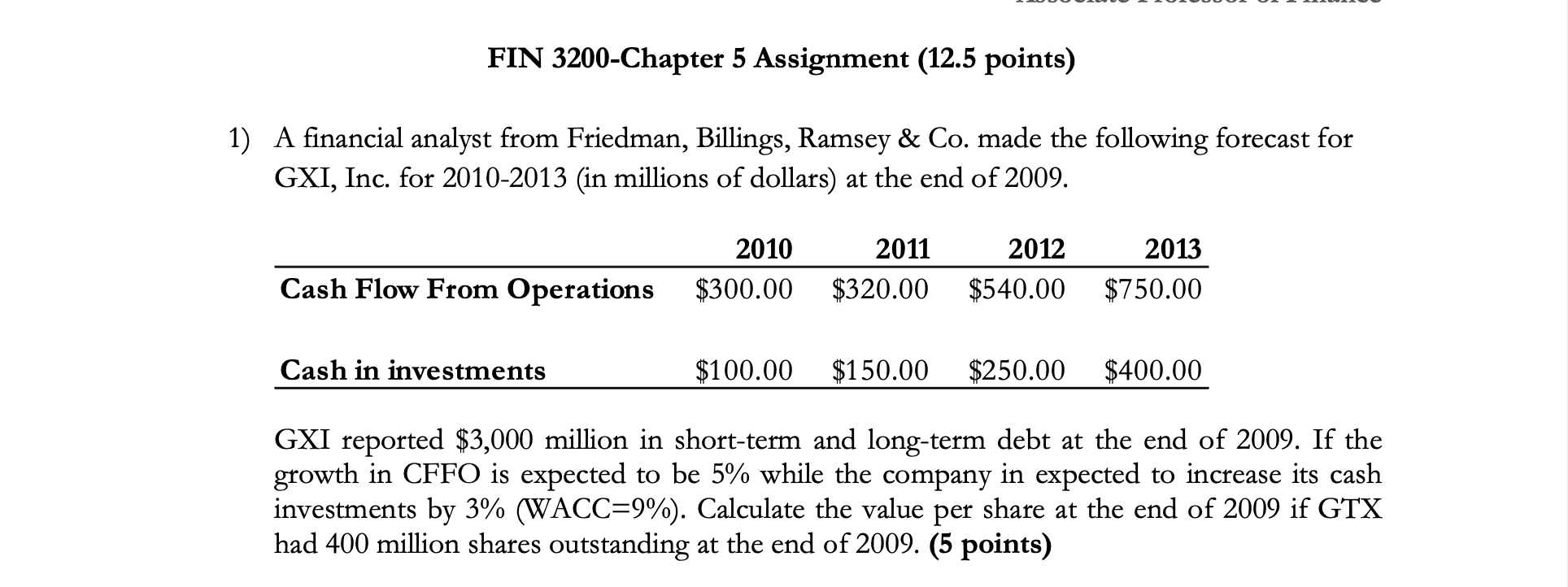

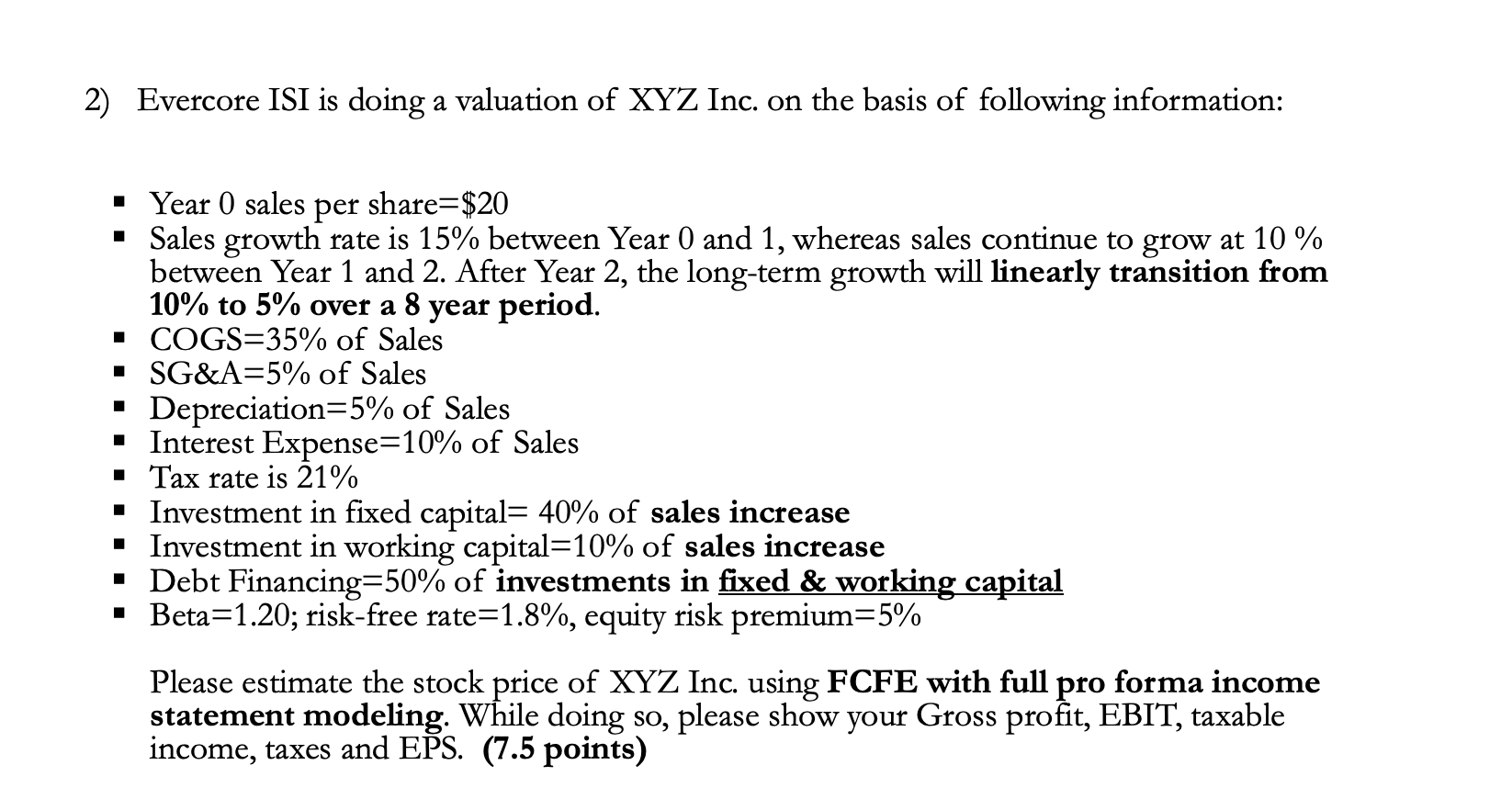

FIN 3200-Chapter 5 Assignment (12.5 points) 1) A financial analyst from Friedman, Billings, Ramsey & Co. made the following forecast for GXI, Inc. for 2010-2013 (in millions of dollars) at the end of 2009. 2010 $300.00 2011 $320.00 2012 $540.00 2013 $750.00 Cash Flow From Operations Cash in investments $100.00 $150.00 $250.00 $400.00 GXI reported $3,000 million in short-term and long-term debt at the end of 2009. If the growth in CFFO is expected to be 5% while the company in expected to increase its cash investments by 3% ( WACC=9%). Calculate the value per share at the end of 2009 if GTX had 400 million shares outstanding at the end of 2009. (5 points) 2) Evercore ISI is doing a valuation of XYZ Inc. on the basis of following information: Year 0 sales per share=$20 Sales growth rate is 15% between Year 0 and 1, whereas sales continue to grow at 10 % between Year 1 and 2. After Year 2, the long-term growth will linearly transition from 10% to 5% over a 8 year period. COGS=35% of Sales SG&A=5% of Sales Depreciation=5% of Sales Interest Expense=10% of Sales Tax rate is 21% Investment in fixed capital= 40% of sales increase Investment in working capital=10% of sales increase Debt Financing=50% of investments in fixed & working capital Beta=1.20; risk-free rate=1.8%, equity risk premium=5% Please estimate the stock price of XYZ Inc. using FCFE with full pro forma income statement modeling. While doing so, please show your Gross profit, EBIT, taxable