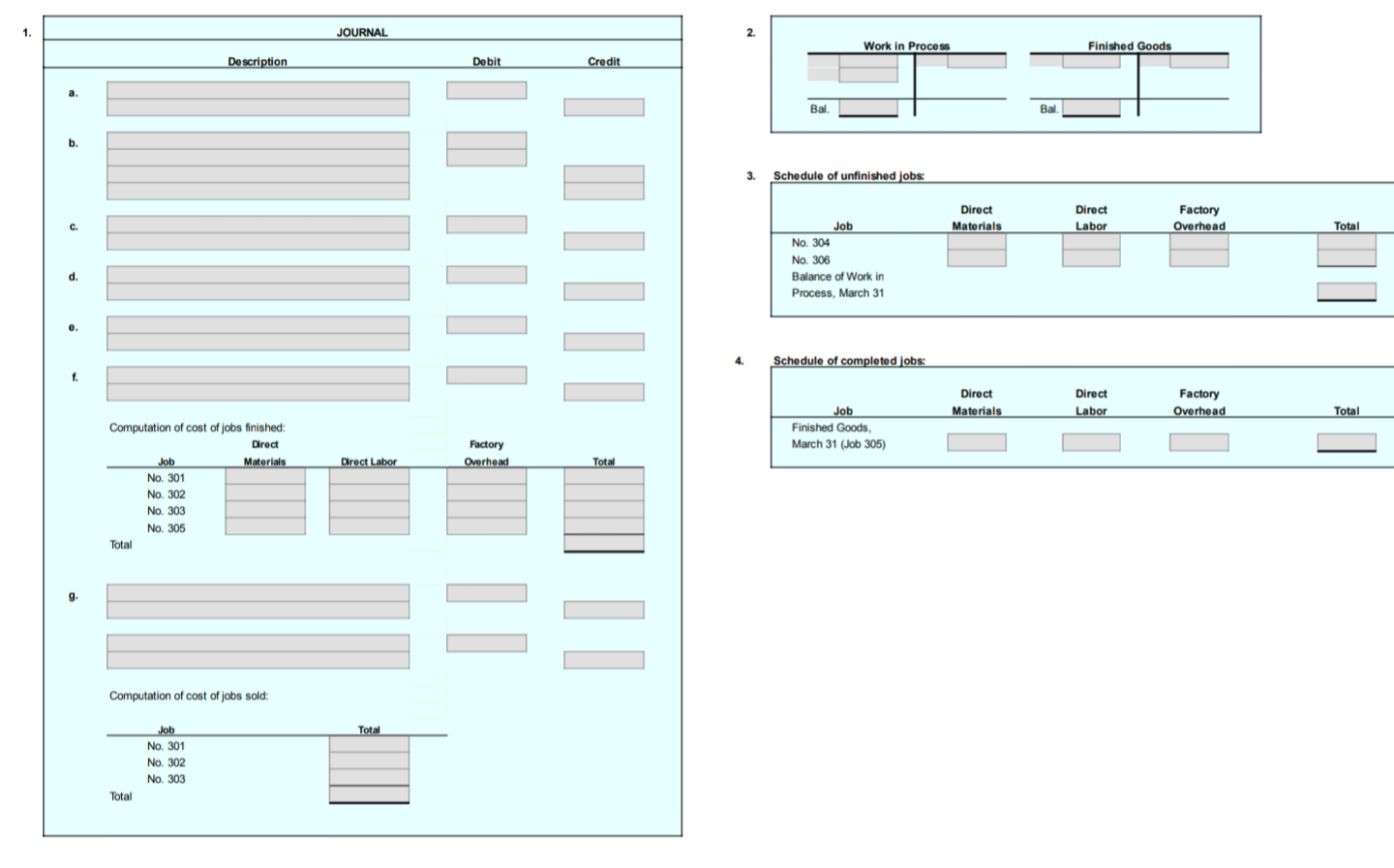

July 18. Received invoice from consultants Wadsley and Harden for $30,000 for expert testimony related to the Obsidian trial. 27. Applied office overhead at a rate of $62 per professional hour charged to the Obsidian case. 31. Paid administrative and support salaries of $28,500 for the month. 31. Used office supplies for the month, $4,000. 31. Paid professional salaries of $74,350 for the month. 31. Billed Obsidian $172,500 for successful defense of the case. a. Provide the journal entries for each of these transactions. b. How much office overhead is over- or underapplied? c. Determine the gross profit on the Obsidian case, assuming that over- or underapplied office overhead is closed monthly to cost of services. EX 16-16 Job order cost accounting for a service company Obj. 3 f The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs and allocated indirect costs. The direct costs include the charged time of professional personnel and media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 65% of media purchases. On August 1, the four advertising projects had the following accumulated costs: During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: At the end of August, both the Vault Bank and Take Off Airlines campaigns were completed. The costs of completed campaigns are debited to the cost of services account. Journalize the summary entry to record each of the following for the month: a. Direct labor costs b. Media purchases c. Overhead applied d. Completion of Vault Bank and Take Off Airlines campaigns eries A PR 16-1A Entries for costs in a job order cost system Obj. 2 Barnes Company uses a job order cost system. The following data summarize the operations related to production for October: a. Materials purchased on account, $315,500. b. Materials requisitioned, $290,100, of which $8,150 was for general factory use. c. Factory labor used, $489,500 of which $34,200 was indirect. d. Other costs incurred on account for factory overhead, $600,000; selling expenses, $150,000; and administrative expenses, $100,000. e. Prepaid expenses expired for factory overhead were $18,000; for selling expenses, $6,000; and for administrative expenses, $5,000. f. Depreciation of office building was $30,000; of office equipment, $7,500; and of factory equipment, $60,000. g. Factory overhead costs applied to jobs, $711,600. h. Jobs completed, $1,425,000. i. Cost of goods sold, $1,380,000. Instructions Journalize the entries to record the summarized operations. PR 16-2A Entries and schedules for unfinished jobs and completed jobs Obj. 2 3. Work in Process Kurtz Fencing Inc. uses a job order cost system. The following data summarize the operations balance, $11,840 related to production for March, the first month of operations: a. Materials purchased on account, \$45,000. b. Materials requisitioned and factory labor used: c. Factory overhead costs incurred on account, $1,800. d. Depreciation of machinery and equipment, \$2,500. e. The factory overhead rate is $30 per machine hour. Machine hours used: f. Jobs completed: 301, 302, 303, and 305. g. Jobs were shipped and customers were billed as follows: Job 301, \$8,500; Job 302, \$16,150; Job 303, \$13,400. Instructions 1. Journalize the entries to record the summarized operations. 2. Post the appropriate entries to T accounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account balances as of the end of the month. 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account. PR 16-3A Job cost sheet Obj. 2 Remnant Carpet Company sells and installs commercial carpeting for office buildings. Remnant Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the Schedule of unfinished jobs: Schedule of completed jobs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started