Answered step by step

Verified Expert Solution

Question

1 Approved Answer

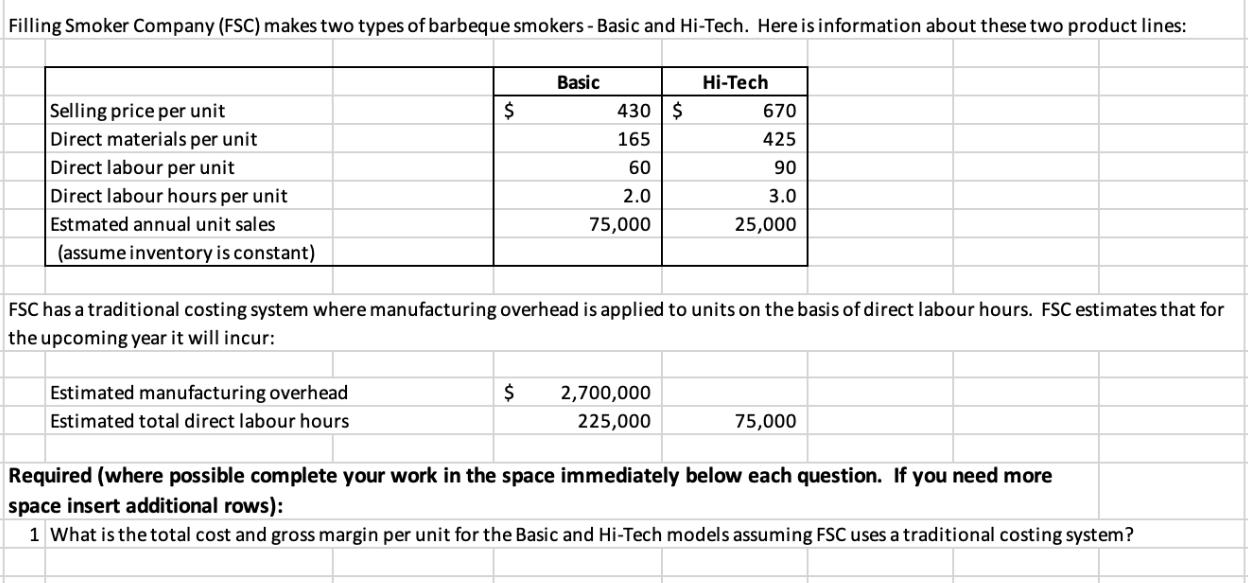

Filling Smoker Company (FSC) makes two types of barbeque smokers - Basic and Hi-Tech. Here is information about these two product lines: Selling price

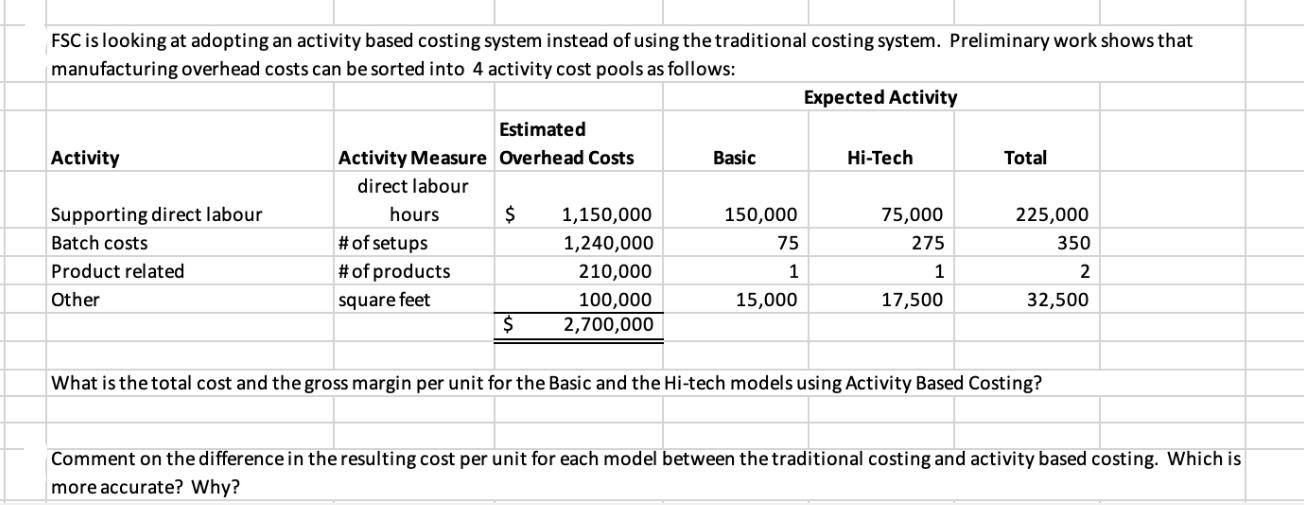

Filling Smoker Company (FSC) makes two types of barbeque smokers - Basic and Hi-Tech. Here is information about these two product lines: Selling price per unit Direct materials per unit Direct labour per unit Direct labour hours per unit Estmated annual unit sales Basic Hi-Tech $ 430 $ 670 165 425 60 90 2.0 75,000 3.0 25,000 (assume inventory is constant) FSC has a traditional costing system where manufacturing overhead is applied to units on the basis of direct labour hours. FSC estimates that for the upcoming year it will incur: Estimated manufacturing overhead Estimated total direct labour hours $ 2,700,000 225,000 75,000 Required (where possible complete your work in the space immediately below each question. If you need more space insert additional rows): 1 What is the total cost and gross margin per unit for the Basic and Hi-Tech models assuming FSC uses a traditional costing system? FSC is looking at adopting an activity based costing system instead of using the traditional costing system. Preliminary work shows that manufacturing overhead costs can be sorted into 4 activity cost pools as follows: Expected Activity Estimated Activity Activity Measure Overhead Costs Basic Hi-Tech Total direct labour Supporting direct labour hours $ 1,150,000 150,000 75,000 Batch costs # of setups 1,240,000 Product related Other # of products square feet 210,000 75 1 275 1 225,000 350 2 $ 100,000 2,700,000 15,000 17,500 32,500 What is the total cost and the gross margin per unit for the Basic and the Hi-tech models using Activity Based Costing? Comment on the difference in the resulting cost per unit for each model between the traditional costing and activity based costing. Which is more accurate? Why?

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Total Cost and Gross Margin per Unit for the Basic and HiTech Models using Traditional Costing System Basic Model Direct Materials per unit 165 Dire...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started