Fill out the form please

Insurance Coverages Applied For Ontario motorists must have the following standard coverages: Liability, Accident Benefits, Uninsured Automobile and Direct Compensation Property Damage. You may also purchase additional insurance for Loss or Damage to the automobile and Optional Increased Accident Benefits. This is a brief explanation of the insurance coverages available to you. For complete details consult your policy. Your Insurer will supply you with a copy of the policy if you request it. Liability - Provides coverage for you or other insured persons if someone else is killed or injured or their property is damaged in an automobile incident. It will pay for legitimate claims against you or other insured persons up to the limit of your coverage, and the cost of settling claims. Accident Benefits - Your insurance company is obligated to explain details of Accident Benefits coverage to you. Provides benefits that you and other insured persons may be entitled to receive if injured or killed in an automobile accident. These benefits include: income replacement for persons who have lost income; payments to nonearners who suffer complete inability to carry on a normal life; payment of care expenses to persons who cannot continue to act as a primary caregiver for a member of their household; payment of medical, rehabilitation and attendant care expenses; payment of certain other expenses; payment of funeral expenses; and payments to survivors of a person who is killed. You may also purchase optional benefits to increase the standard level of benefits provided in your policy. The optional benefits your insurance company must offer are: Increased Income Replacement - The standard level of income replacement provided in the policy ($400 per week maximum) may be increased by purchasing optional coverage so that the weekly limit is up to $600, $800 or $1,000. All income replacement benefits are based on 70% of your gross weekly income. Increased Medical, Rehabilitation and Attendant Care - The standard benefit pays up to $65,000 for medical, rehabilitation and attendant care expenses with a 5 year time limit in most cases. If catastrophically impaired, the standard benefit pays up to $1,000,000 for medical, rehabilitation and attendant care expenses. You may purchase an optional medical, rehabilitation and attendant care benefit of $130,000 or $1,000,000. Additional Catastrophic Impairment - You may purchase an optional catastrophic impairment benefit of an additional $1,000,000 added to the standard medical, rehabilitation and attendant care benefit or the optional increased medical, rehabilitation and attendant care benefit. Caregiver Benefit, Housekeeping and Home Maintenance Expenses - The standard benefit for caregiver benefit, housekeeping and home maintenance expenses is available only for a person who is catastrophically impaired. You may purchase an optional benefit to provide these coverages for other impairments. Death and Funeral - The standard level of death benefits paid to the surviving spouse and dependant of a person who is killed ($25,000 to a surviving spouse and $10,000 to each surviving dependant) may be doubled by purchasing this optional coverage. This coverage also increases the standard funeral expense benefit from $6,000 to $8,000. Dependant Care - There is no standard dependant care benefit. You may purchase an optional benefit to receive weekly dependant care expenses of $75 for the first dependant, and $25 for each additional dependant, up to $150 per week, for employed persons not receiving a weekly caregiver benefit. Indexation Benefit - This optional coverage will ensure that certain weekly benefit payments and monetary limits will be adjusted on an annual basis to reflect changes in the cost of living. Uninsured Automobile Provides coverage if you or other insured persons are injured or killed by an uninsured motorist or by an unidentified (e.g. hit-and-run) driver. It also covers damage to your automobile and its contents caused by an identified, uninsured motorist, subject to a $300 deductible. Direct Compensation Property Damage Provides coverage in Ontario, under certain conditions, for damage to your automobile and to property it is carrying, when another motorist is responsible. It is called Direct Compensation because you will collect from us, your insurance company, even though you are not at fault for the accident. There may be a deductible amount, and this amount is either paid by you toward the cost of repairs or is deducted from the loss settlement. Higher deductibles may reduce