Answered step by step

Verified Expert Solution

Question

1 Approved Answer

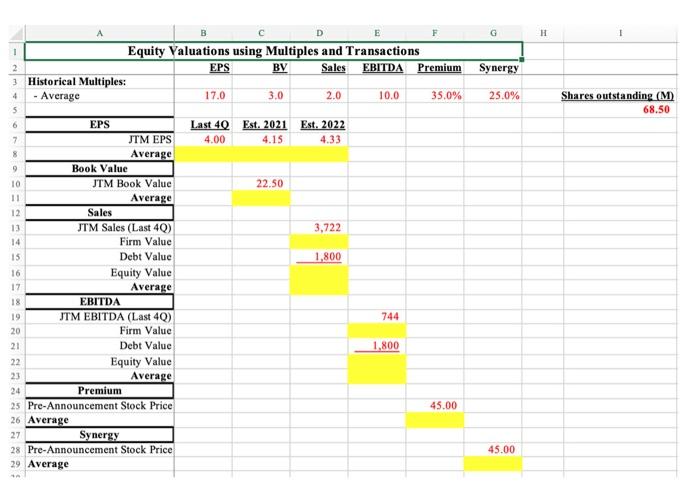

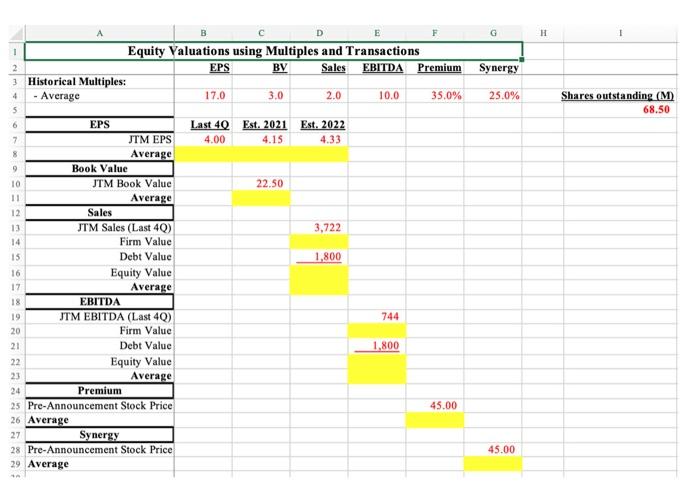

Fill the blanks in Yellow. 2 3 Historical Multiples: 4 - Average 5 10 11 12 13 14 15 16 17 18 19 20 21

Fill the blanks in Yellow.

2 3 Historical Multiples: 4 - Average 5 10 11 12 13 14 15 16 17 18 19 20 21 22 23 EPS B D E Equity Valuations using Multiples and Transactions EPS BV Book Value JTM Book Value Average JTM EPS Average Sales JTM Sales (Last 4Q) Firm Value Debt Value Equity Value Average EBITDA JTM EBITDA (Last 4Q) Firm Value Debt Value Premium Equity Value Average Synergy 24 25 Pre-Announcement Stock Price 26 Average 27 28 Pre-Announcement Stock Price 29 Average 4A 17.0 Last 40 4.00 3.0 Est. 2021 4.15 22.50 Sales EBITDA Premium 2.0 Est. 2022 4.33 3,722 1,800 10.0 744 1,800 35.0% 45.00 G Synergy 25.0% 45.00 H I Shares outstanding (M) 68.50 2 3 Historical Multiples: 4 - Average 5 10 11 12 13 14 15 16 17 18 19 20 21 22 23 EPS B D E Equity Valuations using Multiples and Transactions EPS BV Book Value JTM Book Value Average JTM EPS Average Sales JTM Sales (Last 4Q) Firm Value Debt Value Equity Value Average EBITDA JTM EBITDA (Last 4Q) Firm Value Debt Value Premium Equity Value Average Synergy 24 25 Pre-Announcement Stock Price 26 Average 27 28 Pre-Announcement Stock Price 29 Average 4A 17.0 Last 40 4.00 3.0 Est. 2021 4.15 22.50 Sales EBITDA Premium 2.0 Est. 2022 4.33 3,722 1,800 10.0 744 1,800 35.0% 45.00 G Synergy 25.0% 45.00 H I Shares outstanding (M) 68.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started