Answered step by step

Verified Expert Solution

Question

1 Approved Answer

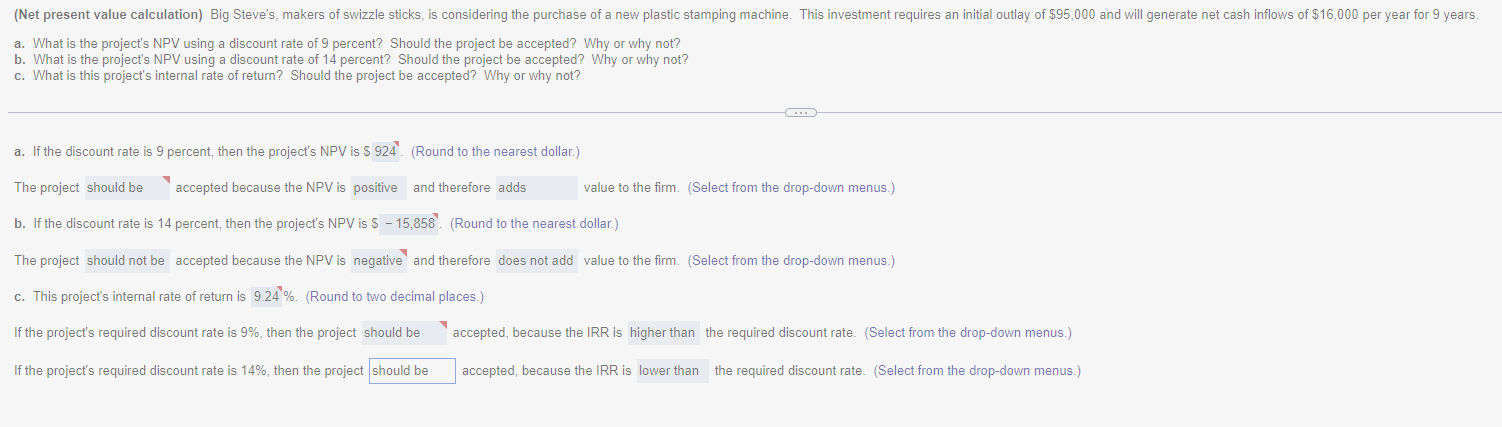

FIN - 3 2 0 ( Net present value calculation ) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic

FIN

Net present value calculationBig Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $ and will generate net cash inflows of $ per year for years.

aWhat is the project's NPV using a discount rate of percent Should the project be accepted? Why or why not?

bWhat is the project's NPV using a discount rate of percent Should the project be accepted? Why or why not?

cWhat is this project's internal rate of return? Should the project be accepted? Why or why not?

Question content area bottom

Part

aIf the discount rate is percent then the project's NPV is $

enter your response here. Round to the nearest dollar.

a What is the project's NPV using a discount rate of percent? Should the project be accepted? Why or why not?

b What is the project's NPV using a discount rate of percent? Should the project be accepted? Why or why not?

c What is this project's internal rate of return? Should the project be accepted? Why or why not?

a If the discount rate is percent, then the project's NPV is $Round to the nearest dollar.

The projec

accepted because the NPV is

and therefore

value to the firm. Select from the dropdown menus.

b If the discount rate is percent, then the project's NPV is $Round to the nearest dollar.

The project should not be accepted because the NPV is negative and therefore does not add value to the firm. Select from the dropdown menus.

c This project's internal rate of return is Round to two decimal places.

If the project's required discount rate is then the project

accepted, because the IRR is higher than the required discount rate. Select from the dropdown menus.

If the project's required discount rate is then the project

accepted, because the IRR is lower than the required discount rate. Select from the dropdown menus. a What is the project's NPV using a discount rate of percent? Should the project be accepted? Why or why not?

b What is the project's NPV using a discount rate of percent? Should the project be accepted? Why or why not?

c What is this project's internal rate of return? Should the project be accepted? Why or why not?

a If the discount rate is percent, then the project's NPV is $Round to the nearest dollar.

The projec

accepted because the NPV is

and therefore

value to the firm. Select from the dropdown menus.

b If the discount rate is percent, then the project's NPV is $Round to the nearest dollar.

The project should not be accepted because the NPV is negative and therefore does not add value to the firm. Select from the dropdown menus.

c This project's internal rate of return is Round to two decimal places.

If the project's required discount rate is then the project

accepted, because the IRR is higher than the required discount rate. Select from the dropdown menus.

If the project's required discount rate is then the project

accepted, because the IRR is lower than the required discount rate. Select from the dropdown menus.

Pictures attached are correct answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started