your premium. Loss or Damage Provides a selection of optional coverages for your own automobile. Payments cover direct and accidental loss of, or damage to, a described automobile and its equipment. There is usually a deductible amount indicated for each coverage and this amount is either paid by you toward the cost of repairs or is deducted from the loss settlement. Higher deductibles may reduce your premium. There are four types of coverages: Specified Perils: Covers the described automobile against loss or damage caused by certain specific perils. They are: fire; theft or attempted theft; lightning, windstorm, hail or rising water; earthquake; explosion; riot or civil disturbance; falling or forced landing of aircraft or parts of aircraft; or the stranding, sinking, burning, derailment or collision of any kind of transport in, or upon which, the described automobile is being transported. Comprehensive: Covers a described automobile against loss or damage other than those covered by Collision or Upset, including perils listed under Specified Perils, falling or flying objects, missiles and vandalism. Collision or Upset: Covers damage when a described automobile is involved in a collision with another object or tips over. All Perils: Combines the Collision or Upset and Comprehensive coverages. For purposes of the Insurance Companies Act (Canada), this document was issued in the course of the insuranc

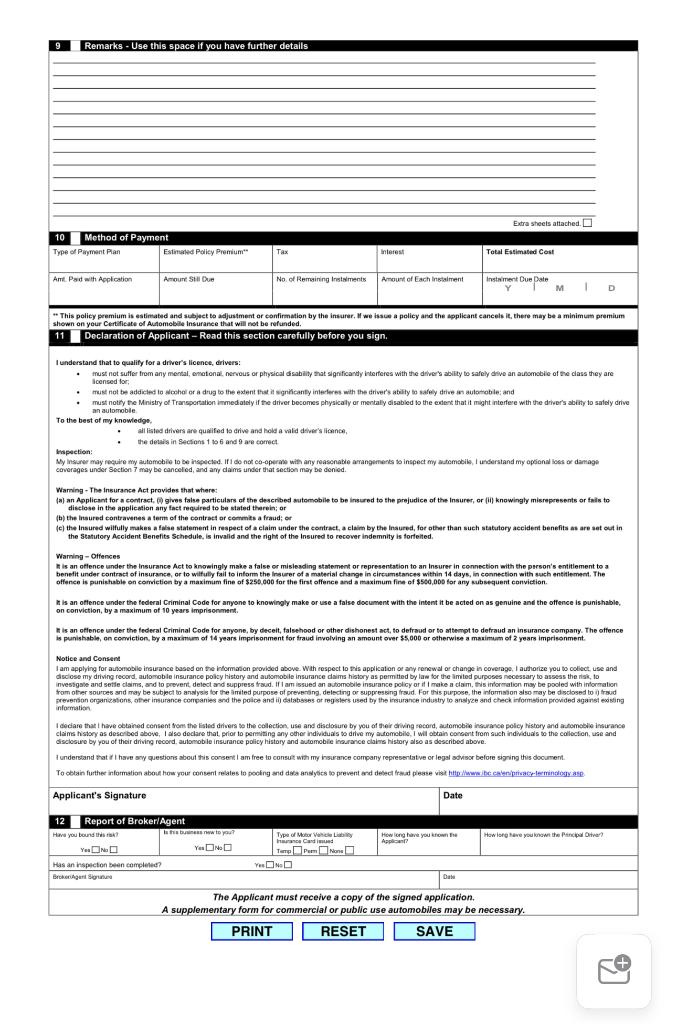

shewn on your Certlificate of Audomelele Insurance that will not be refunded. 11 Declaration of Applicant - Read this section carefully before you sign. I understand that to qualify for a diver's licence, drivers: - inust not suffer from any mental, emotonal nervous or physioal disability that significantly interferes with the dtiver's ability to safely dive an ausomobie of the class they are icensed lor; - must notily fe Misistry of Transportation immed atedy if the drizer bocomes physicaly or mentally disabied to the edent that it might interfere with the driver's abinty to salely drive an automoble To the best of my knowledos. - adi listed drivers are qualifed lo drive and hold a vald diber's licance, - the detais in Sectons 1 io 6 and 9 are comect Mapection: eoverages under Soction 7 may be canceled, and any daims under that section may be deniod. Warning - The insurance Act provides thet wherw: (a) an Applicant for n contract, (1) gives false particuiars of the described wutomobile to be insured to the prejudice of the Insurer, or (ii) knowingly misrepresents or falis to disciose in the applicetion any fact required to be stated therein; or (b) the insured contravenes a term of the contract or commits a fraud; or (c) the Insured wilfully makes a fwise statement in respect of a claim under the contract, a clakm by the insured, for othar than such statulory aceidert benefits as are aet out in the statutory Accident Benefits Schedule, is invalid and the right of the Insured to recover indemnity is forieited, Warning - Ottences In is an oflence under the insurance Act to knowingly make a false or mislesding statement or representation to an Insurer in connection with the person's entitiement to a benefit under contract of insurance, or to wilfully fail to intorm the insurer of a material change in cirtumstances within 14 days, lin connection with such entitiement. The offenen is puniehable on comiction by a maximum fine of $256.000 for the first offence and a maximum fine of $500,060 for any subsequent conviction. In is an oftence under the federal Criminal Code for anyone to knowingly make or use a faise document with the intent it be acted on as genuine and the offence is punishable, on conviction, by a maximum of 10 years imprisonment. In is an oflence under the tederal Criminal Code for anyone, by deceit, falsehood or other dishonest act, to defraud or to attempt to defraud an insurance company. The offence is punishable, on comiction, by a maximum of 14 years imprisonment for fraud involving an amount over \$5, 000 or otherwise a masimum of 2 years imprisonment. Notice and Censent lam applying for aubonoble inauance based on the intomasion provibed above. Wath respect to this application or any renowal or change in corerage, I authorize you bo coliect, use and disciose my driving recond, automobie insurance polky histary and ausomobile insurance daims history as permitied by law for the limited purposes neoessary to assess the nisk, to invessgale and setle clami, and to prevent, detect and suppess frad. If 1 am issued an astomobile insurance policy or it I make a clam, this indorenation may be pooled