income, taxes and EPS. (7.5 points) FIN 3200-Chapter 5 Assignment (12.5 points) 1) A financial analyst from Friedman, Billings, Ramsey & Co. made the following forecast for GXI, Inc. for 2010-2013 (in millions of dollars) at the end of 2009. 2010 $300.00 2011 $320.00 2012 $540.00 2013 $750.00 Cash Flow From Operations Cash in investments $100.00 $150.00 $250.00 $400.00 GXI reported $3,000 million in short-term and long-term debt at the end of 2009. If the growth in CFFO is expected to be 5% while the company in expected to increase its cash investments by 3% ( WACC=9%). Calculate the value per share at the end of 2009 if GTX had 400 million shares outstanding at the end of 2009. (5 points) 2) Evercore ISI is doing a valuation of XYZ Inc. on the basis of following information: Year 0 sales per share=$20 Sales growth rate is 15% between Year 0 and 1, whereas sales continue to grow at 10 % between Year 1 and 2. After Year 2, the long-term growth will linearly transition from 10% to 5% over a 8 year period. COGS=35% of Sales SG&A=5% of Sales Depreciation=5% of Sales Interest Expense=10% of Sales Tax rate is 21% Investment in fixed capital= 40% of sales increase Investment in working capital=10% of sales increase Debt Financing=50% of investments in fixed & working capital Beta=1.20; risk-free rate=1.8%, equity risk premium=5% Please estimate the stock price of XYZ Inc. using FCFE with full pro forma income statement modeling. While doing so, please show your Gross profit, EBIT, taxable income, taxes and EPS. (7.5 points)