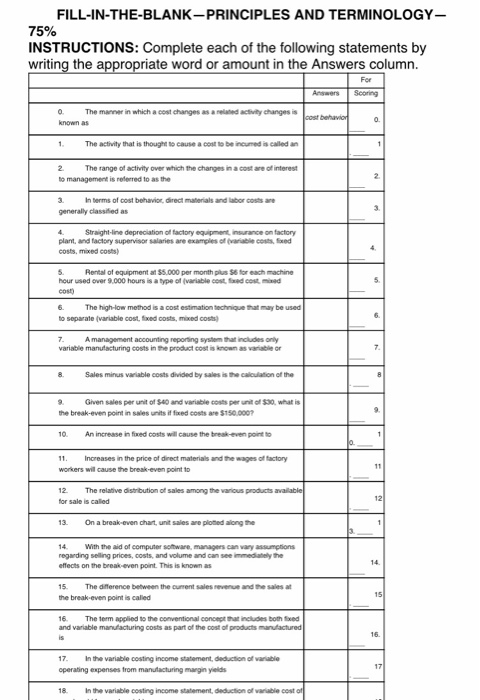

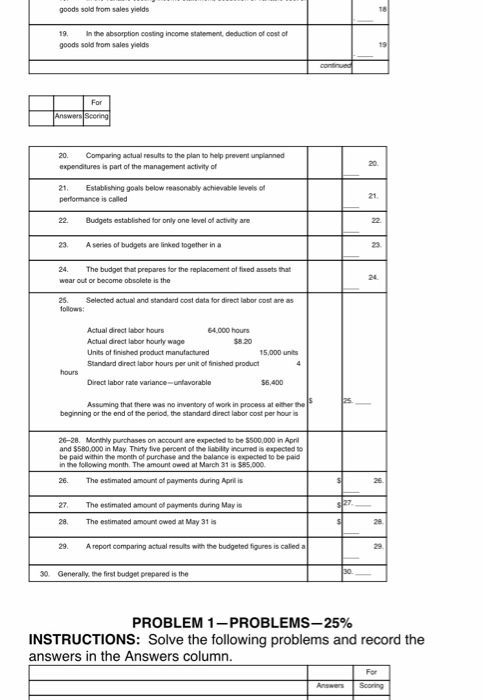

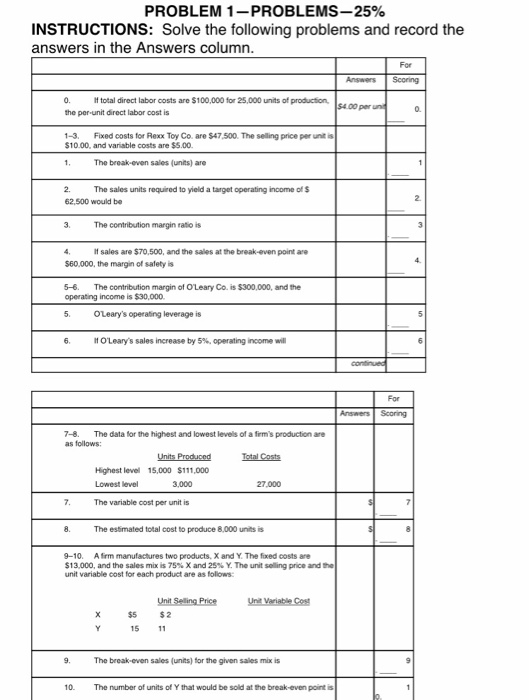

FILL-IN-THE-BLANK-PRINCIPLES AND TERMINOLOGY 75% INSTRUCTIONS: Complete each of the following statements by writing the a riate word or amount in the Answers column. For Answers Scoring . The manner in which a cost changes as a nelated acivity changes is 1. The activity that is thought to cause a cost to be incurred is called an 2. The range of activity over which the changes in a cost are of interest to management is referred to as the In berms of cost behavior, direct materials and labor costs are generally classified as Straight-line depreciation of factory equipment, insurance on factory plant, and factory supervisor salaries are examples of (varable costs, xed costs, mxed costs) Rental of equipment at $5.000 per month plus S6 for each machine hour used over 9,000 hours is a type of (variable cost aed cost maad cost 6. The high-low method is a cost estimation technique that may be used to separate (variable cost, xed costs, mxed costs A managemment accounting reporing system that includes only variable manufacturing costs in the product cost is known as vaniable or 8. Sales minus variable costs divided by sales is the calcuiation of the Given sales per unit of $40 and variable costs per unit of $30, what is the break-even point sales units fixed costs aro $150 ? 10 An increase in fixed costs will cause the break-even point to Increases in the price of direct materials and the wages of factory workers will cause the break-even point to 12. The relative distribution of sales among the warious products for sale is called 13. On a break-even chart, unilt sales are ploted along the 14. With the aid of computer software, managers can vary assumptions regarding selling prices, costs, and volume and can see immediahely the effects on the break-even point. This is known as 14. 15. The diference between the current sales revenue and the sales at the break-even point is called 16. The term applied to the conventional concegt that includes both xed and variable manufacturing costs as part of the cost off products manufactured 17. Inthe variable costing income statement, deduction of waniable operating expenses trom manutacturing margin yields 18. Inthe variable costing income statement, deduction of variable cost goods sold from sales yields 19. In the absorption costing income statement, deduction of cost of goods sold from sales yields For 20. Comparing actual results to the plan to help prevent unplanned 20 expenditures is part of the management activity of 21. Establishing goals below reasonably achievable levels of 21. performance is caled 22. Budgets established for only one level of activity are 23. Aseries of budgets are linked together in a 23 24. The budget hat prepares for the replacement of fiwed assets that wear out or become obsolete is 24. 