Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill out all entries within the Excel tables. Can use an online example from Cliffnotes as an example if needed. Hitchen's Widget store Part 1

Fill out all entries within the Excel tables. Can use an online example from Cliffnotes as an example if needed.

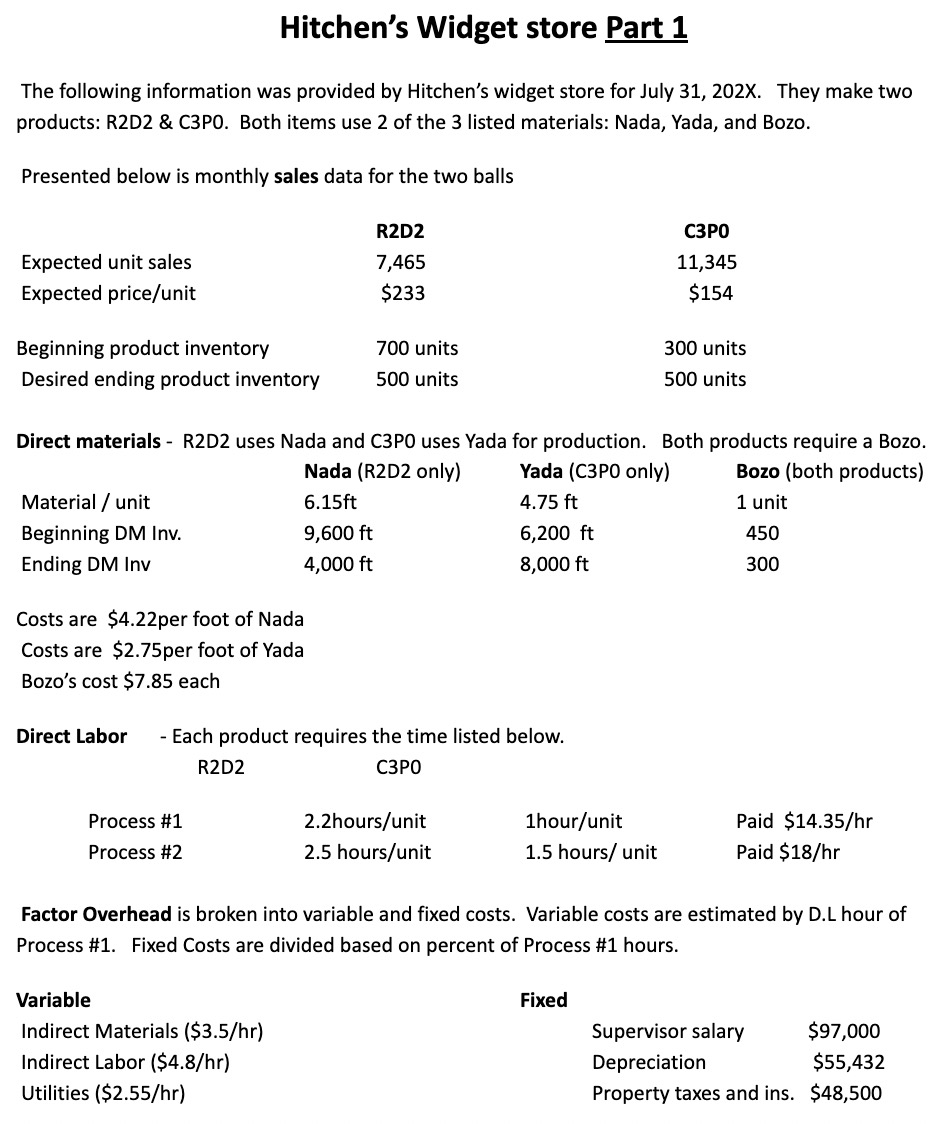

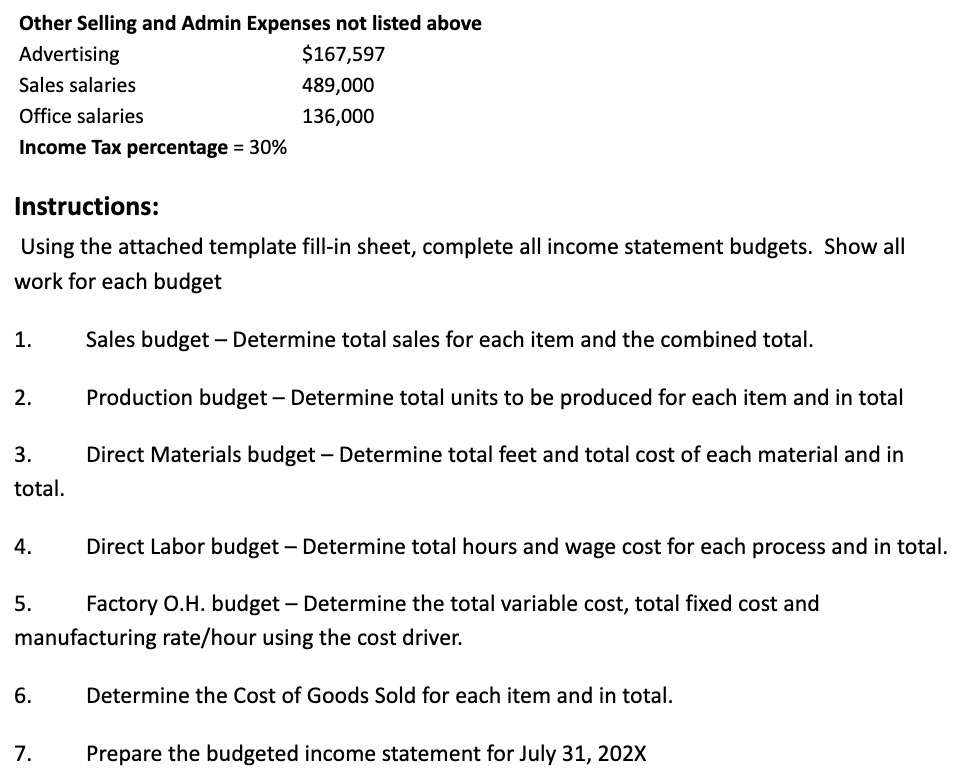

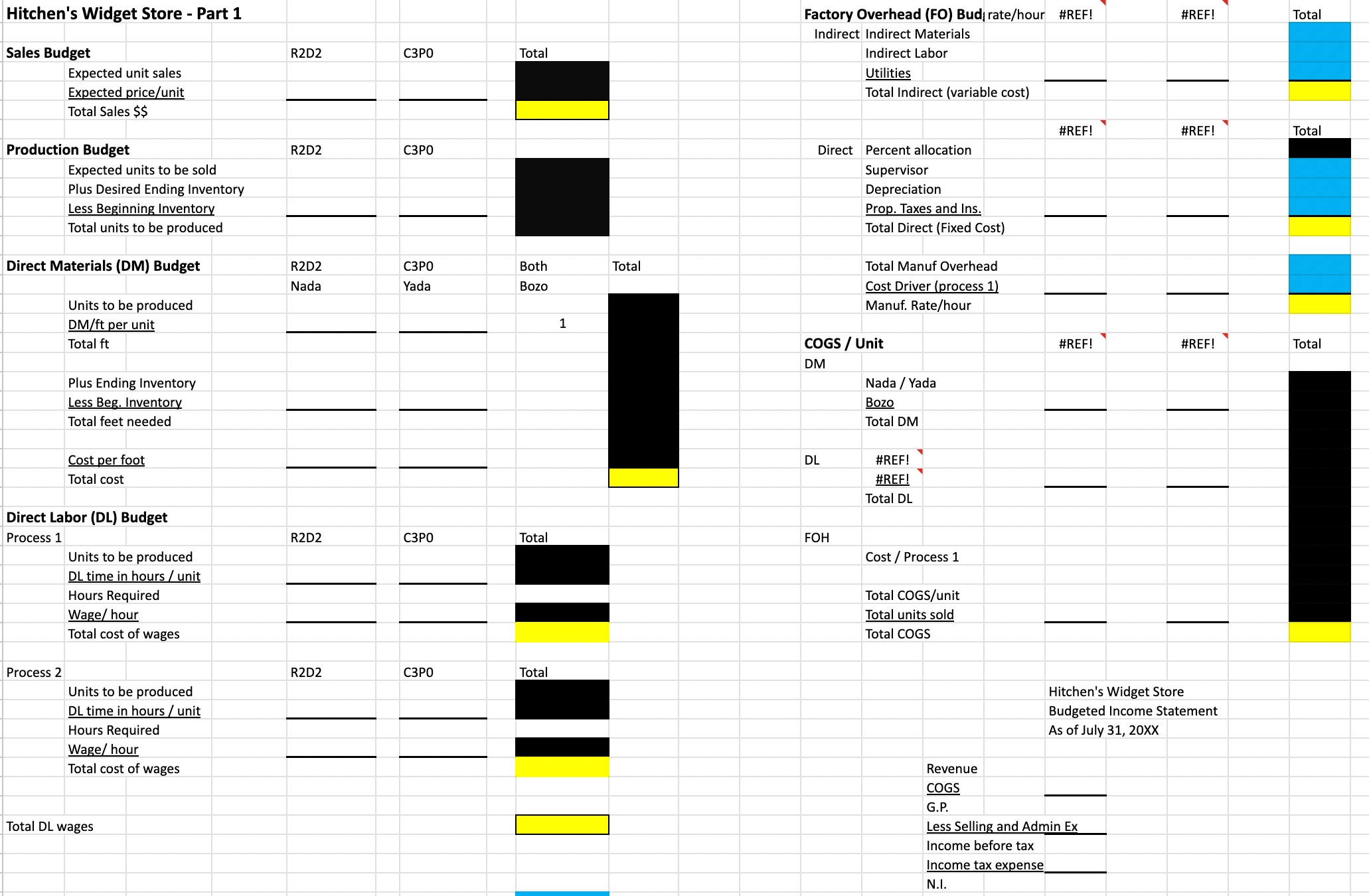

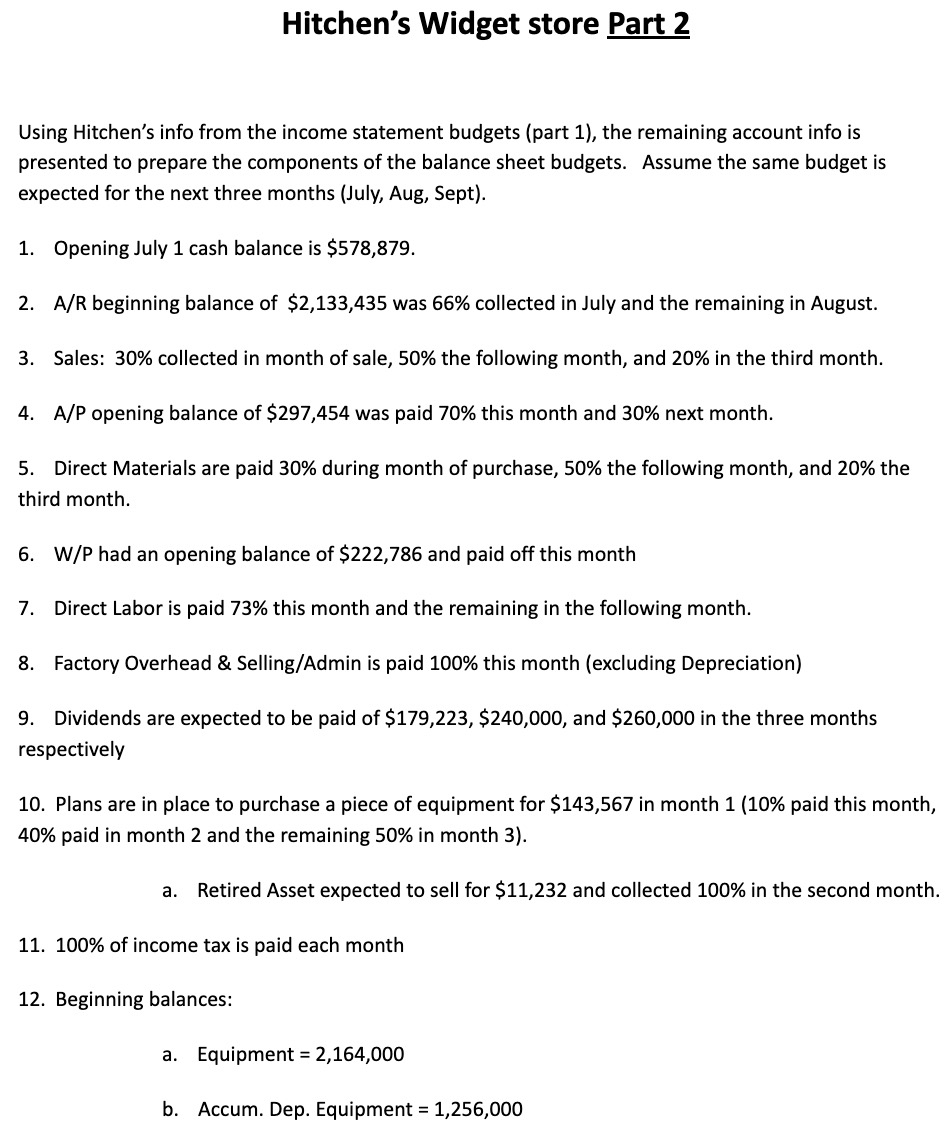

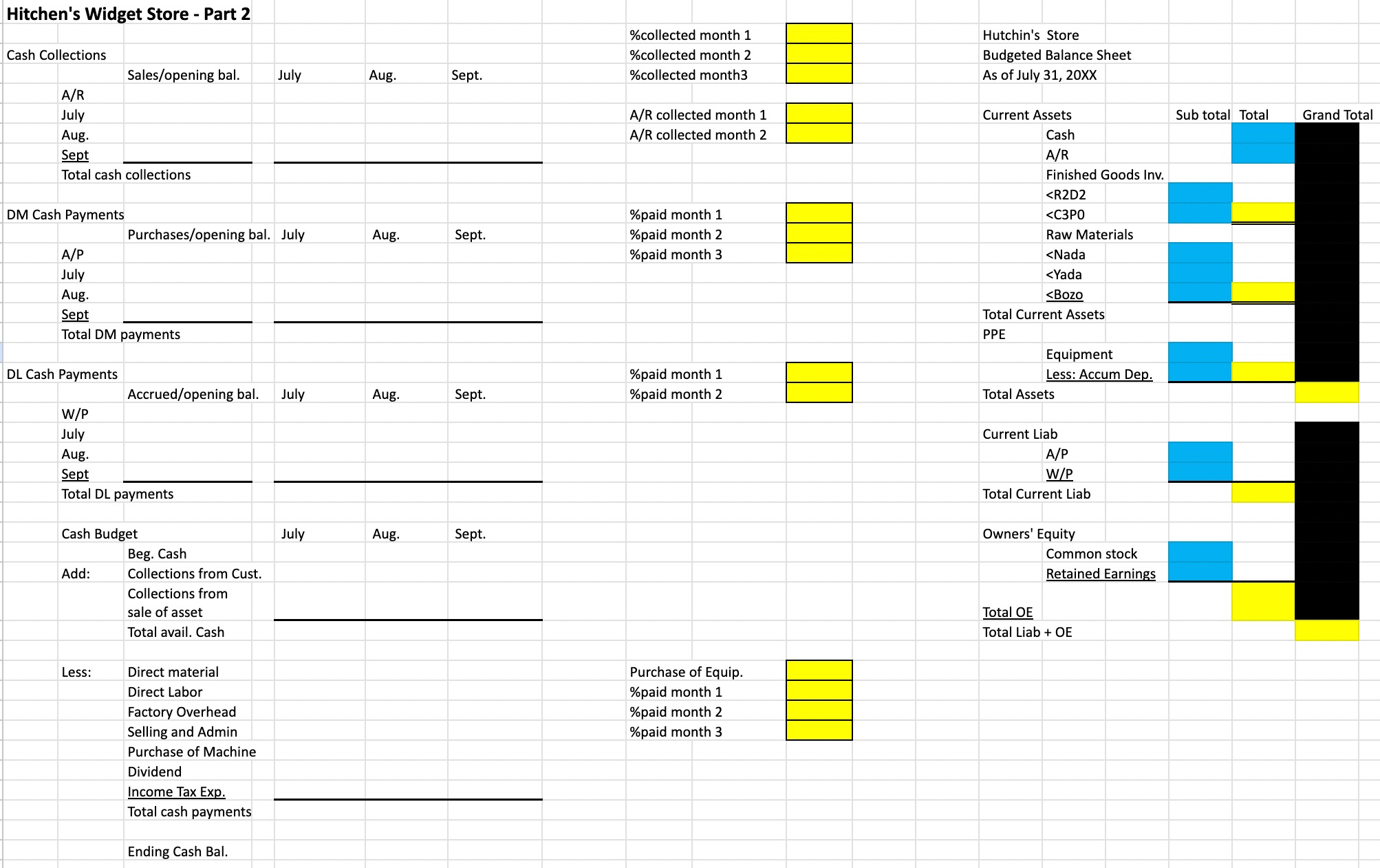

Hitchen's Widget store Part 1 The following information was provided by Hitchen's widget store for July 31, 202X. They make two products: R2D2 \& C3P0. Both items use 2 of the 3 listed materials: Nada, Yada, and Bozo. Presented