Answered step by step

Verified Expert Solution

Question

1 Approved Answer

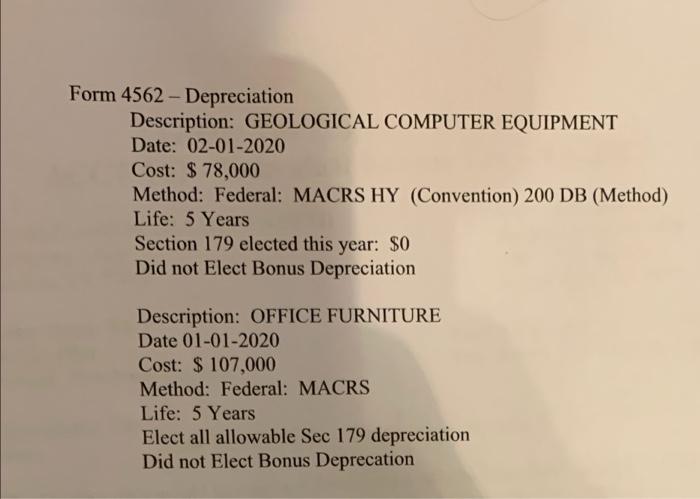

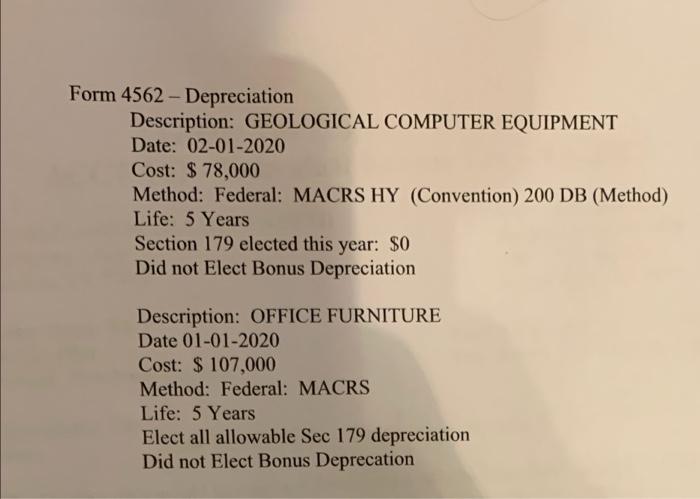

fill out form 4562 with information given Form 4562 - Depreciation Description: GEOLOGICAL COMPUTER EQUIPMENT Date: 02-01-2020 Cost: $ 78,000 Method: Federal: MACRS HY (Convention)

