Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill the table 6 pts D Question 1 NuWave electronics currently produces digital watches. However, they are considering expanding into one of two other product

fill the table

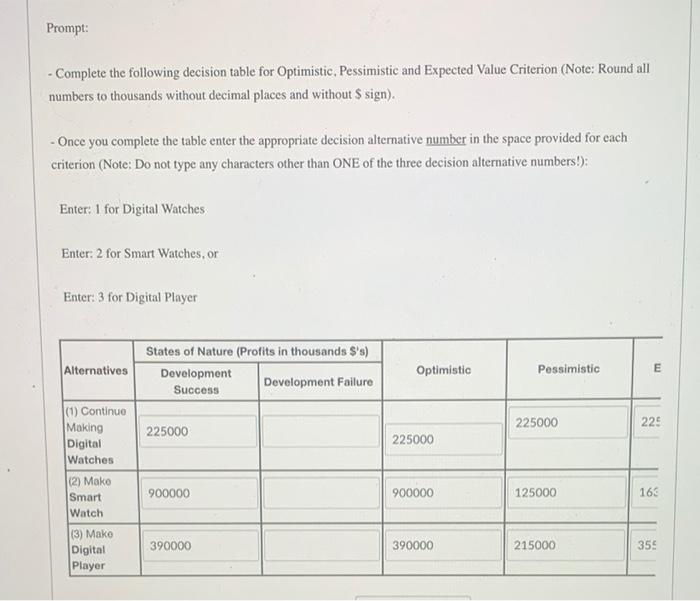

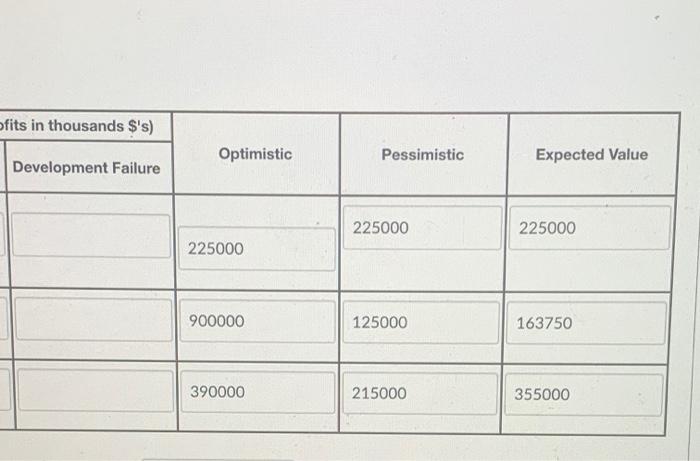

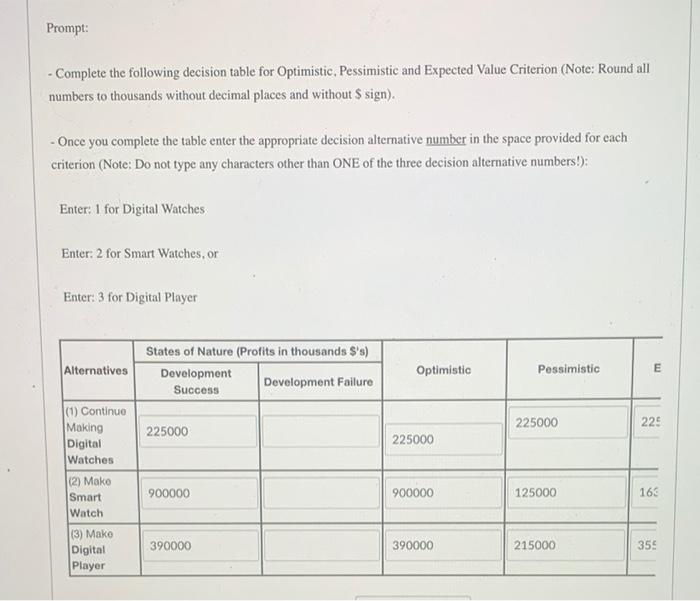

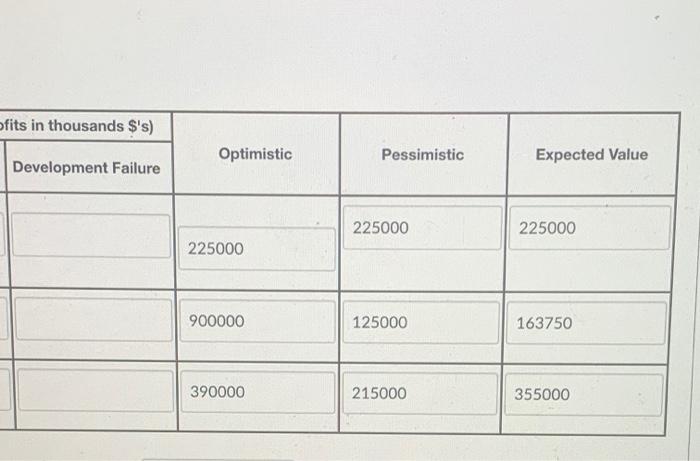

6 pts D Question 1 NuWave electronics currently produces digital watches. However, they are considering expanding into one of two other product markets: (1) smart watches or (ii) digital music players. They have completed some preliminary market tests to confirm that a market exists for both products. If the smart watches are successfully developed, the company projects revenues of $1.000.000 over the next five years. If the digital music players are successfully developed, the company projects revenues of $400,000 over the next five years. Since both products are very different from NuWave's current products, the company may not be able to successfully complete the product development process. The smart watch is a breakthrough product which will require significant research and development (R&D) investments. There is only a 5% chance that the development of the smart watch will be successful. The company estimates that product development cost for the smart watch will be $100.000 However, the digital music players will only cost $10,000 of research and development (R&D) investments. There is an 80% chance that the development of the digital music player will be successful. For both new products, if the NPD process is not successful, then NuWave will realize SO in revenues If the product development of either of these products is successful, then NuWave will discontinue sales of the digital watches. If they the development of either new products is a failure, they will discontinue that product and continue to produce digital watches at current output levels, which is predicted to yield $225,000 in annual profits for the next five years. In this case, development cost will have to deducted from the profits generated by the production of digital watches Prompt: - Complete the following decision table for Optimistic, Pessimistic and Expected Value Criterion (Note: Round all numbers to thousands without decimal places and without $ sign). - Once you complete the table enter the appropriate decision alternative number in the space provided for each criterion (Note: Do not type any characters other than ONE of the three decision alternative numbers!): Enter: 1 for Digital Watches Enter: 2 for Smart Watches, or Enter: 3 for Digital Player Alternatives States of Nature (Profits in thousands $'s) Development Success Development Failure Optimistic Pessimistic m 225000 225 (1) Continue Making Digital Watches 225000 225000 (2) Mako Smart Watch 900000 900000 125000 163 390000 390000 215000 353 (3) Make Digital Player Ofits in thousands $'s) Optimistic Pessimistic Expected Value Development Failure 225000 225000 225000 900000 125000 163750 390000 215000 355000 6 pts D Question 1 NuWave electronics currently produces digital watches. However, they are considering expanding into one of two other product markets: (1) smart watches or (ii) digital music players. They have completed some preliminary market tests to confirm that a market exists for both products. If the smart watches are successfully developed, the company projects revenues of $1.000.000 over the next five years. If the digital music players are successfully developed, the company projects revenues of $400,000 over the next five years. Since both products are very different from NuWave's current products, the company may not be able to successfully complete the product development process. The smart watch is a breakthrough product which will require significant research and development (R&D) investments. There is only a 5% chance that the development of the smart watch will be successful. The company estimates that product development cost for the smart watch will be $100.000 However, the digital music players will only cost $10,000 of research and development (R&D) investments. There is an 80% chance that the development of the digital music player will be successful. For both new products, if the NPD process is not successful, then NuWave will realize SO in revenues If the product development of either of these products is successful, then NuWave will discontinue sales of the digital watches. If they the development of either new products is a failure, they will discontinue that product and continue to produce digital watches at current output levels, which is predicted to yield $225,000 in annual profits for the next five years. In this case, development cost will have to deducted from the profits generated by the production of digital watches Prompt: - Complete the following decision table for Optimistic, Pessimistic and Expected Value Criterion (Note: Round all numbers to thousands without decimal places and without $ sign). - Once you complete the table enter the appropriate decision alternative number in the space provided for each criterion (Note: Do not type any characters other than ONE of the three decision alternative numbers!): Enter: 1 for Digital Watches Enter: 2 for Smart Watches, or Enter: 3 for Digital Player Alternatives States of Nature (Profits in thousands $'s) Development Success Development Failure Optimistic Pessimistic m 225000 225 (1) Continue Making Digital Watches 225000 225000 (2) Mako Smart Watch 900000 900000 125000 163 390000 390000 215000 353 (3) Make Digital Player Ofits in thousands $'s) Optimistic Pessimistic Expected Value Development Failure 225000 225000 225000 900000 125000 163750 390000 215000 355000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started