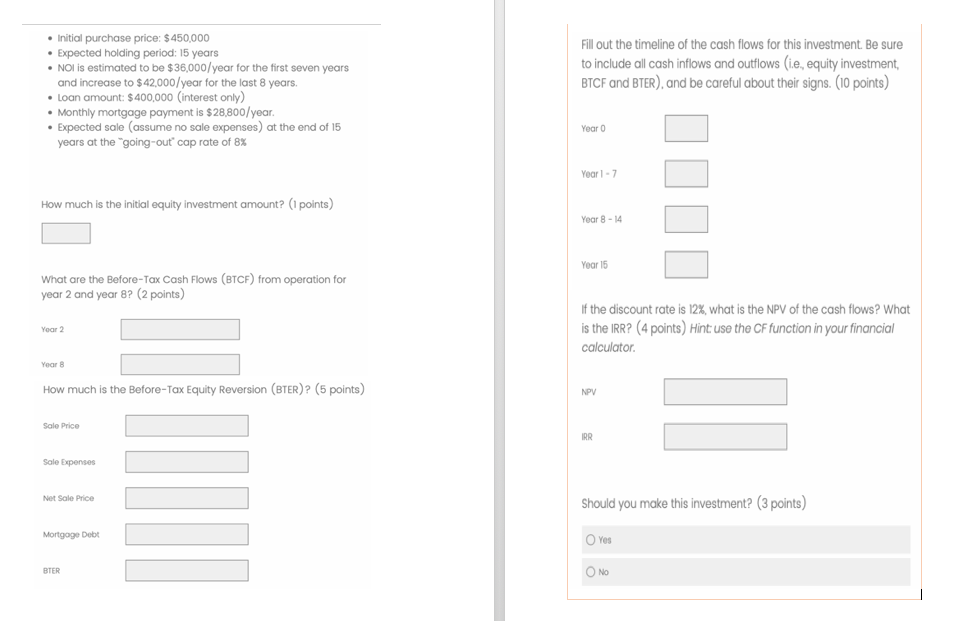

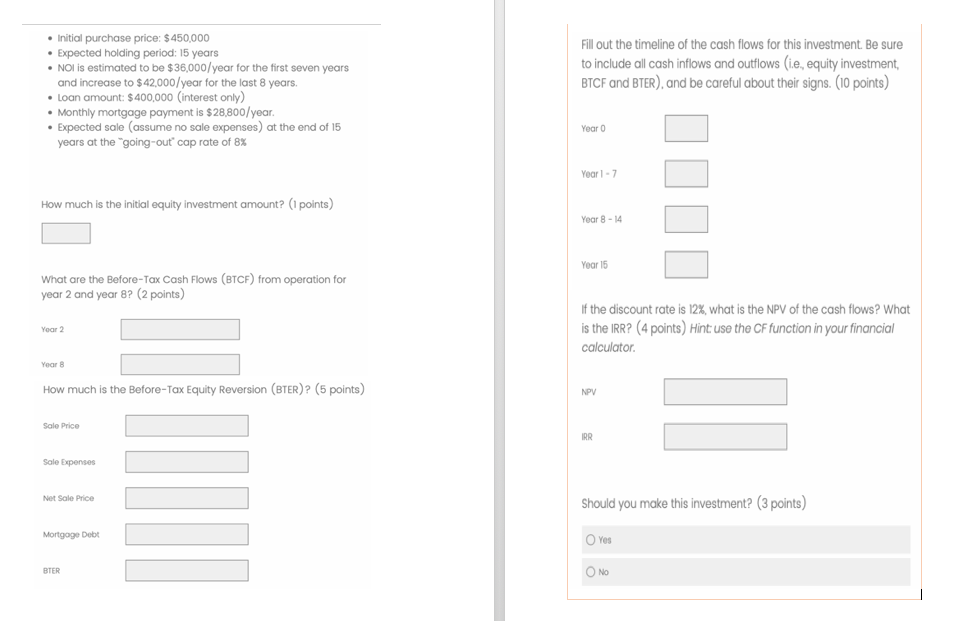

Fill out the timeline of the cash flows for this investment. Be sure to include all cash inflows and outflows (ie, equity investment, BTCF and BTER) and be careful about their signs. (10 points) Initial purchase price: $450,000 Expected holding period: 15 years NOI is estimated to be $36,000/year for the first seven years and increase to $42,000/year for the last 8 years. Loan amount: $400,000 interest only) Monthly mortgage payment is $28.800/year. Expected sale (assume no sale expenses) at the end of 15 years at the "going-out' cap rate of 8% Year o Year 1 - 7 How much is the initial equity investment amount? (1 points) Year 8-14 Year 15 What are the Before-Tax Cash Flows (BTCF) from operation for year 2 and year 8? (2 points) Year 2 If the discount rate is 12%, what is the NPV of the cash flows? What is the IRR? (4 points) Hint use the CF function in your financial calculator Year How much is the Before-Tax Equity Reversion (BTER)? (5 points) NPV Sale Price IRR Sale Expenses Net Sale Price Should you make this investment? (3 points) Mortgage Debt Yes BTER O NO Fill out the timeline of the cash flows for this investment. Be sure to include all cash inflows and outflows (ie, equity investment, BTCF and BTER) and be careful about their signs. (10 points) Initial purchase price: $450,000 Expected holding period: 15 years NOI is estimated to be $36,000/year for the first seven years and increase to $42,000/year for the last 8 years. Loan amount: $400,000 interest only) Monthly mortgage payment is $28.800/year. Expected sale (assume no sale expenses) at the end of 15 years at the "going-out' cap rate of 8% Year o Year 1 - 7 How much is the initial equity investment amount? (1 points) Year 8-14 Year 15 What are the Before-Tax Cash Flows (BTCF) from operation for year 2 and year 8? (2 points) Year 2 If the discount rate is 12%, what is the NPV of the cash flows? What is the IRR? (4 points) Hint use the CF function in your financial calculator Year How much is the Before-Tax Equity Reversion (BTER)? (5 points) NPV Sale Price IRR Sale Expenses Net Sale Price Should you make this investment? (3 points) Mortgage Debt Yes BTER O NO