Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIN 300: Introduction to Finance Practice Exam 2 1. 1. A preferred stock pays $10 of dividends a year. You have no reason to believe

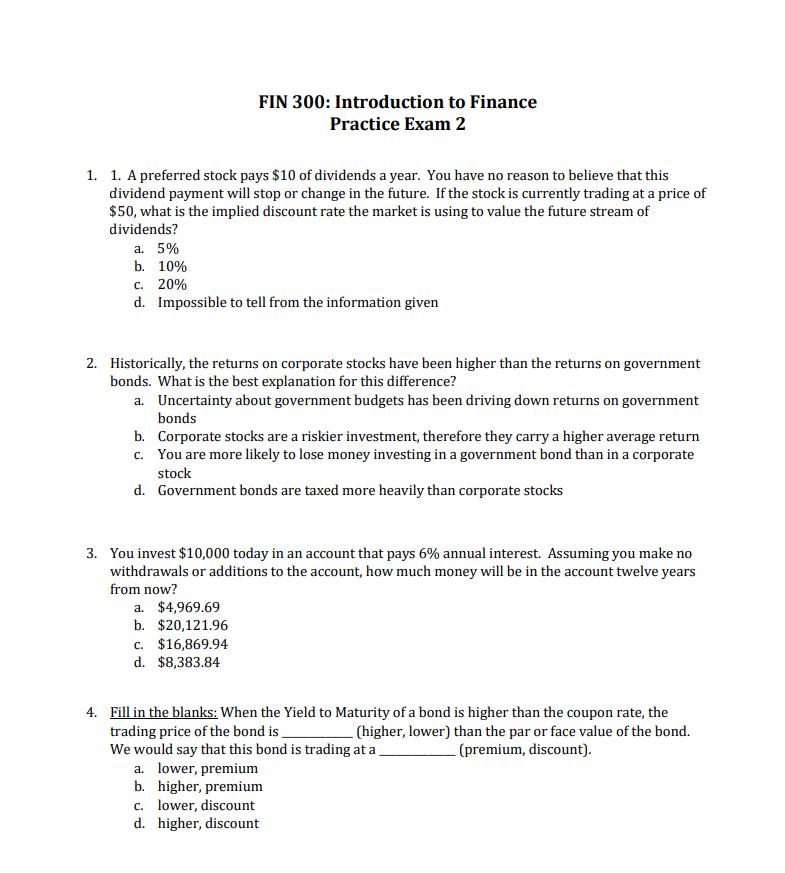

FIN 300: Introduction to Finance Practice Exam 2 1. 1. A preferred stock pays $10 of dividends a year. You have no reason to believe that this dividend payment will stop or change in the future. If the stock is currently trading at a price of $50, what is the implied discount rate the market is using to value the future stream of dividends? a. 5% b. 10% c. 20% d. Impossible to tell from the information given 2. Historically, the returns on corporate stocks have been higher than the returns on government bonds. What is the best explanation for this difference? a. Uncertainty about government budgets has been driving down returns on government bonds b. Corporate stocks are a riskier investment, therefore they carry a higher average return c. You are more likely to lose money investing in a government bond than in a corporate stock d. Government bonds are taxed more heavily than corporate stocks 3. You invest $10,000 today in an account that pays 6% annual interest. Assuming you make no withdrawals or additions to the account, how much money will be in the account twelve years from now? a. $4,969.69 b. $20,121.96 c. $16,869.94 d. $8,383.84 4. Fill in the blanks: When the Yield to Maturity of a bond is higher than the coupon rate, the trading price of the bond is (higher, lower) than the par or face value of the bond. We would say that this bond is trading at a (premium, discount). a. lower, premium b. higher, premium c. lower, discount d. higher, discount FIN 300: Introduction to Finance Practice Exam 2 1. 1. A preferred stock pays $10 of dividends a year. You have no reason to believe that this dividend payment will stop or change in the future. If the stock is currently trading at a price of $50, what is the implied discount rate the market is using to value the future stream of dividends? a. 5% b. 10% c. 20% d. Impossible to tell from the information given 2. Historically, the returns on corporate stocks have been higher than the returns on government bonds. What is the best explanation for this difference? a. Uncertainty about government budgets has been driving down returns on government bonds b. Corporate stocks are a riskier investment, therefore they carry a higher average return c. You are more likely to lose money investing in a government bond than in a corporate stock d. Government bonds are taxed more heavily than corporate stocks 3. You invest $10,000 today in an account that pays 6% annual interest. Assuming you make no withdrawals or additions to the account, how much money will be in the account twelve years from now? a. $4,969.69 b. $20,121.96 c. $16,869.94 d. $8,383.84 4. Fill in the blanks: When the Yield to Maturity of a bond is higher than the coupon rate, the trading price of the bond is (higher, lower) than the par or face value of the bond. We would say that this bond is trading at a (premium, discount). a. lower, premium b. higher, premium c. lower, discount d. higher, discount

FIN 300: Introduction to Finance Practice Exam 2 1. 1. A preferred stock pays $10 of dividends a year. You have no reason to believe that this dividend payment will stop or change in the future. If the stock is currently trading at a price of $50, what is the implied discount rate the market is using to value the future stream of dividends? a. 5% b. 10% c. 20% d. Impossible to tell from the information given 2. Historically, the returns on corporate stocks have been higher than the returns on government bonds. What is the best explanation for this difference? a. Uncertainty about government budgets has been driving down returns on government bonds b. Corporate stocks are a riskier investment, therefore they carry a higher average return c. You are more likely to lose money investing in a government bond than in a corporate stock d. Government bonds are taxed more heavily than corporate stocks 3. You invest $10,000 today in an account that pays 6% annual interest. Assuming you make no withdrawals or additions to the account, how much money will be in the account twelve years from now? a. $4,969.69 b. $20,121.96 c. $16,869.94 d. $8,383.84 4. Fill in the blanks: When the Yield to Maturity of a bond is higher than the coupon rate, the trading price of the bond is (higher, lower) than the par or face value of the bond. We would say that this bond is trading at a (premium, discount). a. lower, premium b. higher, premium c. lower, discount d. higher, discount FIN 300: Introduction to Finance Practice Exam 2 1. 1. A preferred stock pays $10 of dividends a year. You have no reason to believe that this dividend payment will stop or change in the future. If the stock is currently trading at a price of $50, what is the implied discount rate the market is using to value the future stream of dividends? a. 5% b. 10% c. 20% d. Impossible to tell from the information given 2. Historically, the returns on corporate stocks have been higher than the returns on government bonds. What is the best explanation for this difference? a. Uncertainty about government budgets has been driving down returns on government bonds b. Corporate stocks are a riskier investment, therefore they carry a higher average return c. You are more likely to lose money investing in a government bond than in a corporate stock d. Government bonds are taxed more heavily than corporate stocks 3. You invest $10,000 today in an account that pays 6% annual interest. Assuming you make no withdrawals or additions to the account, how much money will be in the account twelve years from now? a. $4,969.69 b. $20,121.96 c. $16,869.94 d. $8,383.84 4. Fill in the blanks: When the Yield to Maturity of a bond is higher than the coupon rate, the trading price of the bond is (higher, lower) than the par or face value of the bond. We would say that this bond is trading at a (premium, discount). a. lower, premium b. higher, premium c. lower, discount d. higher, discount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started