Answered step by step

Verified Expert Solution

Question

1 Approved Answer

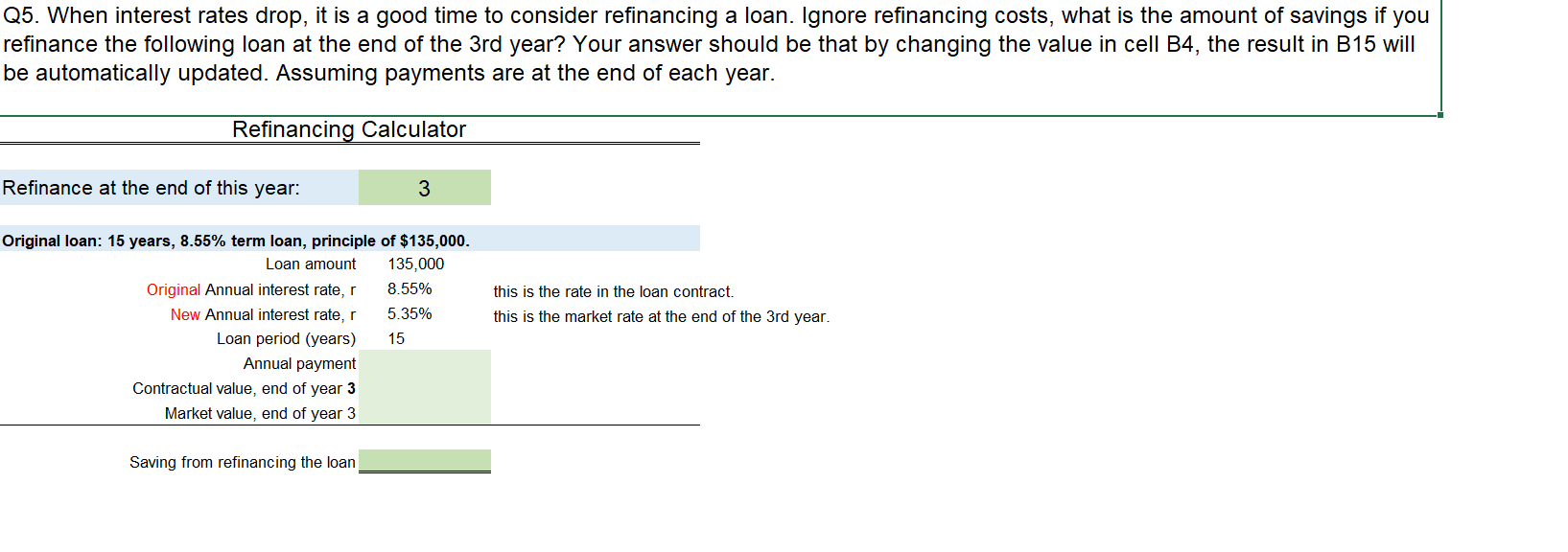

fill the green Q 5 . When interest rates drop, it is a good time to consider refinancing a loan. Ignore refinancing costs, what is

fill the green Q When interest rates drop, it is a good time to consider refinancing a loan. Ignore refinancing costs, what is the amount of savings if you

refinance the following loan at the end of the rd year? Your answer should be that by changing the value in cell B the result in B will

be automatically updated. Assuming payments are at the end of each year.

Refinancing Calculator

Refinance at the end of this year:

Original loan: years, term loan, principle of $

Loan amount

Original Annual interest rate, this is the rate in the loan contract.

New Annual interest rate, this is the market rate at the end of the rd year.

Loan period years

Annual payment

Contractual value, end of year

Market value, end of year

Saving from refinancing the loan

What is the saving from refinancing at the end of the rd year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started