Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIN 3010 ASSIGNMENT 1 QUESTION ONE (i) Discounted payback ensures that you don't accept an investment with a negative NPV but it can't stop

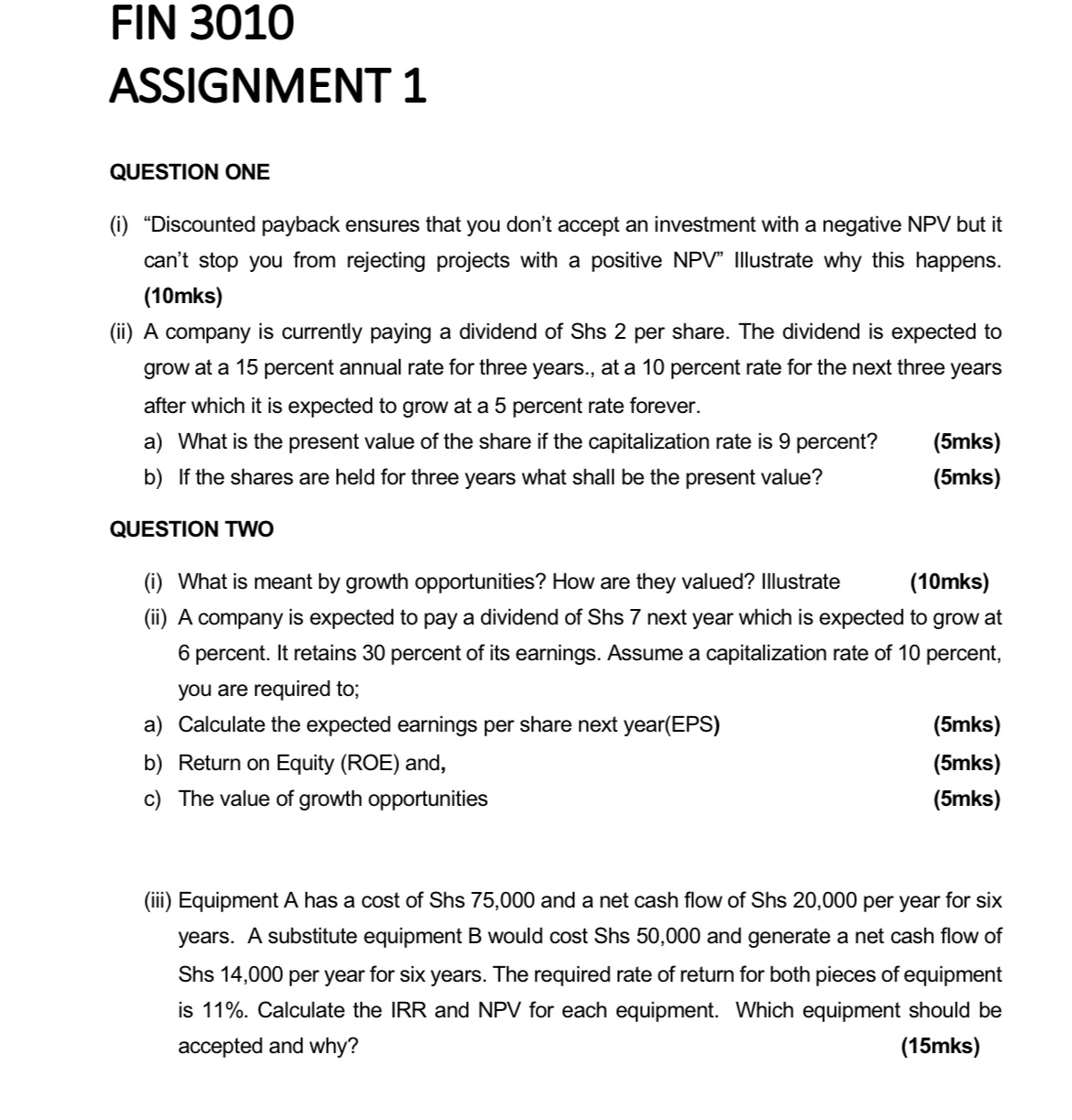

FIN 3010 ASSIGNMENT 1 QUESTION ONE (i) "Discounted payback ensures that you don't accept an investment with a negative NPV but it can't stop you from rejecting projects with a positive NPV" Illustrate why this happens. (10mks) (ii) A company is currently paying a dividend of Shs 2 per share. The dividend is expected to grow at a 15 percent annual rate for three years., at a 10 percent rate for the next three years after which it is expected to grow at a 5 percent rate forever. a) What is the present value of the share if the capitalization rate is 9 percent? b) If the shares are held for three years what shall be the present value? QUESTION TWO (5mks) (5mks) (10mks) (i) What is meant by growth opportunities? How are they valued? Illustrate (ii) A company is expected to pay a dividend of Shs 7 next year which is expected to grow at 6 percent. It retains 30 percent of its earnings. Assume a capitalization rate of 10 percent, you are required to; a) Calculate the expected earnings per share next year(EPS) b) Return on Equity (ROE) and, c) The value of growth opportunities (5mks) (5mks) (5mks) (iii) Equipment A has a cost of Shs 75,000 and a net cash flow of Shs 20,000 per year for six years. A substitute equipment B would cost Shs 50,000 and generate a net cash flow of Shs 14,000 per year for six years. The required rate of return for both pieces of equipment is 11%. Calculate the IRR and NPV for each equipment. Which equipment should be accepted and why? (15mks)

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions Question 1 i Discounted payback period only considers the cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started