Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill tables The following information is available for two different types of businesses for the Year 1 accounting year. Hopkins CPAs is a service business

fill tables

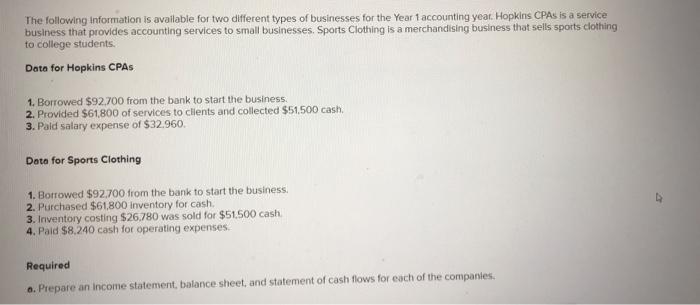

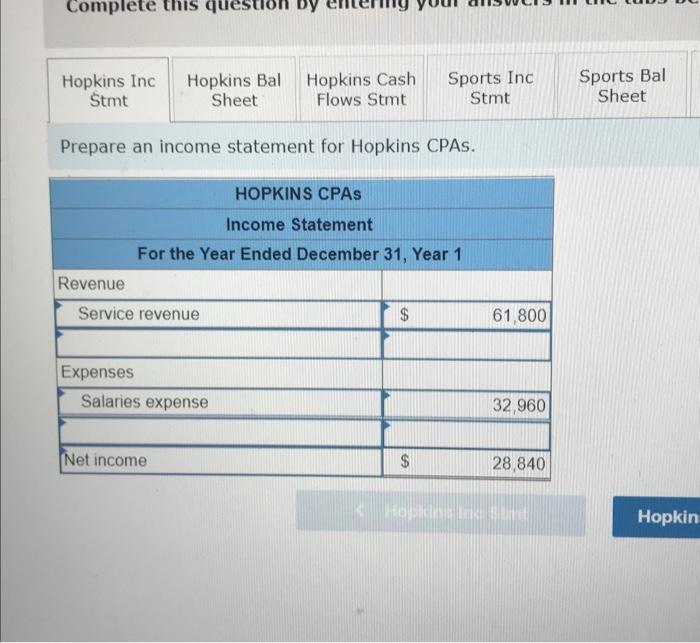

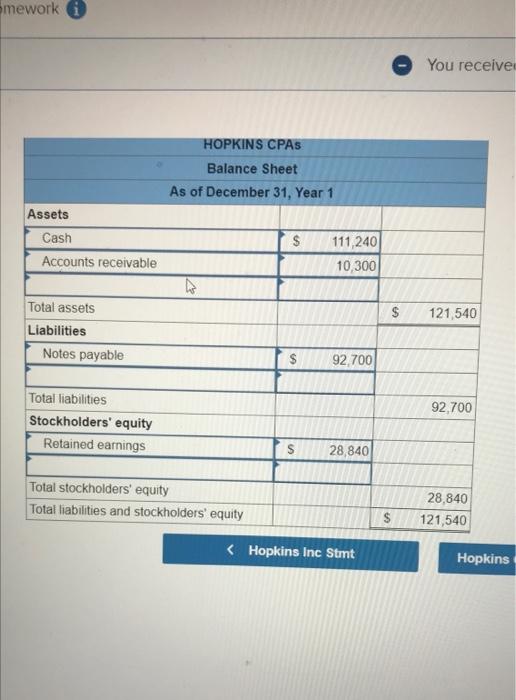

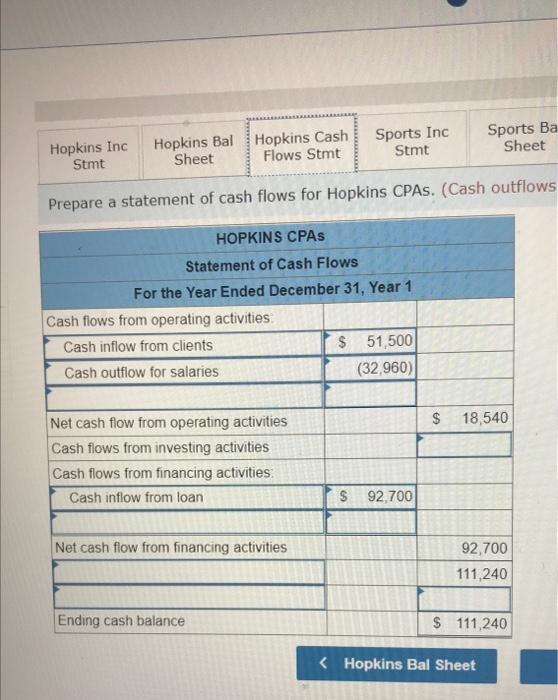

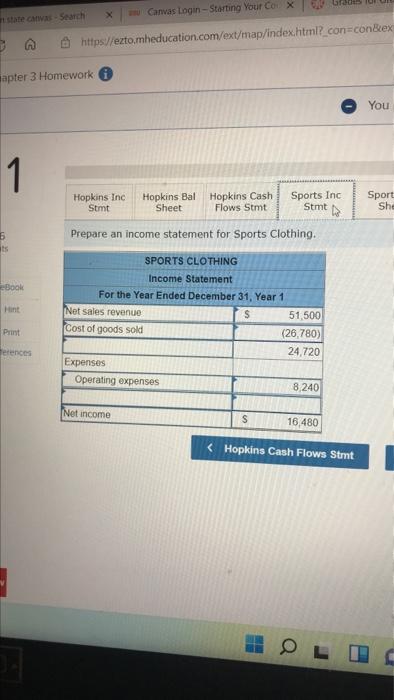

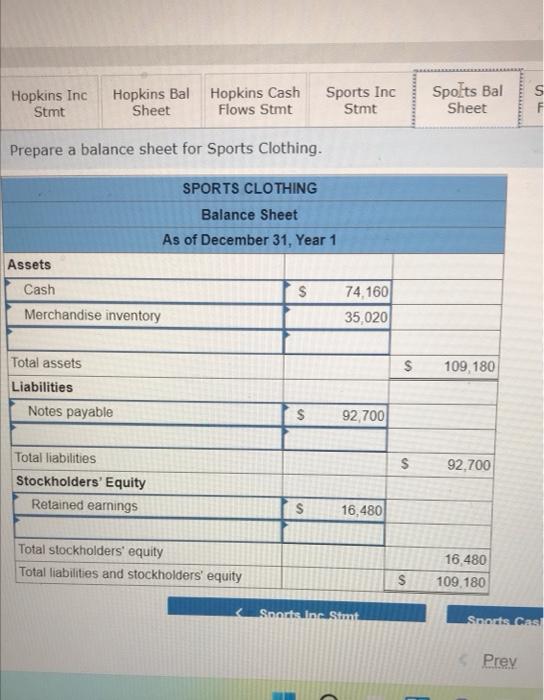

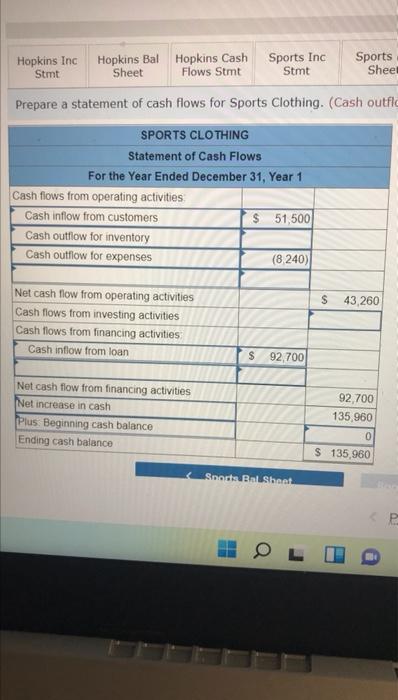

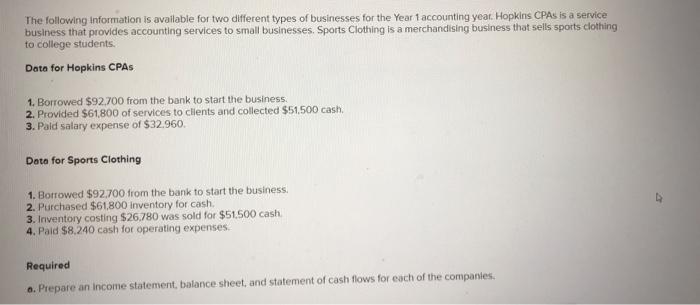

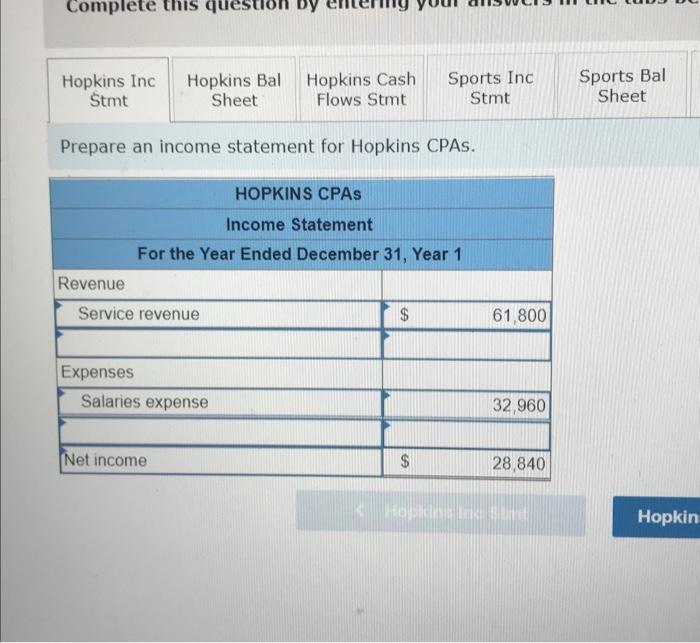