25 Selected actual and standard cost data for direct labor cost are as Actual direct labor hours Actual direct labor hourtly wage Units of tinished product manufactured Standard direct labor hours per unit of finished product $8.20 15,000 units Direct labor rate variance-unfavorable Assuming that there was no inventory of work in process at ether the beginning or the end of the period, the standard direct labor cost per hour is 26-28. Monthly purchases on account are expected to be $500,000 in April and $580,000 in May. Thirty five percet of the liability incurred is expected to be paid within the month of purchase and the balance is expected to be paid in the following month. The amount owed at March 31 is $85.000 26. The estimated amount of payments during April is The estimated amount of payments during May is 28. The estimated amount owed at May 31 is 28 29. Areport comparing actual results with the budgeted figures is caled a 29 30. Generally, the first budget prepared is the PROBLEM I-PROBLEMS-25% INSTRUCTIONS: Solve the following problems and record the answers in the Answers column For Answers Scoring PROBLEM 1-PROBLEMS-25% INSTRUCTIONS: Solve the following problems and record the answers in the Answers column For Answers Scoring 0. If total direct labor costs are $100,000 for 25,000 units of production 00 per the per-unit direct labor cost is 1-3. Fixed costs for Rexx Toy Co. are $47,500. The selling price per unit is $10.00, and variable costs are $5.00 The break-even sales (units) are 2. The sales units required to yield a target operating income of 62,500 would be 3. The contribution margin ratio is If sales are $70,500, and the sales at the break-even point are 560,000, the margin of safety is 5-6. The contribution margin of O'Leary Co. is $300,000, and the operating income is $30.000 5. OLeary's operating leverage is t10Leary's sales increase by 5%, operating incom e will For AnswersScoring 7-8. The data for the highest and lowest levels of a firm's production are as follows: Highest level 15,000 $111,000 Lowest level The variable cost per unit is The estimated total cost to produce 8.000 units is 3,000 27.000 8 9-10. A firm manufactures two products, X and Y. The fixed costs are $13.000, and the sales mix is 75% X and 25% Y. The unit seling prce and unit variable cost for each product are as folows: $5 15 11 $2 9. The break-even sales (units) for the given sales mix is 0 The number of units of Y that would be sold at the break-even point