Answered step by step

Verified Expert Solution

Question

1 Approved Answer

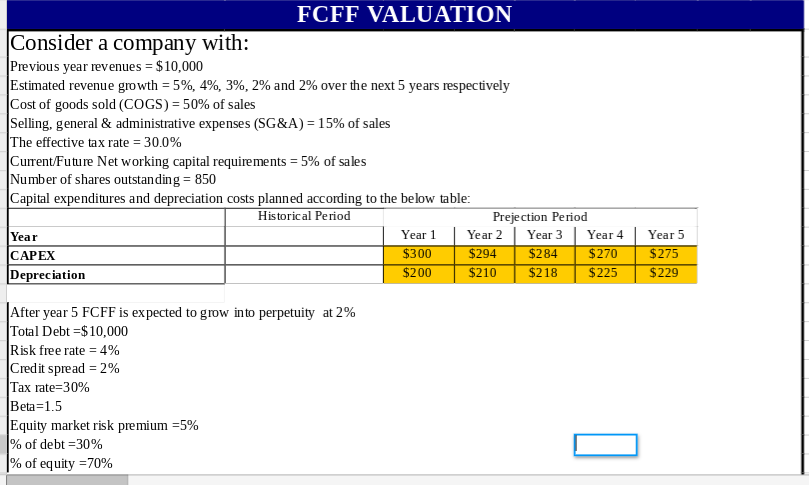

fill out the cells ! FCFF VALUATION Consider a company with: Previous year revenues $10,000 Estimated revenue growth : 5%, 4%, 3%, 2% and 2%

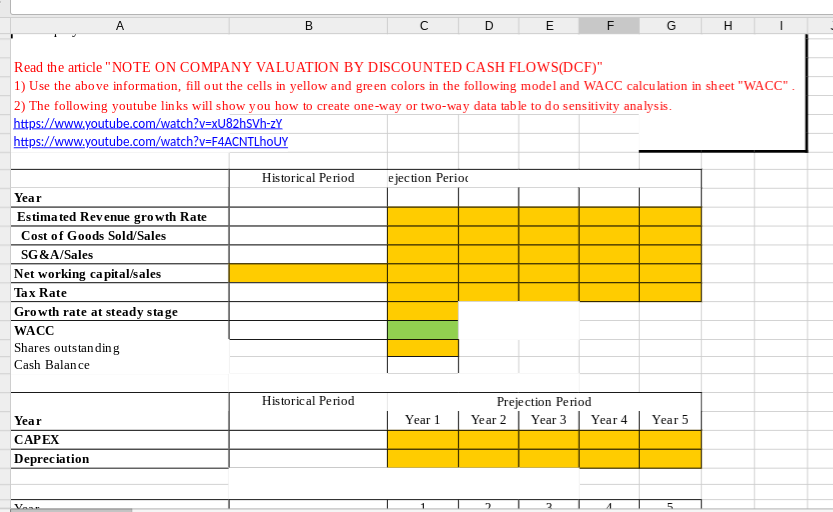

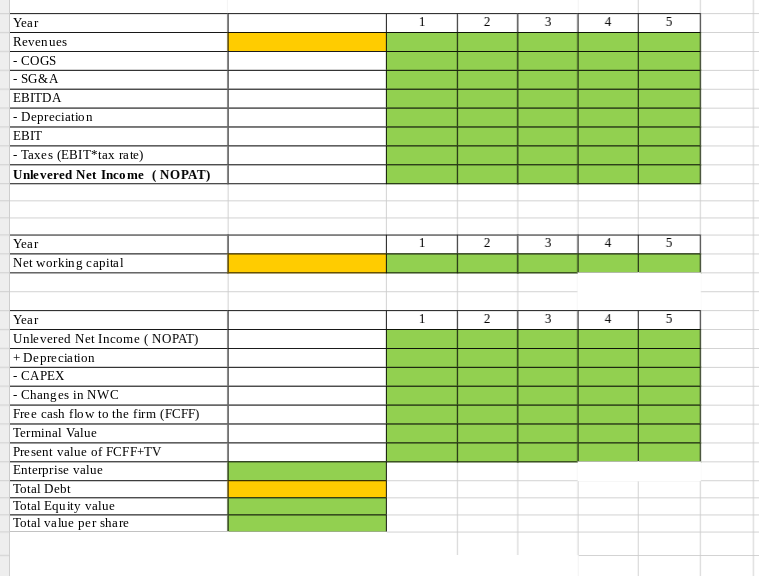

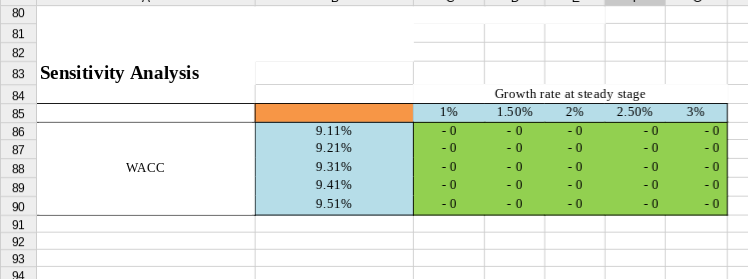

fill out the cells !

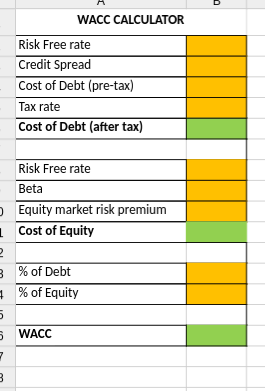

FCFF VALUATION Consider a company with: Previous year revenues $10,000 Estimated revenue growth : 5%, 4%, 3%, 2% and 2% over the next 5 years respectively Cost of goods sold (COGS)-50% of sales Selling, general & administrative expenses (SG&A)-15% of sales The effective tax rate-30.0% Current/Future Networking capital requirements-5% of sales Number of shares outstanding850 Capital expenditures and depreciation costs planned according to the below table: Historical Period Prejection Period Year 2 Year3 Year4 Year5 Year CAPEX Depreciation ear 1 300 $200 294 284 270 275 $210 $218 $225 $229 After year 5 FCFF is expected to grow into perpetuity at 2% Total Debt -$10,000 Risk free rate = 4% Credit spread-2% Tax rate-30% Beta-1.5 Equity market risk premium 5% % of debt-30% % of equity-70% FCFF VALUATION Consider a company with: Previous year revenues $10,000 Estimated revenue growth : 5%, 4%, 3%, 2% and 2% over the next 5 years respectively Cost of goods sold (COGS)-50% of sales Selling, general & administrative expenses (SG&A)-15% of sales The effective tax rate-30.0% Current/Future Networking capital requirements-5% of sales Number of shares outstanding850 Capital expenditures and depreciation costs planned according to the below table: Historical Period Prejection Period Year 2 Year3 Year4 Year5 Year CAPEX Depreciation ear 1 300 $200 294 284 270 275 $210 $218 $225 $229 After year 5 FCFF is expected to grow into perpetuity at 2% Total Debt -$10,000 Risk free rate = 4% Credit spread-2% Tax rate-30% Beta-1.5 Equity market risk premium 5% % of debt-30% % of equity-70%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started