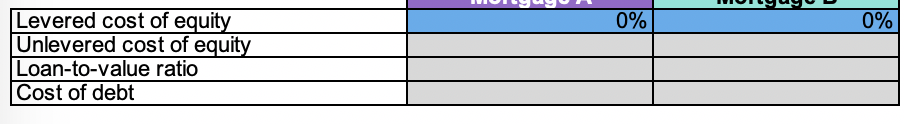

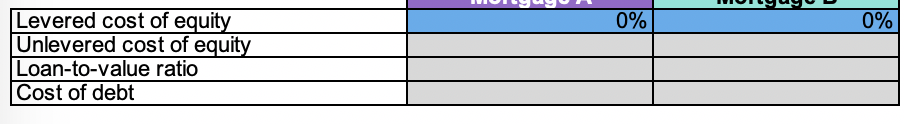

Fill this table this is answer for 1.1 and 1.2

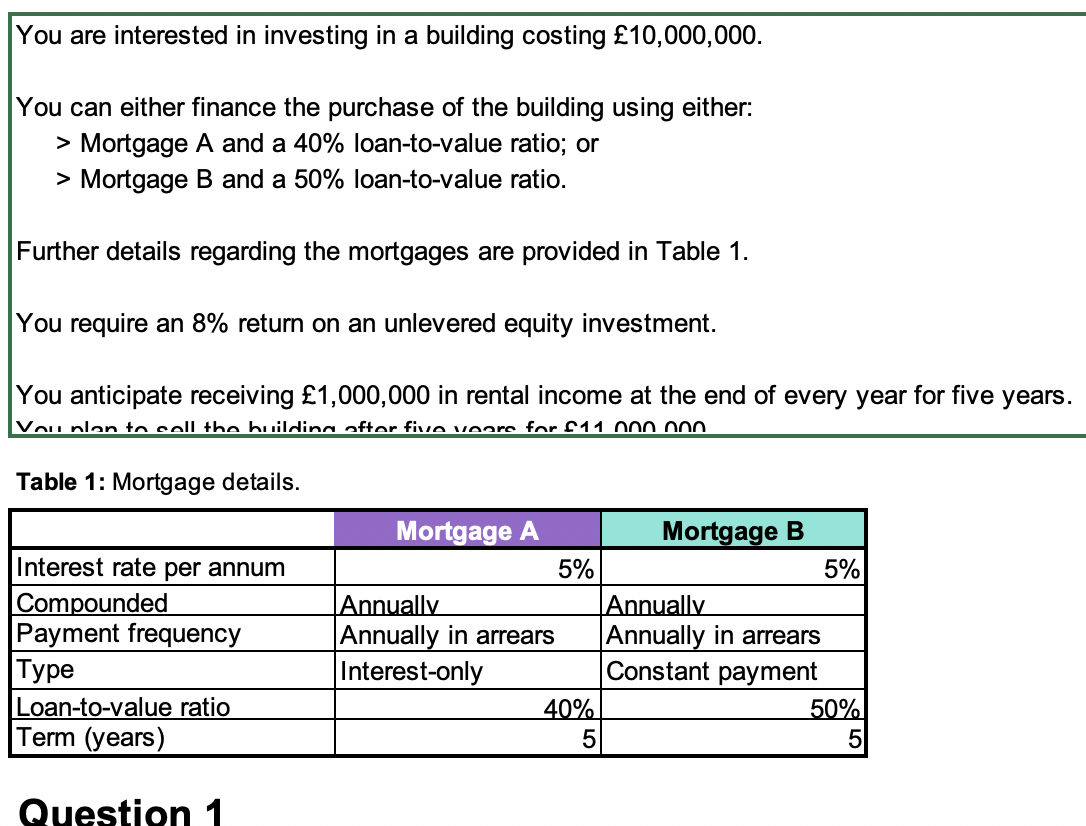

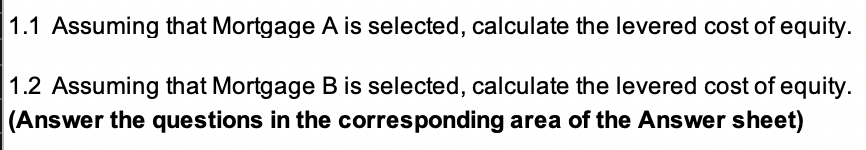

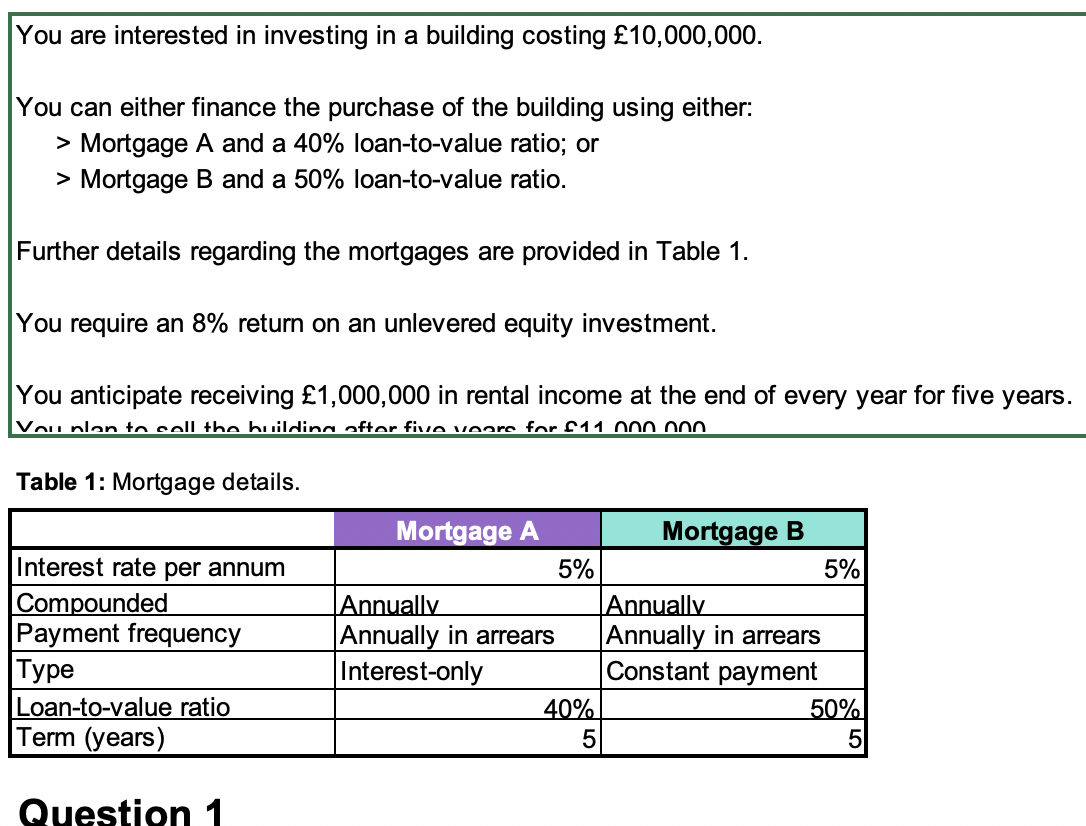

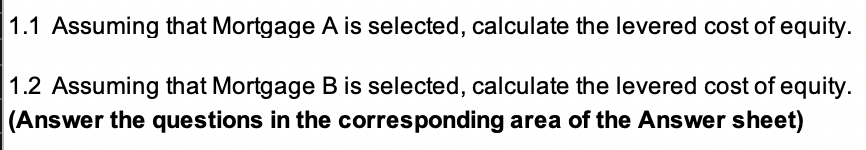

You are interested in investing in a building costing 10,000,000. You can either finance the purchase of the building using either: > Mortgage A and a 40% loan-to-value ratio; or > Mortgage B and a 50% loan-to-value ratio. Further details regarding the mortgages are provided in Table 1. You require an 8% return on an unlevered equity investment. You anticipate receiving 1,000,000 in rental income at the end of every year for five years. Vou nlon to call the building ofter five voare for 11 000 non Table 1: Mortgage details. Interest rate per annum Compounded mnounded Payment frequency Type Loan-to-value ratio Term (years) Mortgage A 5% Annually Annually in arrears Interest-only 40% Mortgage B 5% Annually Annually in arrears Constant payment 50% 5 Question 1 1.1 Assuming that Mortgage A is selected, calculate the levered cost of equity. 