with indormation trom oher sources snd may be subject to anslysis for the amited purpose of prevertin. delecting or suppreseng lraud. For this pupose, the information aso may be disclosed to a trad information I dociare that I have obtained censent trem the listed driven so the colection, use and disclosure by you of their criving secard, automobio insurance polcy history and artomobie insurance disclocure by you of their driving reoord. automoble insurance policy history and automobile inaurance elaims history also as described above. I understand that if I have swy questions about this consent 1 am free to consut with my harance company representatve or legsl sdvisor before signing this dooument. Applicant's Signature shewn on your Certlificate of Audomelele Insurance that will not be refunded. 11 Declaration of Applicant - Read this section carefully before you sign. I understand that to qualify for a diver's licence, drivers: - inust not suffer from any mental, emotonal nervous or physioal disability that significantly interferes with the dtiver's ability to safely dive an ausomobie of the class they are icensed lor; - must notily fe Misistry of Transportation immed atedy if the drizer bocomes physicaly or mentally disabied to the edent that it might interfere with the driver's abinty to salely drive an automoble To the best of my knowledos. - adi listed drivers are qualifed lo drive and hold a vald diber's licance, - the detais in Sectons 1 io 6 and 9 are comect Mapection: eoverages under Soction 7 may be canceled, and any daims under that section may be deniod. Warning - The insurance Act provides thet wherw: (a) an Applicant for n contract, (1) gives false particuiars of the described wutomobile to be insured to the prejudice of the Insurer, or (ii) knowingly misrepresents or falis to disciose in the applicetion any fact required to be stated therein; or (b) the insured contravenes a term of the contract or commits a fraud; or (c) the Insured wilfully makes a fwise statement in respect of a claim under the contract, a clakm by the insured, for othar than such statulory aceidert benefits as are aet out in the statutory Accident Benefits Schedule, is invalid and the right of the Insured to recover indemnity is forieited, Warning - Ottences In is an oflence under the insurance Act to knowingly make a false or mislesding statement or representation to an Insurer in connection with the person's entitiement to a benefit under contract of insurance, or to wilfully fail to intorm the insurer of a material change in cirtumstances within 14 days, lin connection with such entitiement. The offenen is puniehable on comiction by a maximum fine of $256.000 for the first offence and a maximum fine of $500,060 for any subsequent conviction. In is an oftence under the federal Criminal Code for anyone to knowingly make or use a faise document with the intent it be acted on as genuine and the offence is punishable, on conviction, by a maximum of 10 years imprisonment. In is an oflence under the tederal Criminal Code for anyone, by deceit, falsehood or other dishonest act, to defraud or to attempt to defraud an insurance company. The offence is punishable, on comiction, by a maximum of 14 years imprisonment for fraud involving an amount over \$5, 000 or otherwise a masimum of 2 years imprisonment. Notice and Censent lam applying for aubonoble inauance based on the intomasion provibed above. Wath respect to this application or any renowal or change in corerage, I authorize you bo coliect, use and disciose my driving recond, automobie insurance polky histary and ausomobile insurance daims history as permitied by law for the limited purposes neoessary to assess the nisk, to invessgale and setle clami, and to prevent, detect and suppess frad. If 1 am issued an astomobile insurance policy or it I make a clam, this indorenation may be pooled with indormation trom oher sources snd may be subject to anslysis for the amited purpose of prevertin. delecting or suppreseng lraud. For this pupose, the information aso may be disclosed to a trad information I dociare that I have obtained censent trem the listed driven so the colection, use and disclosure by you of their criving secard, automobio insurance polcy history and artomobie insurance disclocure by you of their driving reoord. automoble insurance policy history and automobile inaurance elaims history also as described above. I understand that if I have swy questions about this consent 1 am free to consut with my harance company representatve or legsl sdvisor before signing this dooument. Applicant's Signature