fill out form 4562 with information given

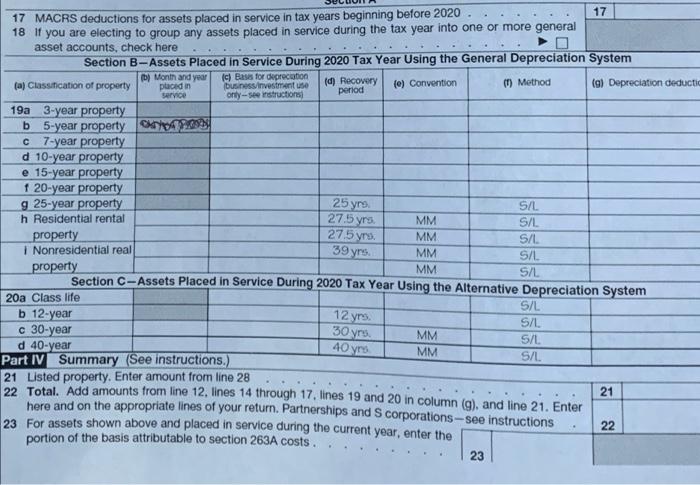

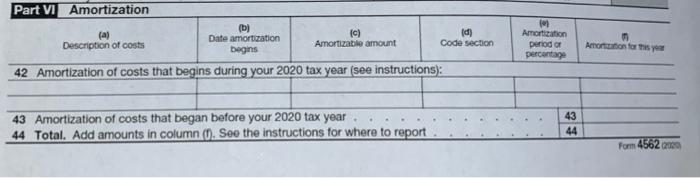

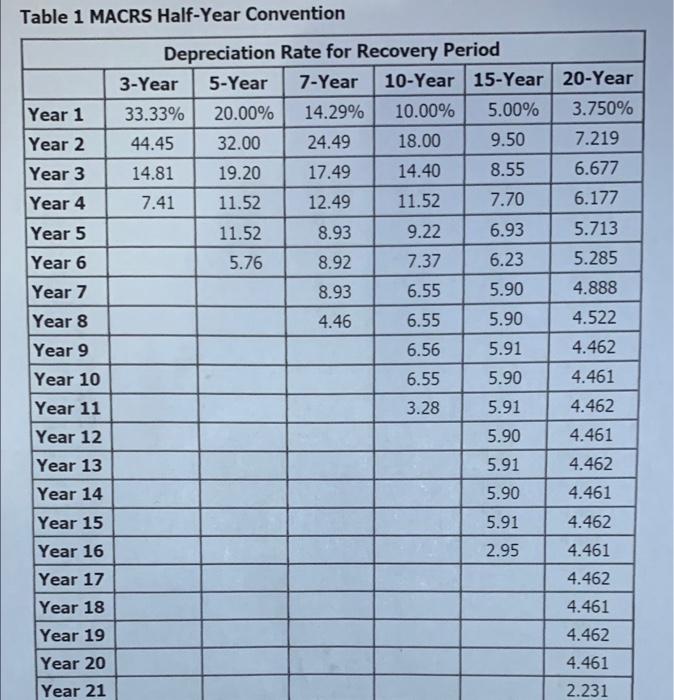

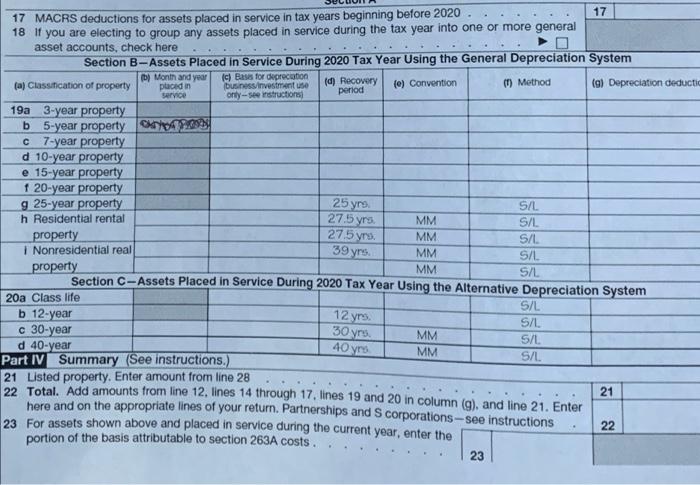

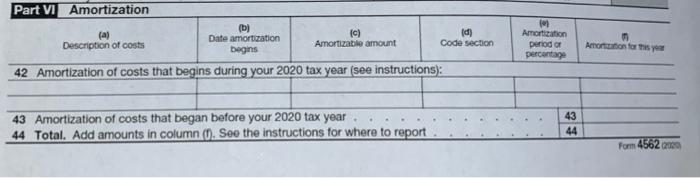

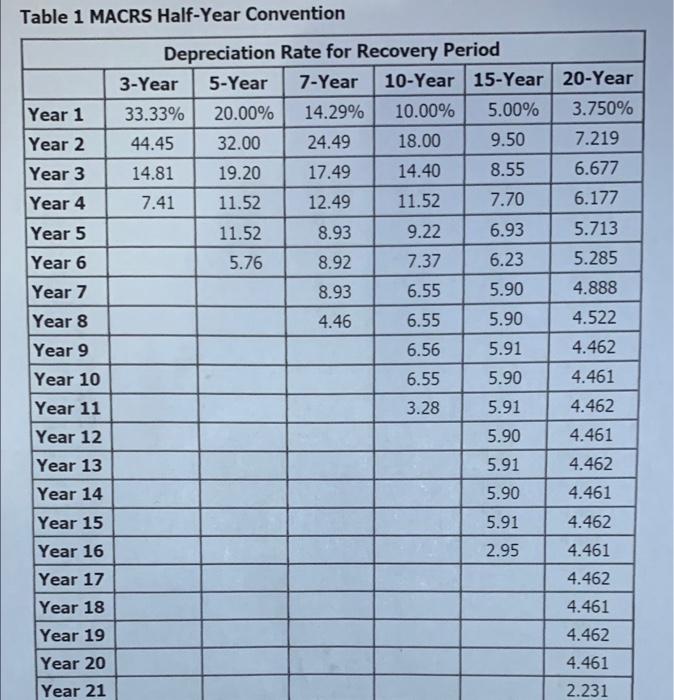

Form 4562 - Depreciation Description: GEOLOGICAL COMPUTER EQUIPMENT Date: 02-01-2020 Cost: $ 78,000 Method: Federal: MACRS HY (Convention) 200 DB (Method) Life: 5 Years Section 179 elected this year: $0 Did not Elect Bonus Depreciation Description: OFFICE FURNITURE Date 01-01-2020 Cost: $ 107,000 Method: Federal: MACRS Life: 5 Years Elect all allowable Sec 179 depreciation Did not Elect Bonus Deprecation 17 17 MACRS deductions for assets placed in service in tax years beginning before 2020 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2020 Tax Year Using the General Depreciation System Month and year c) Basis for depreciation (a) Classification of property placed in business investments (d) Recovery (e) Convention (1) Method (g) Depreciation deductic service orty-seestructions period 19a 3-year property b5-year property 7-year property d 10-year property e 15-year property 1 20-year property g 25-year property 25 Syre. SAL h Residential rental MM S/L property MM SAL I Nonresidential real MM SAL property MM S/L Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Class life b 12-year S/L c 30-year MM d 