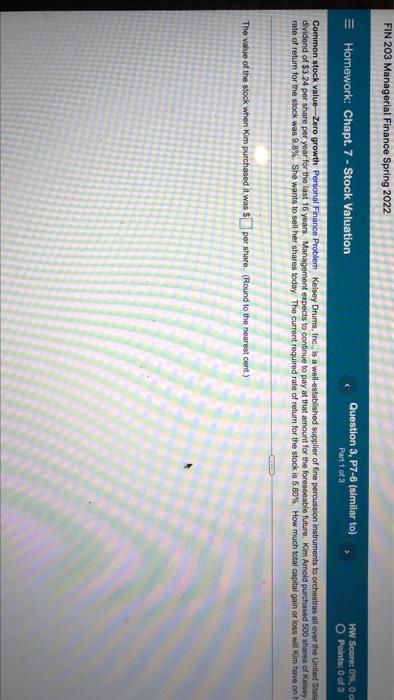

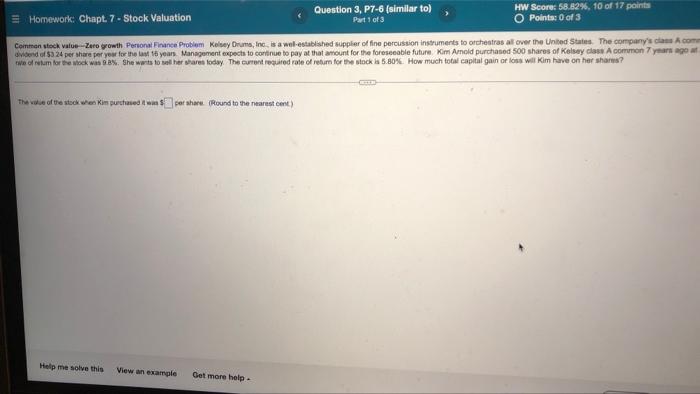

FIN 203 Managerial Finance Spring 2022 HII Homework: Chapt. 7 - Stock Valuation Question 3, P7-6 (similar to) Part 1 of 3 HW Score0%, 0G O Points: 0 of 3 Common stock value Zero growth Personal Finance Problem Kelsey Drums, Inc., is a well-established supplier of fine percussion Instruments to orchestras all over the United State dividend of $3.24 per share per year for the last 16 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Amold purchased 500 shares of Keise rate of return for the stock was 9.8%. She wants to sell her shares today. The current required rate of return for the stock is 6.80% How much total capital gain or loss wil Kim have on The value of the stock when Kim purchased it was per share. (Round to the nearest cont.) Question 3, P7-6 (similar to) HW Score: 0%, 0 of 17 points Part 1 of 3 O Points: 0 of 3 Save s, Inc., is a well-established supplier of fine percussion instruments to orchestres all over the United States. The company's casa A common stock has paid a to continue to pay at that amount for the foreseeable future, Kim Amold purchased 500 shares of Kelsey class A common 7 years ago at a time when the required urrent required rate of return for the stock is 5.80% How much total capital gain or ons wil Kim have on her shares? nearest cont) Homework: Chapt. 7 - Stock Valuation Question 3, P7-6 (similar to) HW Score: 58.8296. 10 of 17 points - Part 1 of 3 O Points: 0 of 3 Common stock value-Zero growth Personal Finance Problem Kelsey Drums, Inc. is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company's clans com Ovided of 5324 per share per you for the last 16 years Management expects to continue to pay at that amount for the foreseeable future. Kim Amold purchased 500 shares of Kelsey class A common 7 years ago two of um for the mock was % She wants to sell her share today. The current required rate of return for the stock is 5.80% How much total capital gain or loss wil Kim have on her shares? The wote uken Kim purchaser showPound to the nearest cent) Help me solve this View on sample Get more help s, Inc., is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company's class A common stock has paida to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 500 shares of Kelsey class A common 7 years ago at a time when the required urrent required rate of return for the stock is 5.80%. How much total capital gain or loss wil Kim have on her shares? e nearest cent)