Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill out the sheet Name: Deal or No Deal: Understanding Car Loans Down payment, interest rate, loan term-the language involved with buying a car can

fill out the sheet

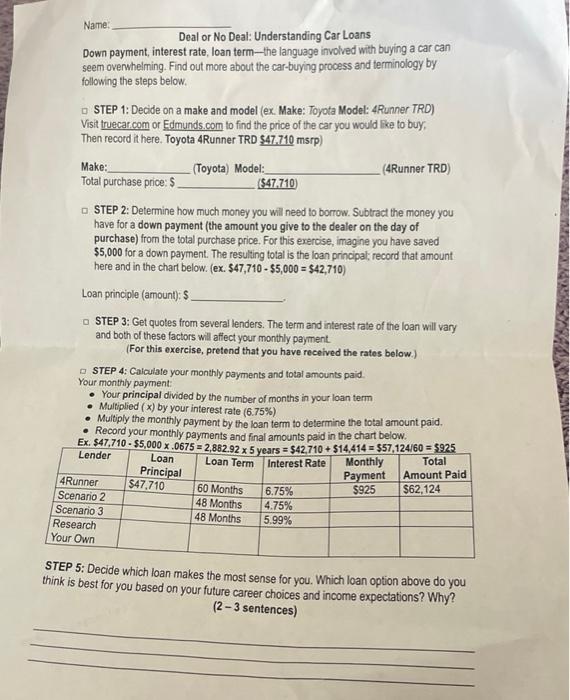

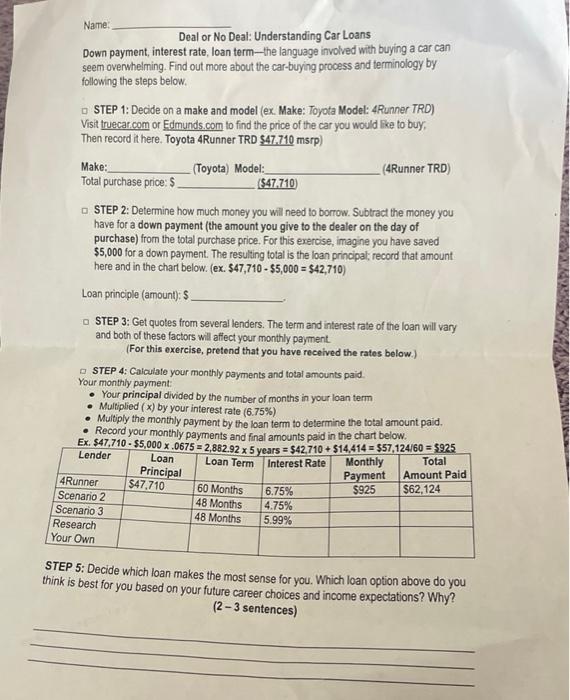

Name: Deal or No Deal: Understanding Car Loans Down payment, interest rate, loan term-the language involved with buying a car can seem overwhelming. Find out more about the car-buying process and terminology by following the steps below. STEP 1: Decide on a make and model (ex. Make: Toyota Model: 4Runner TRD) Visit truecar.com or Edmunds.com to find the price of the car you would like to buy, Then record it here. Toyota 4Runner TRD $47.710 msrp) Make: (Toyota) Model: (4Runner TRD) Total purchase price: $ ($47.710) STEP 2: Determine how much money you will need to borrow. Subtract the money you have for a down payment (the amount you give to the dealer on the day of purchase) from the total purchase price. For this exercise, imagine you have saved $5,000 for a down payment. The resulting total is the loan principal; record that amount here and in the chart below. (ex. $47,710-$5,000 = $42,710) Loan principle (amount):$_ STEP 3: Get quotes from several lenders. The term and interest rate of the loan will vary and both of these factors will affect your monthly payment. (For this exercise, pretend that you have received the rates below.) STEP 4: Calculate your monthly payments and total amounts paid. Your monthly payment: Your principal divided by the number of months in your loan term Multiplied (x) by your interest rate (6.75%) Multiply the monthly payment by the loan term to determine the total amount paid. Record your monthly payments and final amounts paid in the chart below. Ex. $47,710-$5,000 x .0675=2,882.92 x 5 years = $42.710+ $14,414=$57,124/60 = $925 Lender Loan Loan Term Interest Rate Monthly Payment Principal $47,710 Total Amount Paid $62,124 4Runner 60 Months 6.75% $925 Scenario 2 48 Months 4.75% Scenario 3 48 Months 5.99% Research Your Own STEP 5: Decide which loan makes the most sense for you. Which loan option above do you think is best for you based on your future career choices and income expectations? Why? (2-3 sentences) B Name: Deal or No Deal: Understanding Car Loans Down payment, interest rate, loan term-the language involved with buying a car can seem overwhelming. Find out more about the car-buying process and terminology by following the steps below. STEP 1: Decide on a make and model (ex. Make: Toyota Model: 4Runner TRD) Visit truecar.com or Edmunds.com to find the price of the car you would like to buy, Then record it here. Toyota 4Runner TRD $47.710 msrp) Make: (Toyota) Model: (4Runner TRD) Total purchase price: $ ($47.710) STEP 2: Determine how much money you will need to borrow. Subtract the money you have for a down payment (the amount you give to the dealer on the day of purchase) from the total purchase price. For this exercise, imagine you have saved $5,000 for a down payment. The resulting total is the loan principal; record that amount here and in the chart below. (ex. $47,710-$5,000 = $42,710) Loan principle (amount):$_ STEP 3: Get quotes from several lenders. The term and interest rate of the loan will vary and both of these factors will affect your monthly payment. (For this exercise, pretend that you have received the rates below.) STEP 4: Calculate your monthly payments and total amounts paid. Your monthly payment: Your principal divided by the number of months in your loan term Multiplied (x) by your interest rate (6.75%) Multiply the monthly payment by the loan term to determine the total amount paid. Record your monthly payments and final amounts paid in the chart below. Ex. $47,710-$5,000 x .0675=2,882.92 x 5 years = $42.710+ $14,414=$57,124/60 = $925 Lender Loan Loan Term Interest Rate Monthly Payment Principal $47,710 Total Amount Paid $62,124 4Runner 60 Months 6.75% $925 Scenario 2 48 Months 4.75% Scenario 3 48 Months 5.99% Research Your Own STEP 5: Decide which loan makes the most sense for you. Which loan option above do you think is best for you based on your future career choices and income expectations? Why? (2-3 sentences) B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started