below is monthly sales data for the two balls Direct materials - R2D2 uses Nada and C3P0 uses Yada for production. Both products require a Bozo. Costs are $4.22 per foot of Nada Costs are $2.75 per foot of Yada Bozo's cost $7.85 each [ Factor Overhead is broken into variable and fixed costs. Variable costs are estimated by D.L hour of Process \#1. Fixed Costs are divided based on percent of Process \#1 hours. Other Selling and Admin Exnenses not listed above Instructions: Using the attached template fill-in sheet, complete all income statement budgets. Show all work for each budget 1. Sales budget - Determine total sales for each item and the combined total. 2. Production budget - Determine total units to be produced for each item and in total 3. Direct Materials budget - Determine total feet and total cost of each material and in total. 4. Direct Labor budget - Determine total hours and wage cost for each process and in total. 5. Factory O.H. budget - Determine the total variable cost, total fixed cost and manufacturing rate/hour using the cost driver. 6. Determine the Cost of Goods Sold for each item and in total. 7. Prepare the budgeted income statement for July 31,202X Hitchen's Widget store Part 2 Using Hitchen's info from the income statement budgets (part 1), the remaining account info is presented to prepare the components of the balance sheet budgets. Assume the same budget is expected for the next three months (July, Aug, Sept). 1. Opening July 1 cash balance is $578,879. 2. A/R beginning balance of $2,133,435 was 66% collected in July and the remaining in August. 3. Sales: 30% collected in month of sale, 50% the following month, and 20% in the third month. 4. A/P opening balance of $297,454 was paid 70% this month and 30% next month. 5. Direct Materials are paid 30% during month of purchase, 50% the following month, and 20% the third month. 6. W/P had an opening balance of $222,786 and paid off this month 7. Direct Labor is paid 73% this month and the remaining in the following month. 8. Factory Overhead \& Selling/Admin is paid 100% this month (excluding Depreciation) 9. Dividends are expected to be paid of $179,223,$240,000, and $260,000 in the three months respectively 10. Plans are in place to purchase a piece of equipment for $143,567 in month 1 (10\% paid this month, 40% paid in month 2 and the remaining 50% in month 3 ). a. Retired Asset expected to sell for $11,232 and collected 100% in the second month. 11. 100% of income tax is paid each month 12. Beginning balances: a. Equipment =2,164,000 b. Accum. Dep. Equipment =1,256,000 c. Common Stock =$2,500,000 d. Retained Earnings =$1,114,081 Prepare these following budgets for month one, two and three. 1. Schedule of cash collections from customers 2. Schedule of cash payments for D.M. 3. Schedule of cash payments for D.L. 4. Cash Budget 5. Budgeted balance sheet (as of month 1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started