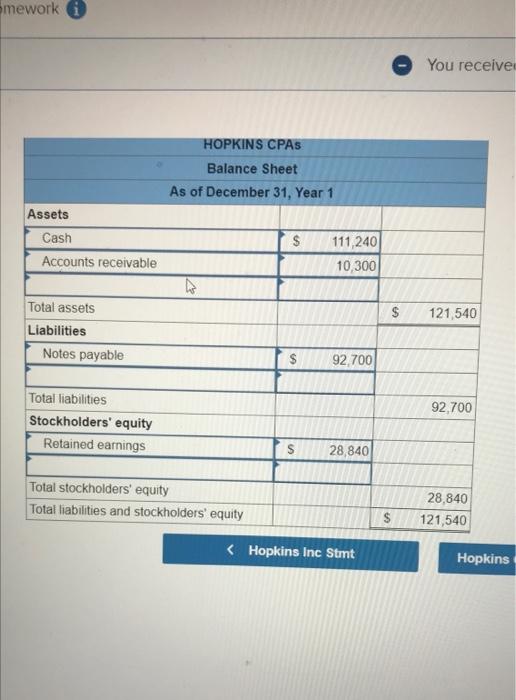

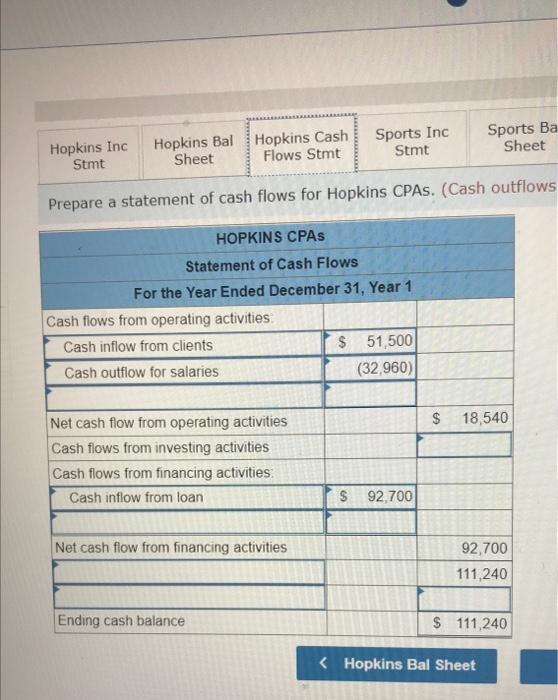

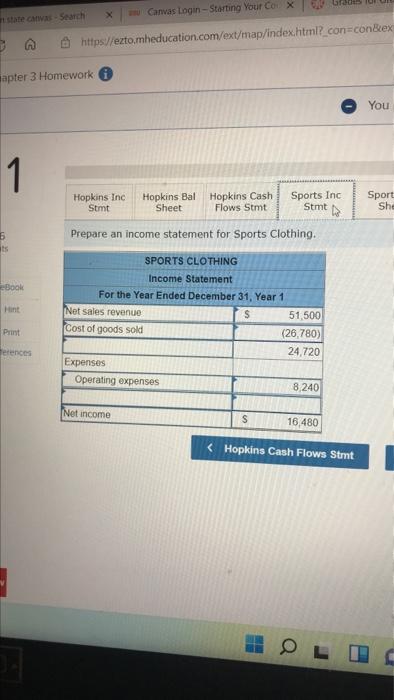

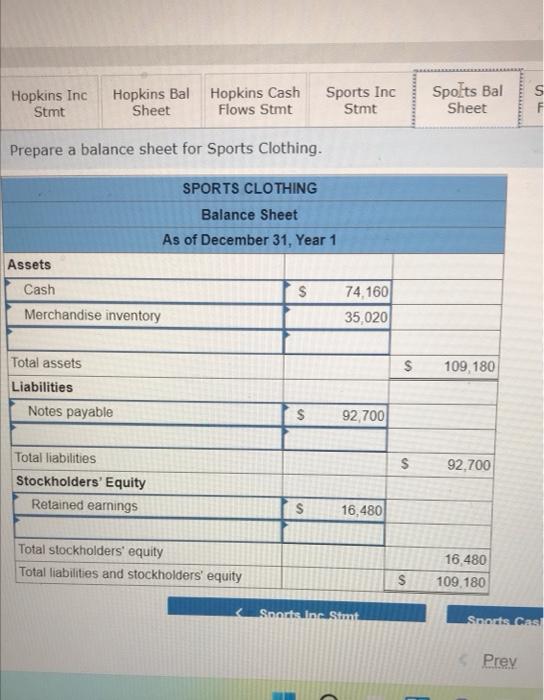

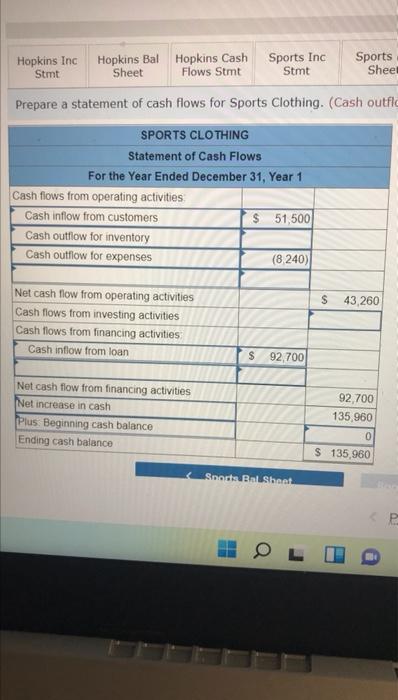

The following information is available for two different types of businesses for the Year 1 accounting year. Hopkins CPAs is a service business that provides accounting services to small businesses, Sports Clothing is a merchandising business that sells sports clothing to college students Data for Hopkins CPAS 1. Borrowed $92.700 from the bank to start the business. 2. Provided $61,800 of services to clients and collected $51,500 cash. 3. Pald salary expense of $32.960. Dato for Sports Clothing 1. Borrowed $92.700 from the bank to start the business. 2. Purchased $61,800 inventory for cash. 3. Inventory costing $26,780 was sold for $51.500 cash 4. Pald $8.240 cash for operating expenses Required 0. Prepare an income statement, balance sheet, and statement of cash flows for each of the companies Complete this question by Hopkins Inc Stmt Hopkins Bal Sheet Hopkins Cash Flows Stmt Sports Inc Sports Bal Sheet Stmt Prepare an income statement for Hopkins CPAs. HOPKINS CPAS Income Statement For the Year Ended December 31, Year 1 Revenue Service revenue $ 61,800 Expenses Salaries expense 32,960 Net income $ 28,840 Hop Hopkin mework You receive HOPKINS CPAS Balance Sheet As of December 31, Year 1 Assets Cash Accounts receivable $ 111,240 10,300 $ 121,540 Total assets Liabilities Notes payable $ 92.700 92.700 Total liabilities Stockholders' equity Retained earnings 28,840 Total stockholders' equity Total liabilities and stockholders' equity 28,840 121,540 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started