1.2 Assuming that Mortgage B is selected, calculate the levered cost of equity. (Answer the questions in the corresponding area of the Answer sheet) OILUI UILyuyu 0% 0 % Levered cost of equity Unlevered cost of equity Loan-to-value ratio Cost of debt You are interested in investing in a building costing 10,000,000. You can either finance the purchase of the building using either: > Mortgage A and a 40% loan-to-value ratio; or > Mortgage B and a 50% loan-to-value ratio. Further details regarding the mortgages are provided in Table 1. You require an 8% return on an unlevered equity investment. You anticipate receiving 1,000,000 in rental income at the end of every year for five years. Vou nlon to call the building ofter five voare for 11 000 non Table 1: Mortgage details. Interest rate per annum Compounded mnounded Payment frequency Type Loan-to-value ratio Term (years) Mortgage A 5% Annually Annually in arrears Interest-only 40% Mortgage B 5% Annually Annually in arrears Constant payment 50% 5 Question 1 1.1 Assuming that Mortgage A is selected, calculate the levered cost of equity. 1.2 Assuming that Mortgage B is selected, calculate the levered cost of equity. (Answer the questions in the corresponding area of the Answer sheet) OILUI UILyuyu 0% 0 % Levered cost of equity Unlevered cost of equity Loan-to-value ratio Cost of debt