Answered step by step

Verified Expert Solution

Question

1 Approved Answer

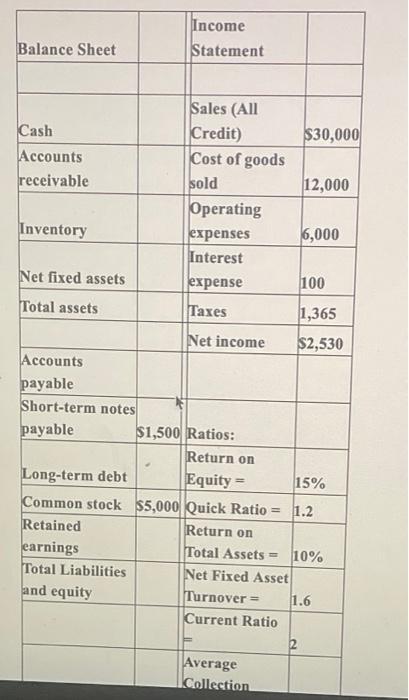

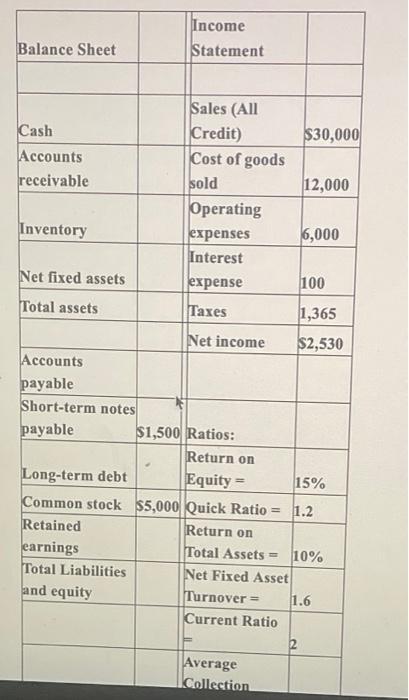

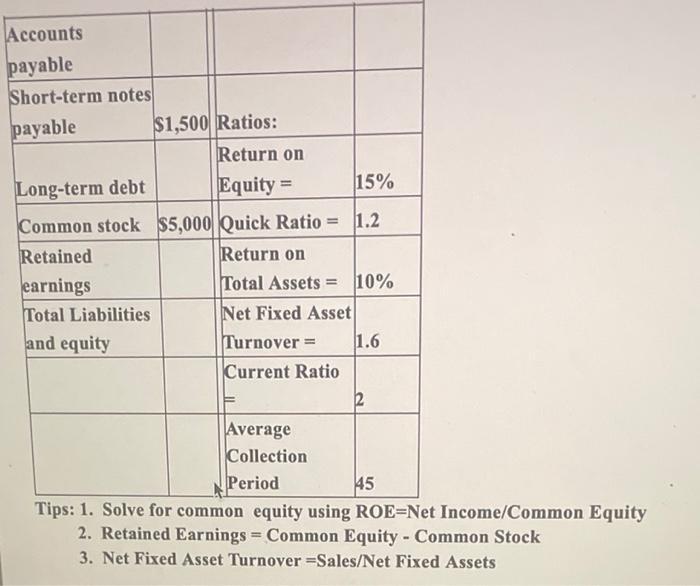

Fill the boxes Balance Sheet Cash Accounts receivable Inventory Net fixed assets Total assets Accounts payable Short-term notes payable Income Statement Sales (All Credit) Cost

Fill the boxes

Balance Sheet Cash Accounts receivable Inventory Net fixed assets Total assets Accounts payable Short-term notes payable Income Statement Sales (All Credit) Cost of goods sold Operating expenses Interest expense Taxes Net income $1,500 Ratios: Return on Equity = $30,000 Average Collection 12,000 6,000 Long-term debt Common stock $5,000 Quick Ratio = Retained Return on earnings Total Assets= 10% Total Liabilities Net Fixed Asset and equity Turnover= 1.6 Current Ratio 100 1,365 $2,530 15% 1.2

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Heres the completed balance sheet and income statement based on the provided information Balance She...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started