40-year S/L. MM Part IV Summary (See instructions.) SAL 21 Listed property. Enter amount from line 28 22 Total. Add amounts from line 12, lines 14 through 17. lines 19 and 20 in column (g), and line 21. Enter 21 here and on the appropriate lines of your return. Partnerships and corporations - see instructions 23 For assets shown above and placed in service during the current year, enter the 22 portion of the basis attributable to section 263A costs. 23 27.5 yrs 275 you. 39 yrs. 5/1 12 yrs. 30 yrs 40 yr Part VI Amortization (a) Description of costs (b) Date amortization begins c) Amortizable amount (d) Code section 11 Amortization period of percentage Anion for this year 42 Amortization of costs that begins during your 2020 tax year (see instructions): 43 Amortization of costs that began before your 2020 tax year 44 Total. Add amounts in column (U. See the instructions for where to report 43 44 for 4562000 Table 1 MACRS Half-Year Convention Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 33.33% 20.00% 14.29% 10.00% 5.00% 3.750% 44.45 32.00 24.49 18.00 9.50 7.219 14.81 19.20 17.49 14.40 8.55 6.677 7.41 11.52 12.49 11.52 7.70 6.177 11.52 8.93 9.22 6.93 5.713 5.76 8.92 7.37 6.23 5.285 8.93 6.55 5.90 4.888 4.46 6.55 5.90 4.522 6.56 5.91 4.462 6.55 5.90 4.461 3.28 5.91 4.462 5.90 4.461 5.91 4.462 5.90 4.461 5.91 4.462 2.95 4.461 4.462 4.461 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started